The continued selling pressure in the cryptocurrency market has shifted the overall sentiment towards a downtrend. In this, Solana (SOL), the world’s fifth largest cryptocurrency by market capitalization, is receiving notable attention from crypto enthusiasts as it keeps itself positive in terms of price changes over the past 24 hours.

Solana defeated Bitcoin and Ethereum

In addition, SOL has outperformed major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and Binance Coin (BNB). At the time of writing, SOL is trading around $172 and has experienced a price increase of over 3.4% in the last 24 hours. During the same period, trading volume fell by 20%, indicating fear among traders and investors, likely due to current market conditions.

Solana technical analysis and upcoming level

According to expert technical analysis, SOL appears bullish. It recently broke out of a two-day strong consolidation between the USD 162 and USD 170 levels. After this breakout, the price could rise 10% to reach the $190 level in the coming days.

As of now, SOL is trading above the 200 Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend.

With this recent breakout, short sellers have liquidated nearly $3.5 million worth of short positions, while bulls have recorded a liquidation of $350,000. This liquidation shows that the bears are currently exhausted.

Bullish statistics in the chain

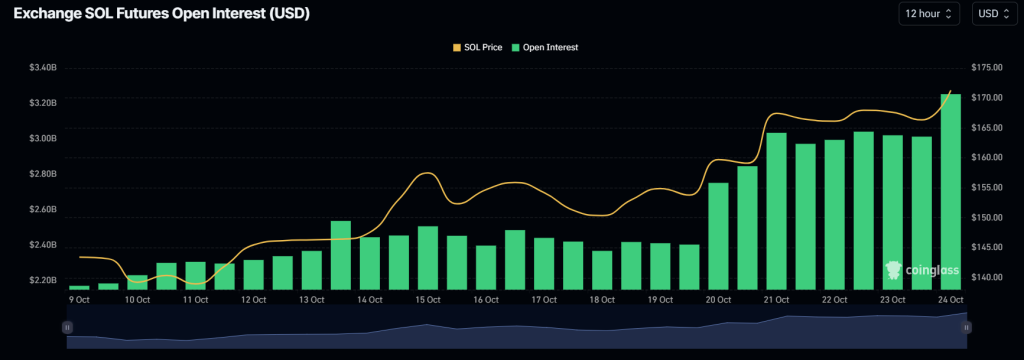

SOL’s bullish outlook is further supported by on-chain metrics. According to an on-chain analytics company MintGlassSOL’s Long/Short ratio currently stands at 1.02, indicating strong bullish market sentiment among traders. Additionally, open interest is up 11%, indicating new position builds likely due to the recent consolidation breakout.

Traders and investors often consider rising open interest and a long/short ratio above 1 when building long positions. Combining these on-chain metrics with technical analysis, it appears that bulls are currently dominating the asset and bulls can support to achieve the goal.

Credit : coinpedia.org

Leave a Reply