- Despite the full unlocking of UNI, over 700 million tokens remain in the hands of key stakeholders such as a16z.

- Net outflows indicate accumulation in the UNION, but market volatility looms as major investors wait for better conditions.

Uniswap [UNI] has reached an important milestone: 100% of the offering is now fully unlocked.

Despite this, only 25.83% of the total 1 billion UNI tokens (approximately 258.3 million) are currently circulating on the market, according to @EmberCN analysis.

This is largely due to the fact that the majority of the supply is held by the community treasury, team members, investors and advisors, who have yet to release a significant portion of their holdings.

Distribution and current circulation

Of the total UNI supply, 17% was distributed early on through liquidity provider (LP) that distributed rewards and airdrops to early users. These tokens have already hit the market and are part of the circulating supply.

In fact, the remaining 83% was allocated to the community’s coffers and key stakeholders, including the team, investors and advisors.

To date, the Community Treasury has released the entire allocation of 430 million UNI, but only about 30 million UNI has entered the market.

Likewise, the 400 million UNI allocated to the team, investors, and advisors have been fully unlocked, yet only about 58.16 million UNI have been sold.

This cautious approach by major stakeholders, including investors like a16zhas contributed to a stable market price by preventing a sudden influx of tokens into circulation.

Holders show confidence in the long term

Despite the full unlocking of UNI tokens, there has been no significant sell-off among key stakeholders.

The decision to hold a large portion of the supply – over 700 million UNI tokens – signals a strong hold mentality among major investors.

This has helped prevent a sharp increase in circulating supply, potentially stabilizing the market.

This holding behavior may reflect long-term confidence in Uniswap’s future, as stakeholders like a16z appear to be waiting for favorable conditions before releasing more of their tokens to the market.

This limited supply could influence future market trends, especially if major stakeholders choose to sell more UNI tokens.

The outflow of UNI signals an accumulation wave

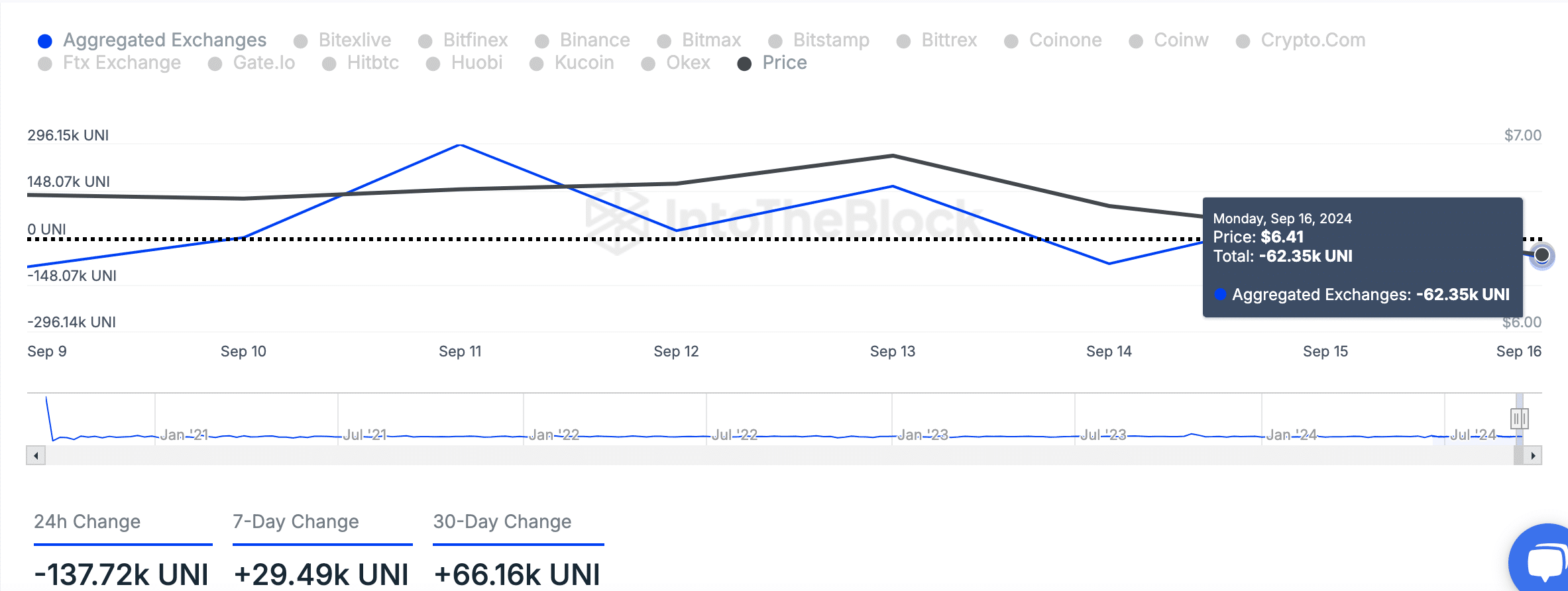

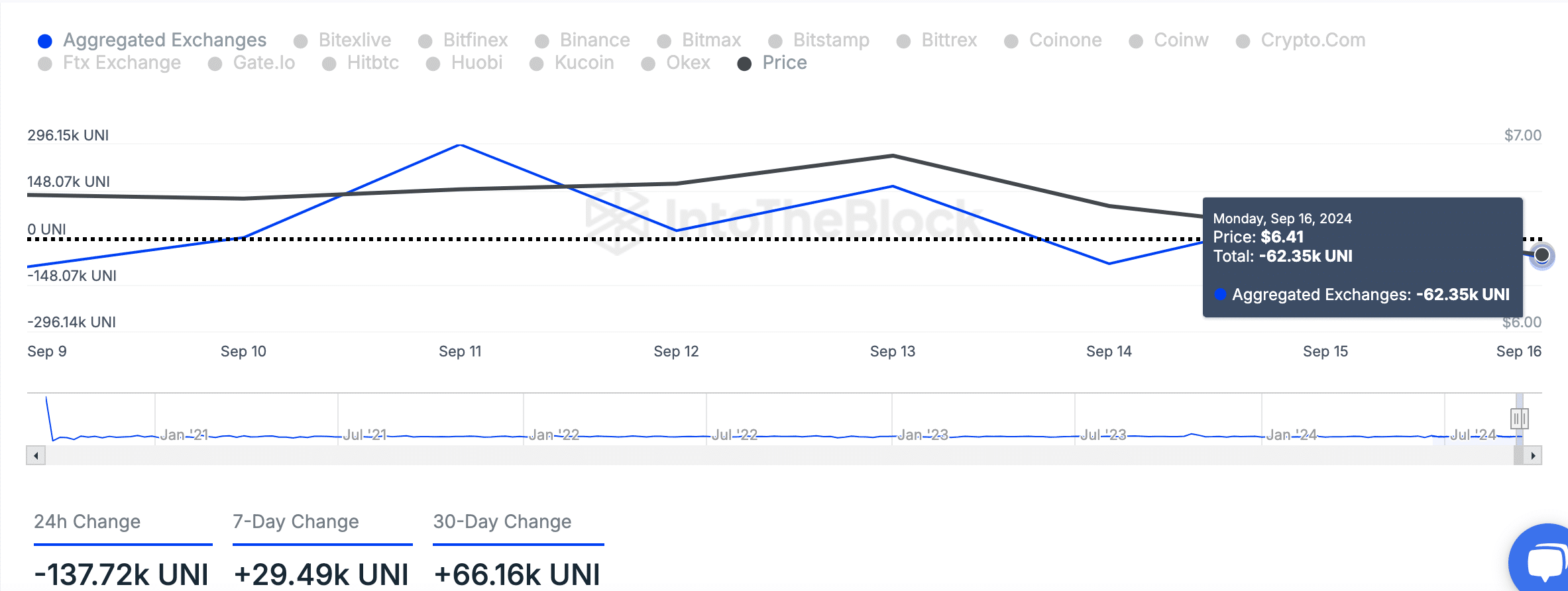

In recent weeks, the UNI market has seen both inflows and outflows, per IntoTheBlock data. On September 16, there was a net outflow of 62,350 UNI, indicating more tokens were being withdrawn from the exchanges.

This could be a signal that holders are preparing to retire or hold their UNI for the long term, rather than selling in the short term.

Source: IntoTheBlock

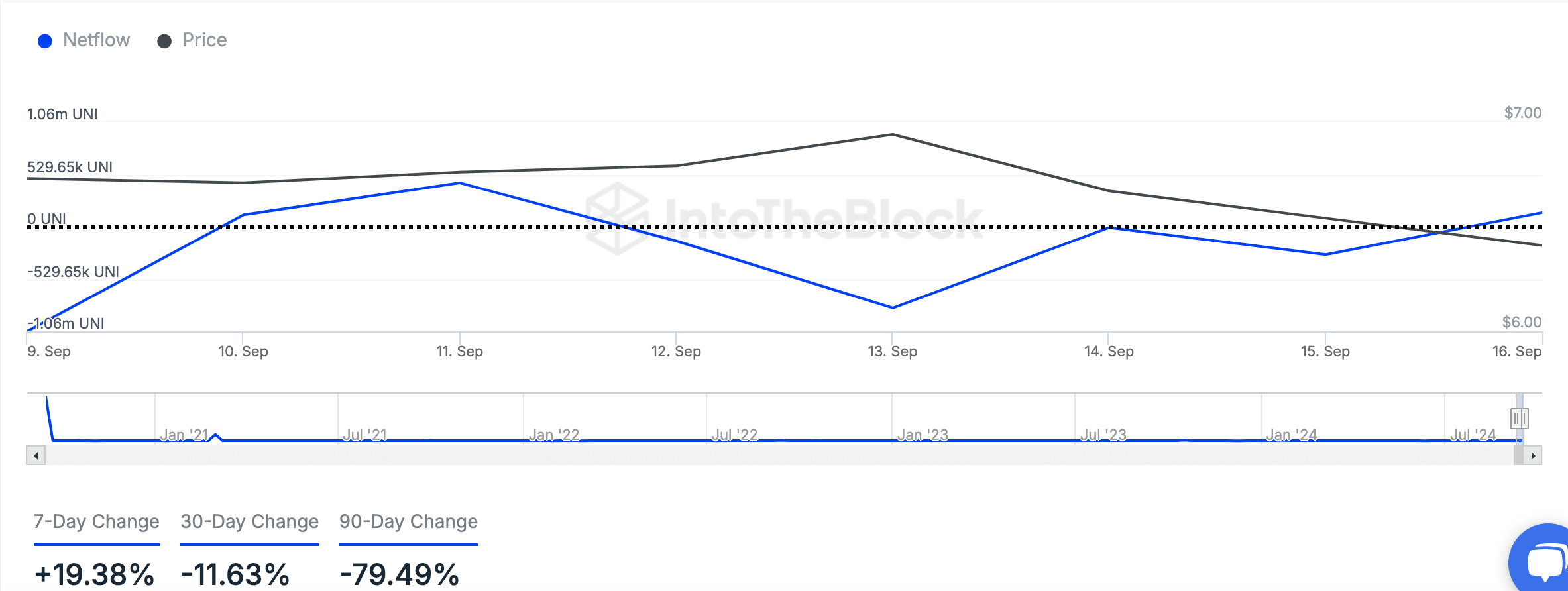

Over the past seven days, net inflows have increased by 19.38%, indicating some accumulation by large holders.

However, over the past thirty and ninety days there has been a trend of net outflows, indicating a possible decline in large farmer activity over time.

Source: IntoTheBlock

Despite this, UNI’s price has remained relatively stable, up 2.55% in the past 24 hours and up 1.09% in the past week, indicating that the market is absorbing these changes well.

Read the one from Uniswap [UNI] Price forecast 2024–2025

At the time of writing, UNI was valued at $6.63 with a 24-hour trading volume of $138 million and a circulating supply of 750 million UNI. This gives Uniswap a market capitalization of almost $5 billion.

While recent net flows show signs of potential accumulation, market volatility could emerge in the future if major stakeholders decide to sell more of their holdings.

Credit : ambcrypto.com

Leave a Reply