In recent market uncertainty, Sol, the native token of the Solana Blockchain, seems to be stronger and it is ready to make a new all time, because it has formed a bullish price action pattern at its four -hour time. During the investigation of the current prospects, traders and investors have shown strong strength and confidence in the actively.

Solana (SOL) Technical analysis and upcoming levels

According to the technical analysis of Coinpedia, SOL has formed a symmetrical price pattern of the triangle and has reached a zone that suggests a potential outbreak. Based on the recent price promotion, if Sol transfers the pattern and a four -hour candle closes above the $ 270 level, there is a strong possibility that it could rise by 25% to the level of $ 330 in the coming days reaches.

The relative strength index (RSI) at 54 indicates that SOL has the potential to break through this pattern and can rise considerably.

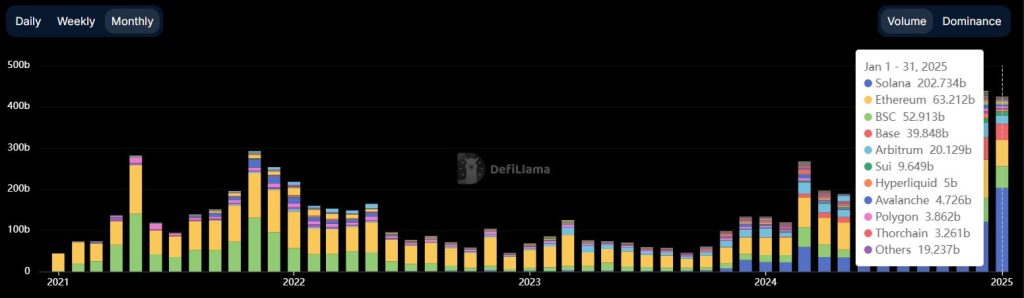

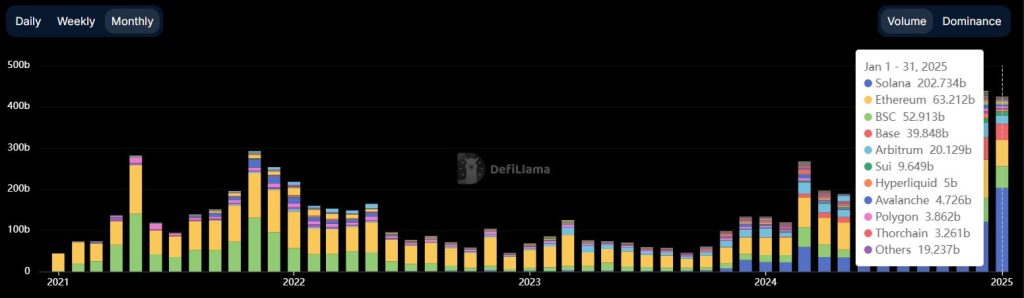

Solana’s Dexs Record volume

In addition to this bullish price promotion, the volume generated by decentralized fairs (Dexs) indicates that Solana becomes stronger every day. Recently, an on-chain analysis company, Defillama, which has registered a substantial $ 202.7 billion in total volume-based Dexs, which exceeds Ethereum, which recorded only $ 63.21 billion last month.

If you look at this, it seems that sol-based DEXs will receive more attention than other DEX tools based on different block chains.

$ 40 million Sol outflow

With this strong development and record adoption, long-term holders have collected the token, as reported by the On-Chain Analytics company Coinglass. Data from Spot -entry/outflow showed that exchanges have witnessed an important outflow of SOL worth $ 40.60 million in the past 24 hours.

This substantial outflow of the stock markets indicates the potential accumulation by holders in the long term and can cause purchasing pressure, which leads to further upward momentum.

SOL is currently being traded near $ 258 and has experienced a modest fall of 0.50% in the last 24 hours. In the same period, the trade volume fell by 32%, indicating a lower participation of traders compared to the previous day.

Credit : coinpedia.org

Leave a Reply