- Bitcoin and Ethereum ETFs saw significant outflows on October 1, totaling millions.

- US election results could shape the regulatory landscape for XRP and SOL ETFs.

Bitcoin [BTC] and ether [ETH] exchange-traded funds (ETFs) saw significant outflows on October 1.

BTC ETFs saw withdrawals totaling $242.6 million and ETH ETFs recorded an outflow of $48.6 million.

Can Trump Boost SOL and XRP ETFs?

Amid this fluctuating ETF market, recent discussions have emerged suggesting that the outcome of the upcoming US presidential election could impact the regulatory landscape for crypto ETFs, especially those involving assets like Ripple. [XRP] and Solana [SOL].

Speculation is rife that a potential Donald Trump victory could impact the future approvals and performance of these digital asset ETFs.

In a recent thread on X (formerly Twitter), analyst Bloomberg Eric Balchunas highlighted the challenges facing new cryptocurrency ETFs, such as those for SOL and XRP, under the strict supervision of SEC Chairman Gary Gensler.

Balchunas highlighted that Gensler’s strong stance on the crypto market has complicated the approval process for these ETFs, impacting major industry players such as Binance and Coinbase.

Balchunas reiterated Trump’s promise to fire Gensler upon taking office, saying in a post on October 2:

“You’ve heard of the Fed Put. This is like the Trump Call. Requests for XRP or Solana or other alt coins are essentially a cheap call option in a Trump victory since Genz will be gone and anything is possible. There is no way Harris will win these approvals, and the call will be worthless.

Bitwise’s move to launch XRP ETF

This comment follows Bitwise’s recent move to establish an XRP ETF, which featured the registration of a trust entity in Delaware.

The timing is important because it aligns with the SEC’s looming deadline to appeal Judge Torres’ ruling, which ruled that secondary XRP sales on exchanges do not qualify as securities.

Managers weigh in…

Alex Thorn, Head of Firmwide Research at Galaxy Digital, provided further insights on this, commenting:

Source: Alex Thorn/X

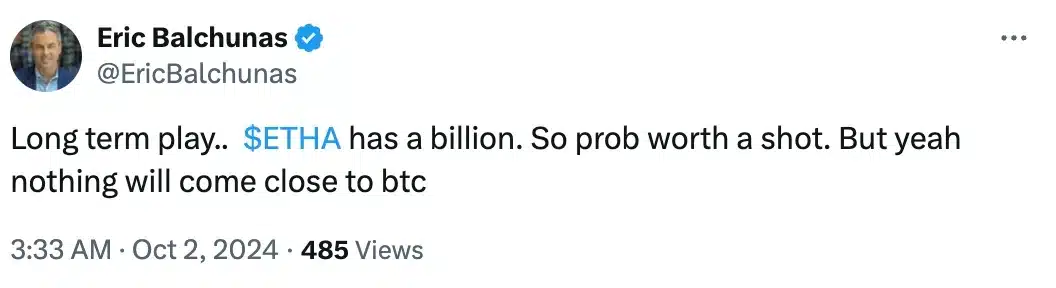

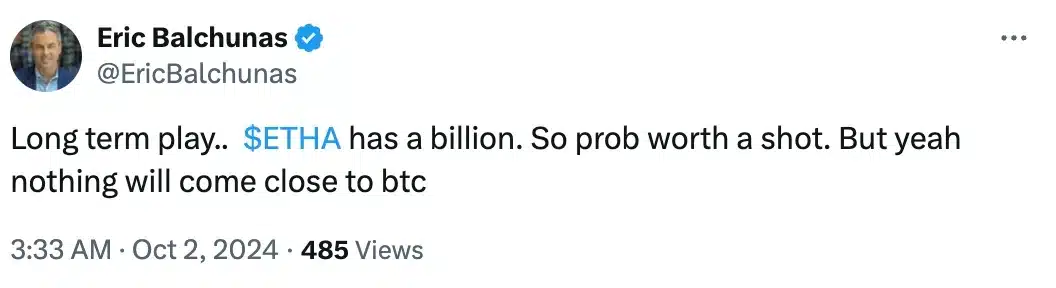

However, there was another X user who asked Balchunas an important question and said:

“If there is no demand for Ethereum ETF, why would there be demand for XRP ETF?”

However, in his defense, Balchunas noted:

Source: Eric Balchunas/X

What lies ahead for Trump and Harris?

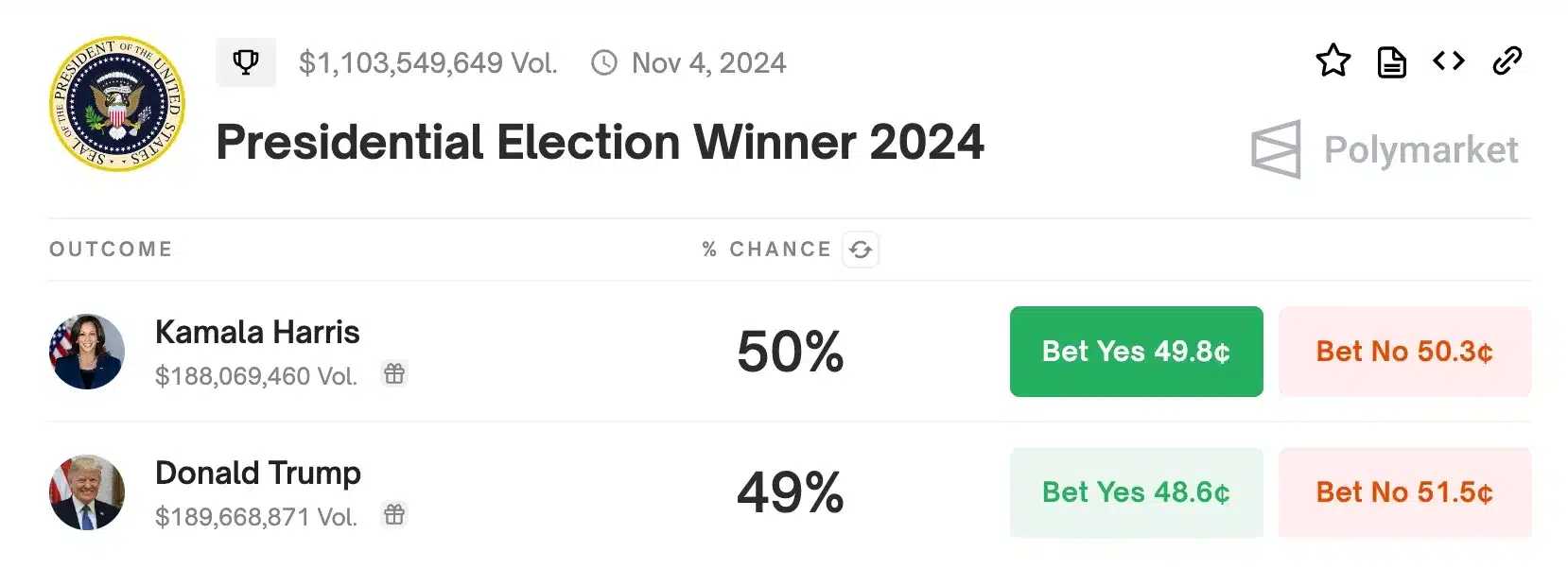

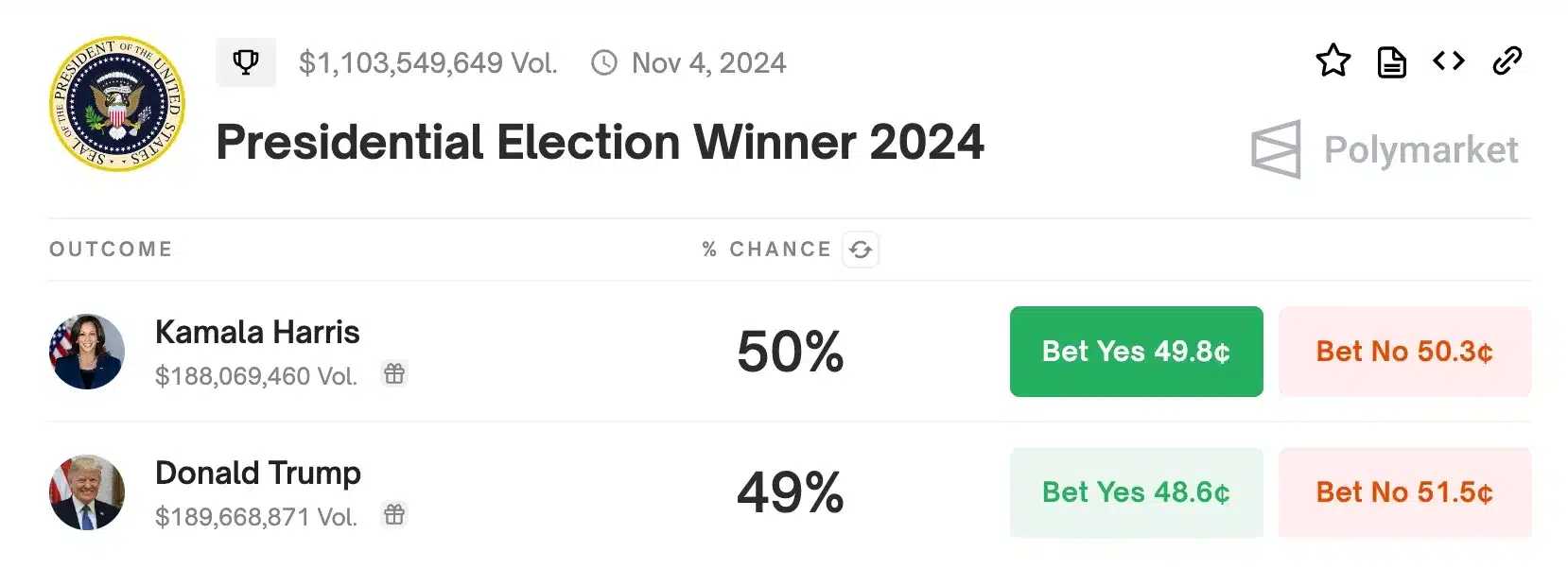

Despite the ongoing political shifts reflected in Polymarket data, with Kamala Harris leading Trump in the votes by a narrow margin, analysts at VanEck remain confident in Bitcoin’s resilience.

Source: Polymarkt

Mathew Sigel believes that regardless of the outcome of the 2024 US elections, Bitcoin will remain largely unaffected.

However, he noted that a Kamala Harris administration could potentially provide more favorable conditions for Bitcoin’s growth compared to a Trump presidency.

So with just 33 days to go until the election, it will be intriguing to see who wins and how the outcome will impact the crypto sector.

Credit : ambcrypto.com

Leave a Reply