- Memecoins have struggled to outpace their rivals by not positioning themselves as a true store of value.

- Now it appears they are losing ground on other fronts as well.

While most coins have rallied following the news of Trump’s return to the White House, memecoins have struggled to keep up, reigniting a debate about their lack of long-term value. Given the performance of other altcoins, that argument might have some weight.

Still, it may not be too late for a change: memecoins have proven resilient before, flourishing thanks to community support and hype. The real question now is: can that same hype spark a shift in momentum, or are we witnessing the beginning of a trend where memecoins finally lose their appeal for good?

The largest memecoin may lose its greatest asset

To really understand the volatility of these tokens, Dogecoin [DOGE] is the perfect example. While many still associate DOGE with the buzz of high-profile endorsements, it is losing perhaps its most powerful asset: the support it once had.

Even with a government department named after this dog coin, the impact on price? It never really got off the ground. In fact, the $1 price target appears to be moving further out of reach.

Could this be a turning point for DOGE? A moment when the community moves beyond the hype and evolves into something more meaningful: a group with a long-term vision?

For now, the answer seems to be a clear ‘No’. A quick look at the price chart tells the story – it is still highly speculative. One red candlestick is enough to erase the gains of a whole bunch of green candlesticks.

As the largest memecoin, with a market cap greater than that of other meme tokens combined, it’s hard to see memecoins overtaking altcoins anytime soon.

These coins are easy targets for market manipulation

In a recent report, AMBCrypto exposed how big players with huge stakes are trapping DOGE in the consolidation phase, using a classic manipulation strategy to prevent any breakout.

This brings us to a crucial point: Memecoins, like DOGE, rely heavily on community support to thrive – but ironically, it is this dependence that causes their wild price swings.

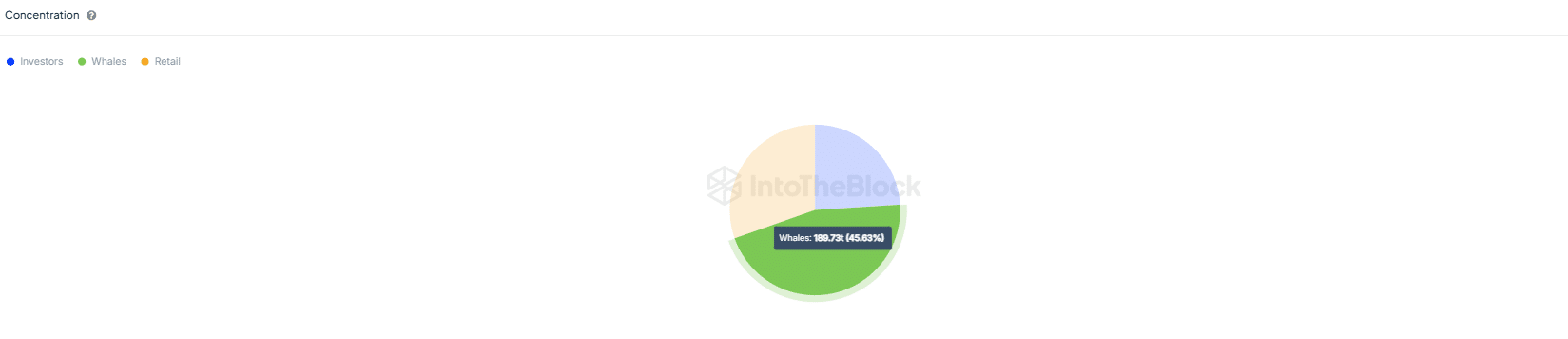

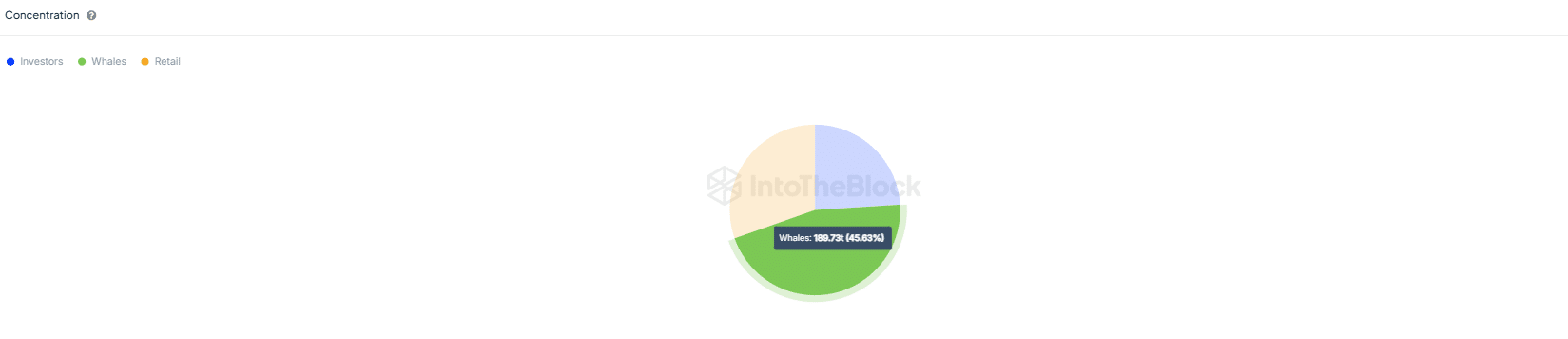

Take PEPE for example. With a market capitalization of almost $9 billion “half” of its assets are controlled by whale wallets, amounting to approximately 190 trillion tokens. These whales have the power to move the market as they see fit, tipping the balance in their favor.

Source: IntoTheBlock

What is even more striking is the dish of their transactions – whether buying or selling – often in the billions or even trillions.

This textbook manipulation strategy of buying at a discount and selling at a premium traps memecoins in a volatile cycle, leaving the market in a constant state of uncertainty and retail investors on edge.

With all this in mind, it might be a bit of wishful thinking to predict that these coins will reach new highs next year.

Read Dogecoin [DOGE] Price forecast 2024-2025

The reasoning is clear: besides losing their appeal as “real-use-case” assets, memecoins are struggling on several fronts.

Major players manipulate the market, stifling their true potential, while their inability to evolve into a true store of value leaves the door wide open for altcoins to dominate.

Credit : ambcrypto.com

Leave a Reply