Despite the Bearish market sentiment, Crypto -Walvissen show a strong interest in Ethereum (ETH). Data from the blockchain-based transaction tracker Lookonchain shows that Eth-Walvissen are on a buying spree.

Buy whales 15,563 ETH in the middle of price accidents

In a recent message on X (formerly Twitter) it was revealed that a crypto -walfish that previously bought 3,195 ETH for $ 5.97 million now bought another 4,100 ETH for $ 7.32 million on April 4, 2025.

It seems that this whale is on average its ETH purchases. The post also showed that since March 26, 2025, the whale has collected 33,441 ETH worth $ 65.5 million at an average price of $ 1,959.

In addition to this whale, another crypto -walvis recently created a new wallet and spent $ 20.78 million to buy 11,463 ETH at an average price of $ 1,813 in the last six hours, as reported by Lookonchain on X.

These enormous ETH purchases through crypto giants make a question and suggest that this can be an ideal time to buy ETH at a lower level.

Current price momentum

At the time of the press, it is traded in the last 24 hours near $ 1,790 and has registered a modest price destination of more than 0.90%. During the same period, however, the trade volume of the active fell by 30%, which indicates lower participation of traders and investors in comparison with the previous day.

Ethereum (ETH) Technical analysis and upcoming levels

According to the technical analysis of experts, EH Bearish appears to break under a crucial support level of $ 1,810 after recently. Based on recent price action, if ETH remains below the level of $ 1,810, there is a strong possibility that it could fall by 15% to reach $ 1500 in the coming days.

The Altcoin is currently being traded under the 200-day exponential advancing average (EMA) on the daily period, which indicates a strong bearish trend.

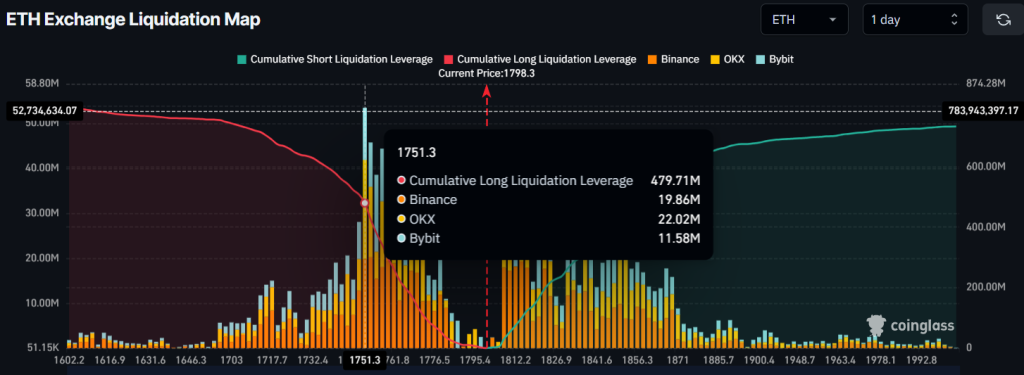

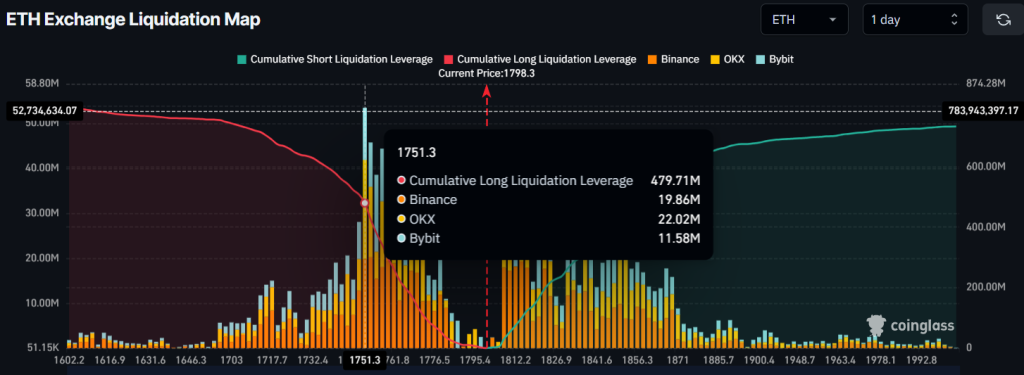

Important liquidation levels

In addition to the Bearish price action, traders are currently too much livered at the support level of $ 1,751 and the resistance level of $ 1,822, as reported by the uncleaning analysis company Coinglass.

Data also shows that traders have built up $ 480 million in long positions and for $ 195 million in short positions at these livered levels, which clearly reflects the current market sentiment.

Credit : coinpedia.org

Leave a Reply