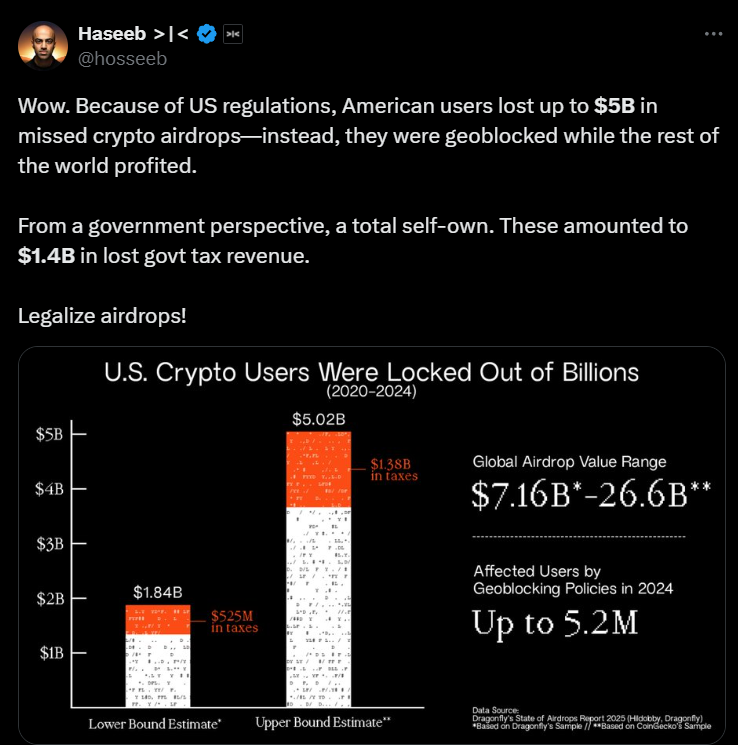

- American crypto users missed up to $ 5 billion in airdrops between 2020 and 2024 due to sec driven geofencing

- Legislators urge the SEC to clarify his Airdrops position

In the past four years, millions of American crypto holders have not been able to participate in large airdrops, which misses an estimated $ 5 billion in potential income.

A recent study From venture capital company Dragonfly, the geoblocking policy, implemented by crypto projects to prevent the US research, were responsible for these losses. These limitations stem from constant legal uncertainty about whether airdroped tokens are eligible as effects or not.

With the SEC that also performs enforcement actions against crypto companies, many projects have chosen a cautious approach by blocking American users downright. The Dragonfly report even estimated that in 2024 between 1.84 million and 5.2 million active American users were affected by these limitations alone.

However, the financial impact of these limitations went beyond individual investors.

$ 1.4 billion in lost tax revenues

The report also showed that by preventing US users from claiming AirDrops, the government lost an estimated $ 1.4 billion in tax revenues between 2020 and 2024.

The lost tax revenues stem from two primary sources – personal income tax on airdroped tokens and corporation tax that would have been generated by crypto projects that are active in the US instead of going offshore.

Haseb Qureshi, managing partner at Dragonfly, assessed“

“Airdrops were once the most democratic way to distribute tokens. Nowadays they have become a game to avoid the wrath of the sec. “

Source: X

A striking example is Tether, which in 2024 reported $ 6.2 billion in profit, but did not pay an American corporation tax due to the offshore design.

Dragonfly’s “State of AirDrops Report 2025”, claimed,

“Tether, who reported $ 6.2 billion in profit in 2024, but Offshore was included, could have contributed around $ 1.3 billion in federal corporation tax and $ 316 million in state tax if it was fully subject to the US tax.”

Regulatory uncertainty has led to an exodus of blockchain startups from the United States.

Startups are looking for more friendly coasts

In 2024 alone, the SEC 33 enforcement actions against Crypto companies started, with 73% fraud allegations and 58% linked to non -registered supply of securities. These actions have created a hair -raising effect on crypto innovation, in which many projects prefer to avoid the American market.

Jessica Furr, counsel at Dragonfly, emphasized The unintended consequences of this approach.

“The enforcement-driven regulatory position of the SEC has forced crypto projects to exclude American users from airdrops, so that they are deprived of billions of possible profit. Clearer guidelines are needed to prevent further economic loss. “

Furr’s comments reflect broader industrial frustrations about the lack of clear legal frameworks for crypto assets -a problem that has encouraged many blockchain developers to move abroad.

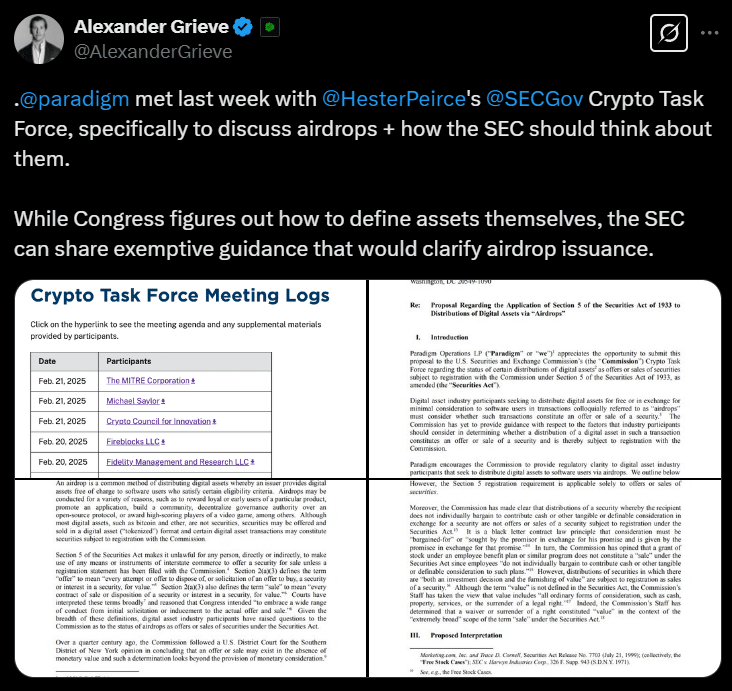

The regulatory challenges around air drops have also attracted the attention of legislators.

Congress to the SEC – “Clarify or justify”

In September 2024, Patrick Mchenry and Tom Emmer sent a letter to SEC chairman Gary Gensler, demanding Clarity about whether Airdrops should be classified as effects. The letter raised important questions about the inconsistent approach to the SEC, in particular in comparison with traditional remuneration programs such as airlines and credit card points.

“Given the unwillingness of the SEC to set up a regulatory framework in the United States, developers are forced to block Americans to claim the ownership of a digitally active in an airdrop”. “

Geofencing-de Practice to block users for specific areas of law that became the standard risk avoidance strategy for crypto projects that operate under legal uncertainty. By one report Variant is often poorly implemented and results in unnecessary exclusion of users of legally conformed markets.

Jake Chervinsky, a legal expert in Crypto-Regulation, believes that Geofencing is a stop-gap measure instead of a long-term solution,

“Many companies Geofence for fear instead of necessity, which leads to lost opportunities for both users and the government.”

The variant report also suggested that a more structured compliance framework would enable crypto projects to serve American users and at the same time meet the legal requirements.

What crypto leaders said against regulators

A16Z Crypto, a major risk capital company, published a policy recommendation for the SEC. The company insisted on the agency to issue formal guidelines for AirDrops. It also called for clear exemptions for token distributions. These exemptions would apply to distributions that do not serve as fundraising mechanisms.

Scott Walker and Bill Hinman have suggested Reforms to also clarify the AirDrop instructions.

They suggested making suitability criteria, so that AirDrops are not classified as effects. Coordinating AirDrop rules with remuneration programs for consumers would offer consistency and reduce the confusion of the regulations.

They have also recommended safe port provisions to protect blockchain projects that distribute tokens to their communities.

Will the SEC adjust or hold the line?

Legislers, market leaders and investors increase the pressure on changes in the regulations.

For example – Alexander Grieve, VP of Public Affairs in Paradigm, shared That the company Hester Peirce and SEC officials met to discuss the airdrop instructions.

Source: X

The SEC could introduce clearer guidelines to tackle constant uncertainties. Clear rules would enable our investors to participate in Airdrops without legal risks.

This would benefit both individuals and the broader economy.

For now, Crypto projects remain careful about recording American users in Airdrops. That is why American investors continue to miss opportunities that are available to international participants.

Credit : ambcrypto.com

Leave a Reply