- Trump’s rates can shift the range of mining installations and stimulate the activities outside the US

- US Bitcoin Mining shares lost $ 12 billion in the midst of falling trust and market instability.

Donald Trump’s proposed tariff plans have sent ripples by the crypto sector, whereby the mining industry is now scraping for a potential fall -out.

In a recent analysis By Hashlabs Mining CEO Jaran Mellerud, it is suggested that the American market could see a sharp decrease in demand for bitcoin [BTC] Mining installations due to the costs of rising equipment.

As American miners are confronted with higher prices, manufacturers can shift surplus inventory to the global markets. This can create a tree for international mining activities.

The report added,

“As the machine prices in the US rise, they can decrease paradoxically in the rest of the world. The demand for shipping machines is set to the US to fall, probably Zero is approaching.”

US loses, but other countries win

Mellerud noticed a reduced interest from American miners, so manufacturers had an oversupply from Rigs for America.

To tackle this surplus, manufacturers can lower prices and concentrate on emerging markets abroad.

Previously, producers such as Bitmain, Microbt and Canaan operations moved to Southeast -Asia to prevent previous rates about China.

Ironically, these countries are now confronted with new rates. Thailand, Indonesia and Malaysia are hit by 36%, 32%and 24%respectively.

Rates push our harness prices up

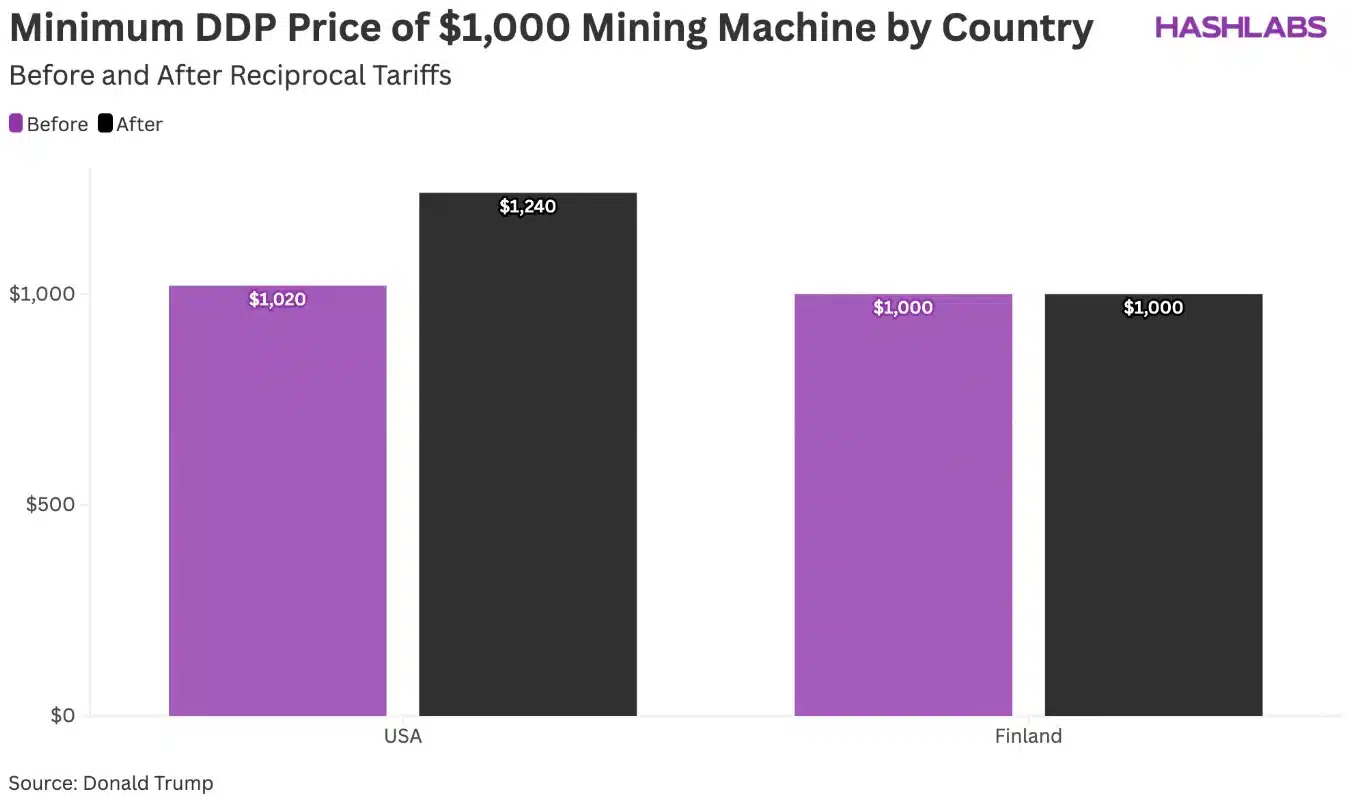

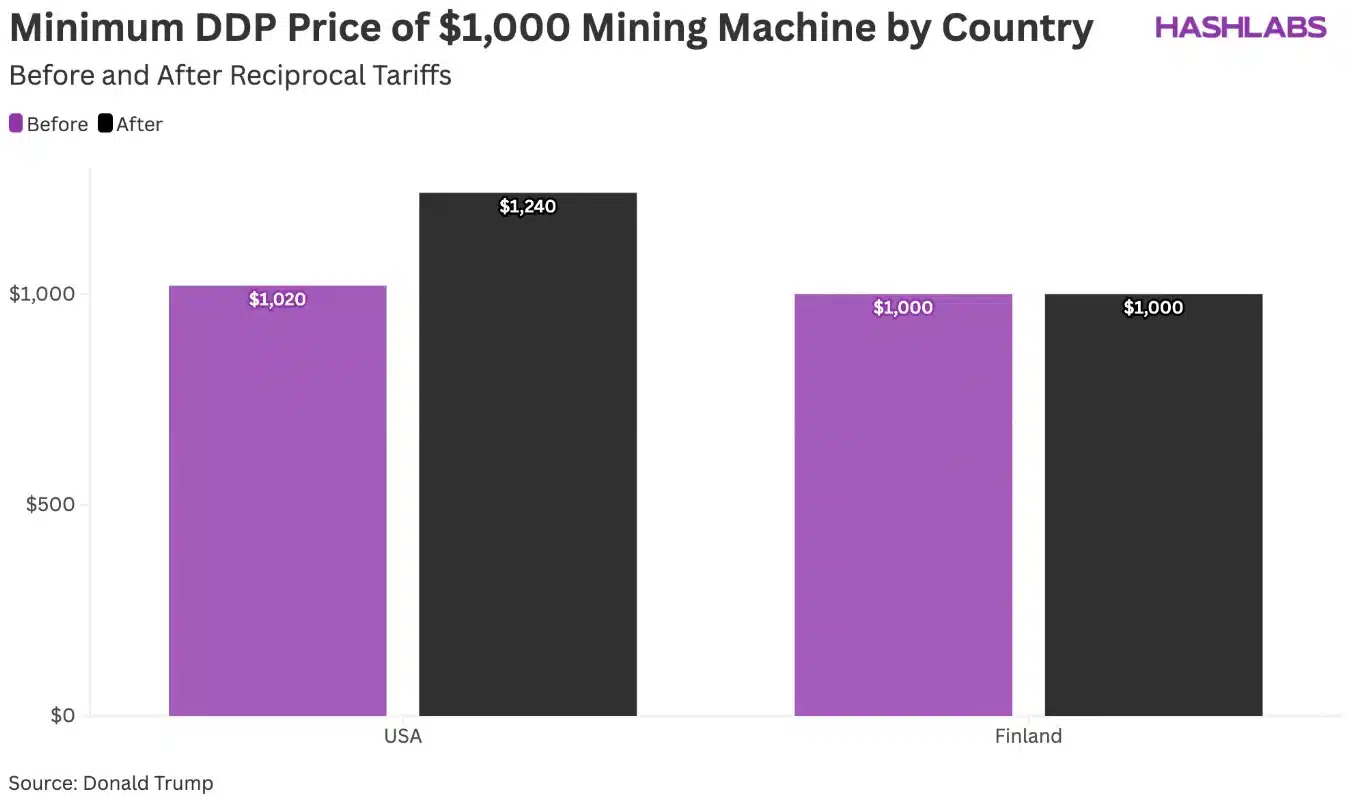

According to Mellerud, Trump’s new rate policy can lead to a competitive price increase for mining hardware in the US, with a $ 1,000 rig that now costs around $ 1,240 due to added import duties.

Source: Hashlabs report

He also expressed doubts when he said,

“Even if these rates are reversed within a few months, the damage caused in long-term planning is shaken. Few will feel comfortable to make large investments when critical variables can change from one day to the next.”

While many American miners initially considered Trump’s return as a sign of regulatory stability, the unexpected rate announcement has shaken that trust.

For that Unware, the US – which has led the global Bitcoin – my construction landscape from China since the total hashrate, has been wearing per data from the hashrate index.

However, Trump’s newest urge for ‘mutual rates’, announced on April 2, threatens to disrupt this dominance.

Impact on crypto shares and the global crypto market

Moreover, since February, Bitcoin -my construction shares have also collectively lost more than $ 12 billion in value, so that the beginning of 2024 has wasted profit.

Leading mining companies have suffered steep losses with double digits and signal a great concern about investors.

According to the latest Coinmarketcap factsThe global crypto market capitalization has fallen to $ 2.44 trillion, which reflects a daily decrease of 3.02%.

Bitcoin, once rising past $ 100,000, now has cellar Up to $ 76,881.52, driven by a weekly fall of 8% and more than 3% fall in the past day. This emphasized how policy decisions can quickly destabilize the landscape of digital assets.

Credit : ambcrypto.com

Leave a Reply