- XLM’s incredible rally indicated intense buying pressure, despite altcoin season not yet fully underway.

- Given the overbought levels, a short-term pullback from the overbought levels cannot be ruled out.

Stellar [XLM] has experienced a parabolic rise as bullish sentiment surrounding Bitcoin [BTC] sparked a rally, pushing Stellar to its multi-year highs.

At the time of writing, XLM was trading at $0.3027, having witnessed a 26% increase in the last 24 hours. With the RSI above 86 and the market heavily overbought, a potential pullback could be on the horizon.

However, the market is still in a bullish phase, so any change in broader market sentiment could significantly impact XLM’s path.

Can XLM bulls hold on after a 220% increase?

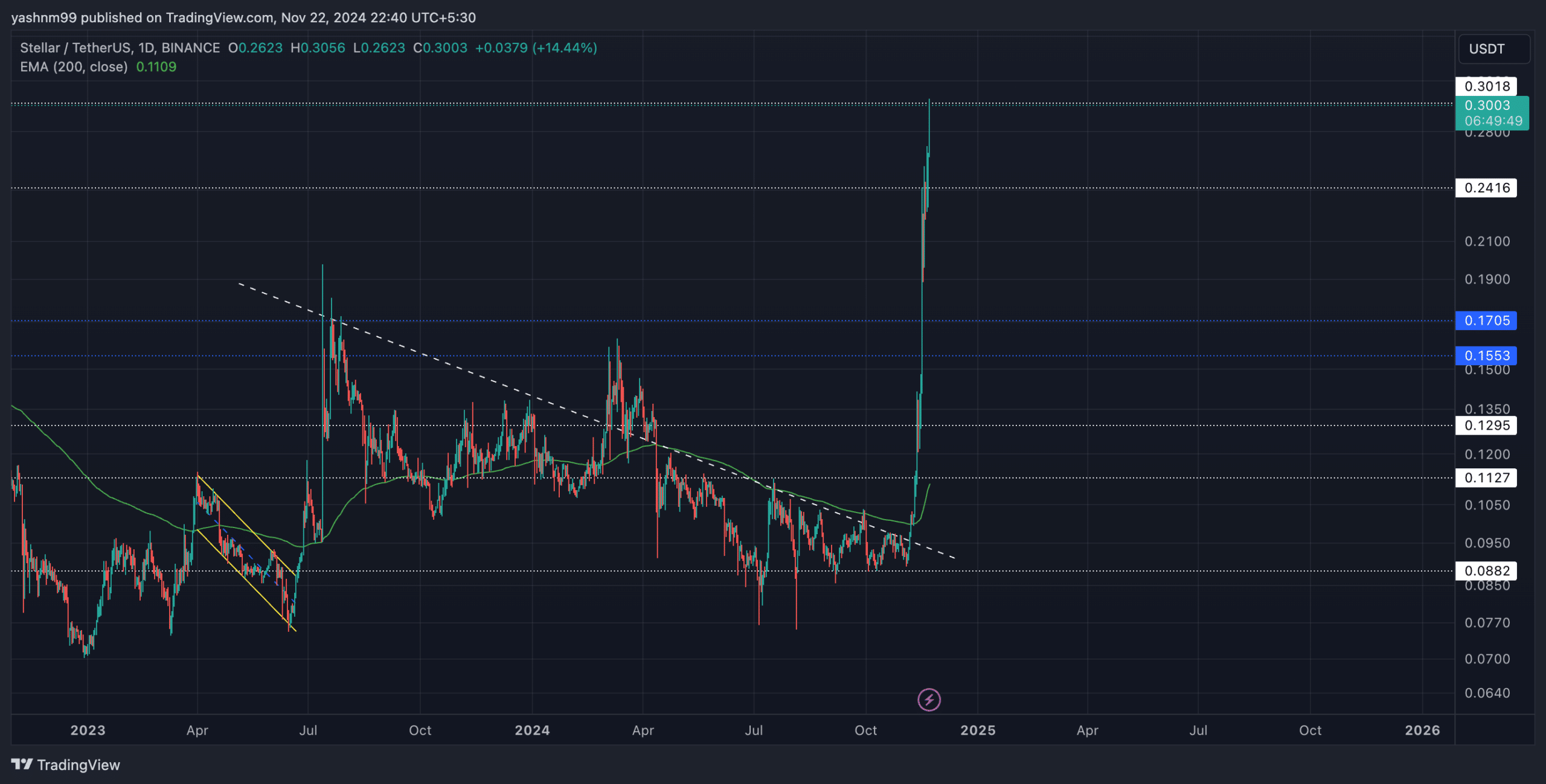

Source: TradingView, XLM/USDT

Although the altcoin season was yet to come (given Ethereum’s [ETH] weak performance), XLM stood out among most altcoins after witnessing a jump of over 220% in the last 17 days.

This move came after support was found at the $0.08 level, pushing the bulls above the critical 200-day EMA (at $0.1109 at the time of writing).

As a result, XLM hit a 35-month high on November 22, testing resistance at $0.3. The current price action has taken XLM near this resistance zone.

Any close above this level could pave the way for bulls to march towards the $0.4 resistance in the coming weeks.

Failure to break this level in the short term could lead to a return to the support at $0.24, which is in line with the previously broken trendline resistance.

The ongoing rally, supported by Bitcoin’s historic climb to new all-time highs, provides hope for continued upward momentum. However, the overbought RSI could soon trigger a possible consolidation or retracement.

Important levels to watch

Resistance: The $0.3 level is a key resistance level for bulls. A successful break above could take XLM to the next resistance level, $0.4.

Support: On the other hand, immediate support is around $0.24. An unlikely decline below could prompt XLM to revisit the $0.17 region.

Data analysis of XLM derivatives

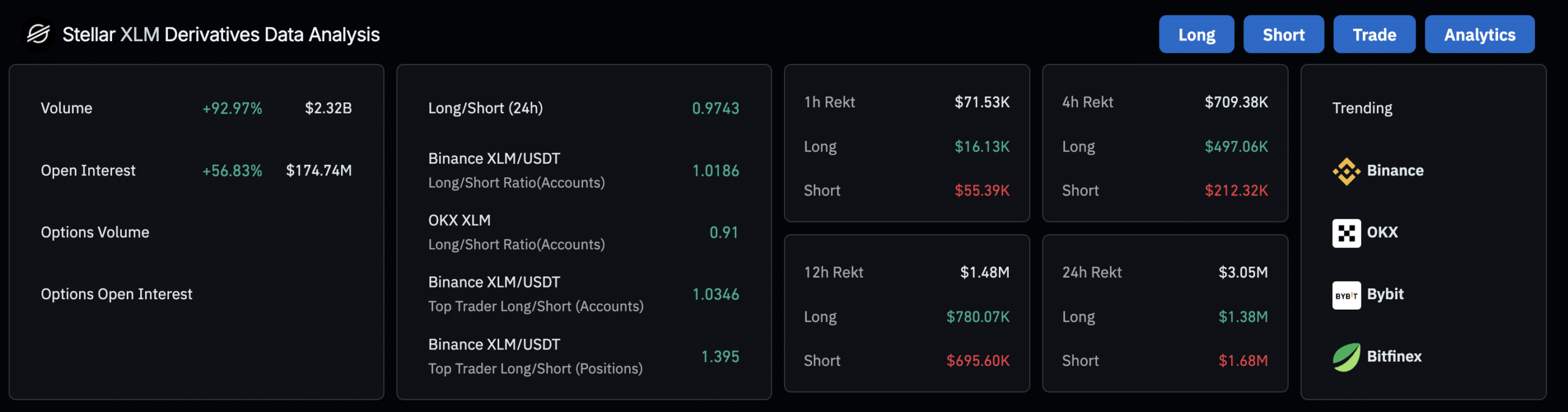

Source: Coinglass

Trading volume is up 92.97% to $2.32 billion – a significant increase that signals strong interest in the ongoing rally.

Open Interest rose 56.83% to $174.74 million, indicating traders are increasingly taking positions and expecting potentially big moves.

The 24-hour long/short ratio for XLM was 0.9743, indicating fairly balanced sentiment.

Read Stellar’s [XLM] Price forecast 2024–2025

However, the Long/Short ratio for accounts and top traders on Binance was more optimistic at 1.0186 and 1.0346, indicating a slight lead for bulls.

Buyers should still monitor Bitcoin’s movement and assess overall market sentiment before opening a long or short position.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer

Credit : ambcrypto.com

Leave a Reply