XRP, the native token of Ripple Labs, attracted enormous attention from long-term holders despite a considerable sale in the cryptocurrency market. On April 4, 2025, data from an on-chain analysis company revealed that exchanges have witnessed continuously, even while the price of the active will continue to fall.

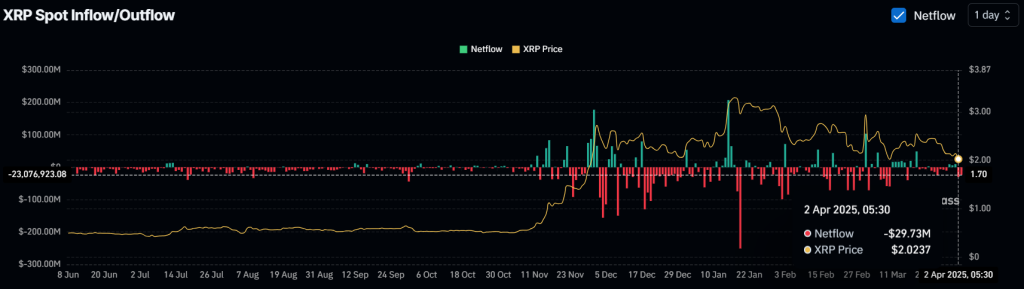

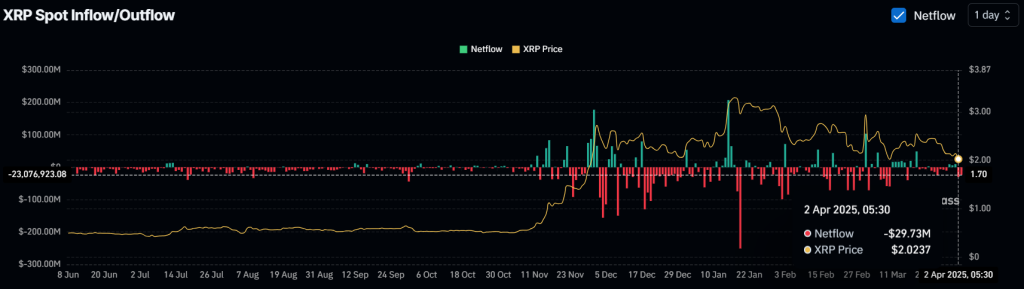

$ 55 million in XRP outflow

Data of Coinglass It revealed that stock markets have witnessed a considerable value of $ 55 million in XRP -Tokens for the past 48 hours. This substantial outflow of stock markets indicates a sign of accumulation and also evokes a concern to whether this is an ideal level to buy or not.

Current price momentum

At the time of the press, XRP is traded near $ 2.05 and has registered a price fall of more than 5% over the past 24 hours. During the same period, however, the trade volume jumped by 95%, which indicates an increased market activity and explaining the outflow of the active from trade fairs.

XRP -price promotion and upcoming levels

According to the technical analysis of experts, it actively achieved an important level after this enormous price fall, which creates a Make-Or-Break situation for XRP. The daily graph of the Active reveals that it has formed a bearish head and shoulder pattern and is currently near the neckline.

However, this level is crucial because of the historical price momentum. Historically, when XRP reaches this level, it tends to show a price reputation or rebound, which could explain the recent outlets of trade fairs.

However, if the current market sentiment remains unchanged and the price continues to fall, there is a strong possibility that XRP could fall by 44% to achieve the $ 1.20 level in the future.

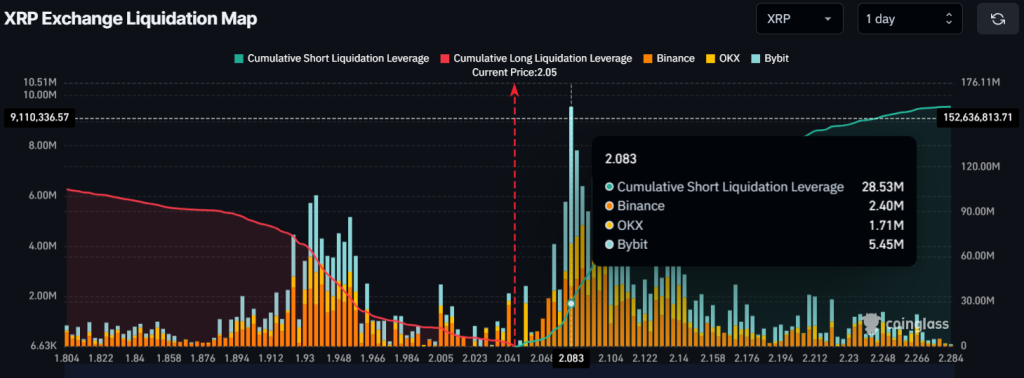

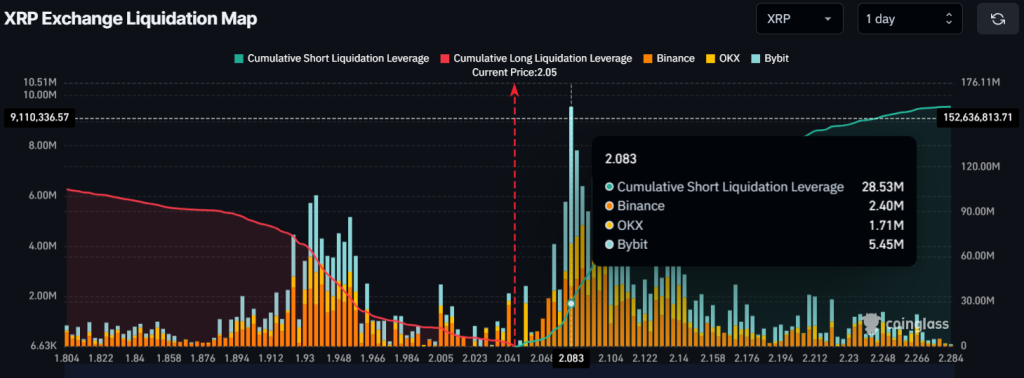

$ 58 million in Bullish bet

Coinglass -Liquidation data show that traders are currently bullish on XRP. At the time of the press, the most important liquidation levels or over-delivery positions are $ 2.08 at the top and $ 1.93 at the bottom. In these levels, traders have built $ 28 million and $ 58.70 million in short and long positions over the past 24 hours.

These levels indicate that bulls are currently actively dominating and hope that the price of XRP will not fall below the level of $ 1.93 in the coming days.

Credit : coinpedia.org

Leave a Reply