This article is available in Spanish.

SUI has recently emerged as one of the best performing altcoins, with an impressive 120% increase since the beginning of September.

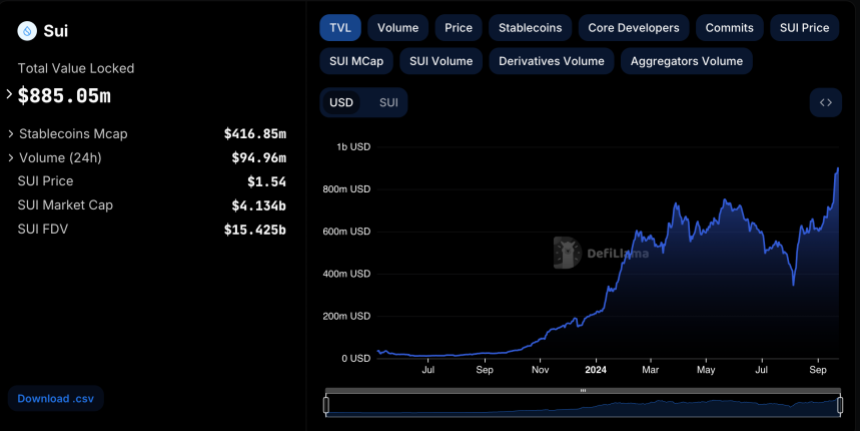

This rapid price increase has caught the attention of investors and analysts alike, as data from DefiLlama shows SUI’s Total Value Locked (TVL) approaching the $1 billion mark.

The rising TVL has fueled speculation that SUI could be on the verge of hitting a new all-time high, with many pointing to its growing ecosystem and increasing adoption as key factors driving the momentum.

Related reading

Currently, SUI is testing a critical resistance level, which if broken could trigger a price surge that could challenge the all-time high of $2.18. As market conditions continue to evolve and interest in decentralized finance grows, many are keeping a close eye on SUI for its potential to lead the next altcoin rally.

If resistance holds, price may consolidate before making a stronger move higher. However, if the bulls break through, it could pave the way for a significant upward move, which could make SUI a standout player in the crypto space.

SUI Rising TVL suggests growing demand

SUI has sparked a wave of optimism among investors and traders who see the Layer-1 blockchain as one of the biggest winners in the ongoing bull run.

Key statistics and analyst insights show growing interest in SUI, driven not only by retail investors, but also by institutions driving up its price.

On August 5, amid a broader market crash, SUI’s Total Value Locked (TVL) plummeted to $342 million. Since then, however, the blockchain has made an impressive recovery, with its TVL almost tripling to $885 million, according to data from DeFiLlama.

TVL is a critical metric that represents the total dollar value of assets deployed or locked within a protocol. A decline in TVL indicates a drain on liquidity, while an increase, such as SUI’s 40% rise in the last thirty days, indicates growing confidence in the project and a healthier ecosystem.

This sharp increase in TVL is a positive sign, indicating that SUI’s network is attracting more liquidity and usage.

Related reading

Currently, SUI’s price is just 40% below its all-time high, creating an ideal situation for bulls who believe this project is primed for explosive growth. Many expect that SUI could be one of the breakout stars of this cycle as the ecosystem continues to expand and investor confidence increases.

Technical levels to watch

SUI is now trading at $1.55 after a massive 60% rally since last Tuesday, showing strong momentum in the market. The price has risen with increasing volume and is consolidating just below a key supply level – a sign of strength and confirmation of a bullish trend. Bulls need to keep SUI above $1.40 to maintain momentum. This level was once a supply zone and can now act as a new demand zone.

A consolidation above $1.40 could push the price higher, specifically towards $1.71. Reclaiming $1.71, a crucial supply zone, would allow SUI to challenge its all-time high. Breaking this level would pave the way for further price increases and possibly a new ATH.

Related reading

A deeper correction is possible if SUI loses its current price level. Lower demand zones around $1.25 or even $1.17 could provide support. This would slow the rally, but the overall bullish outlook remains intact if the price stays within these key levels.

Featured image of Dall-E, chart from TradingView

Credit : www.newsbtc.com

Leave a Reply