Ripple’s native token XRP has received massive attention from crypto enthusiasts due to its impressive upward rally in recent days. On November 24, 2024, a whale trade tracker, Whale Alert, posted a message on X (formerly Twitter), alerting every investor and trader that this rally may be nearing its end.

XRP Whale Move 20 Million Tokens to Upbit

The post on However, this massive dump occurred at a time when the overall cryptocurrency market was in a correction phase and XRP itself was struggling.

After this dump on the centralized exchange (CEX), the daily chart of XRP appears bearish, indicating that the price could undergo a significant correction.

XRP technical analysis and upcoming level

According to expert technical analysis, XRP appears to be forming a bearish evening star candlestick pattern near the $1.40 breakout level. Based on recent price action, if the altcoin successfully forms this candlestick pattern and closes the daily candle below the $1.30 level, it could fall 20% to reach $1.05 in the coming days.

However, XRP has been on a parabolic move, and to maintain this momentum in the coming days, the asset may need to undergo a correction or a period of price consolidation.

Currently, the altcoin is trading above the 200 Exponential Moving Average (EMA) on the daily time frame, indicating an uptrend. However, the Relative Strength Index (RSI) indicates limited room for a further rally as it has been above 80 since November 11, 2024, indicating that the asset is in overbought territory.

Trader sentiment: bullish or bearish

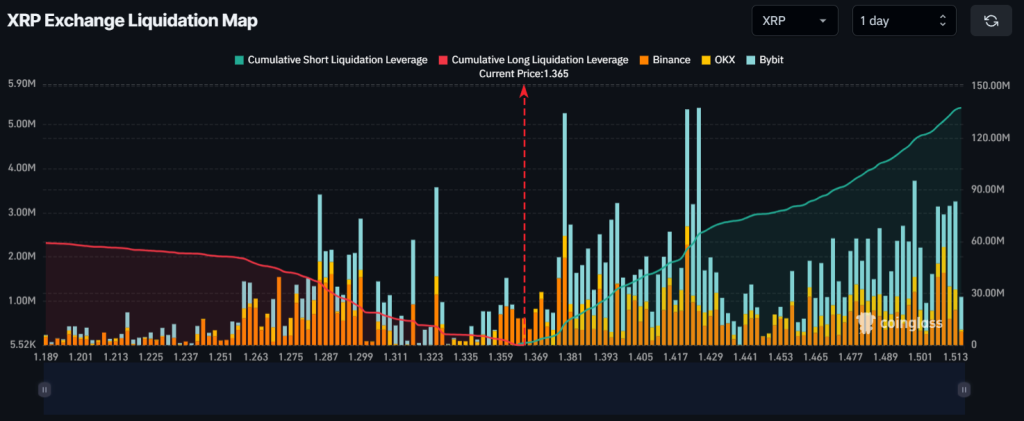

Whale activity aside, readers may wonder what traders are up to right now. Data from on-chain analytics firm Coinglass shows traders are over-indebted, with key levels of $1,325 at the low end and $1,379 at the high end.

Coinglass’ stock market liquidation map further indicates that traders hold $10.76 million worth of long positions at the lower level, while $12.41 million worth of short positions are concentrated at the higher level.

This liquidation data indicates that sell-side traders are relatively higher, which could lead to a price decline in the coming days.

Current price momentum

At the time of writing, XRP is trading around $1.38 and has registered a price drop of 7.10% over the past 24 hours. During the same period, trading volume fell by 30%, indicating lower participation from traders and investors compared to the day before.

Credit : coinpedia.org

Leave a Reply