- UNI showed strong signals across the chain with significant growth in large transactions and network activity

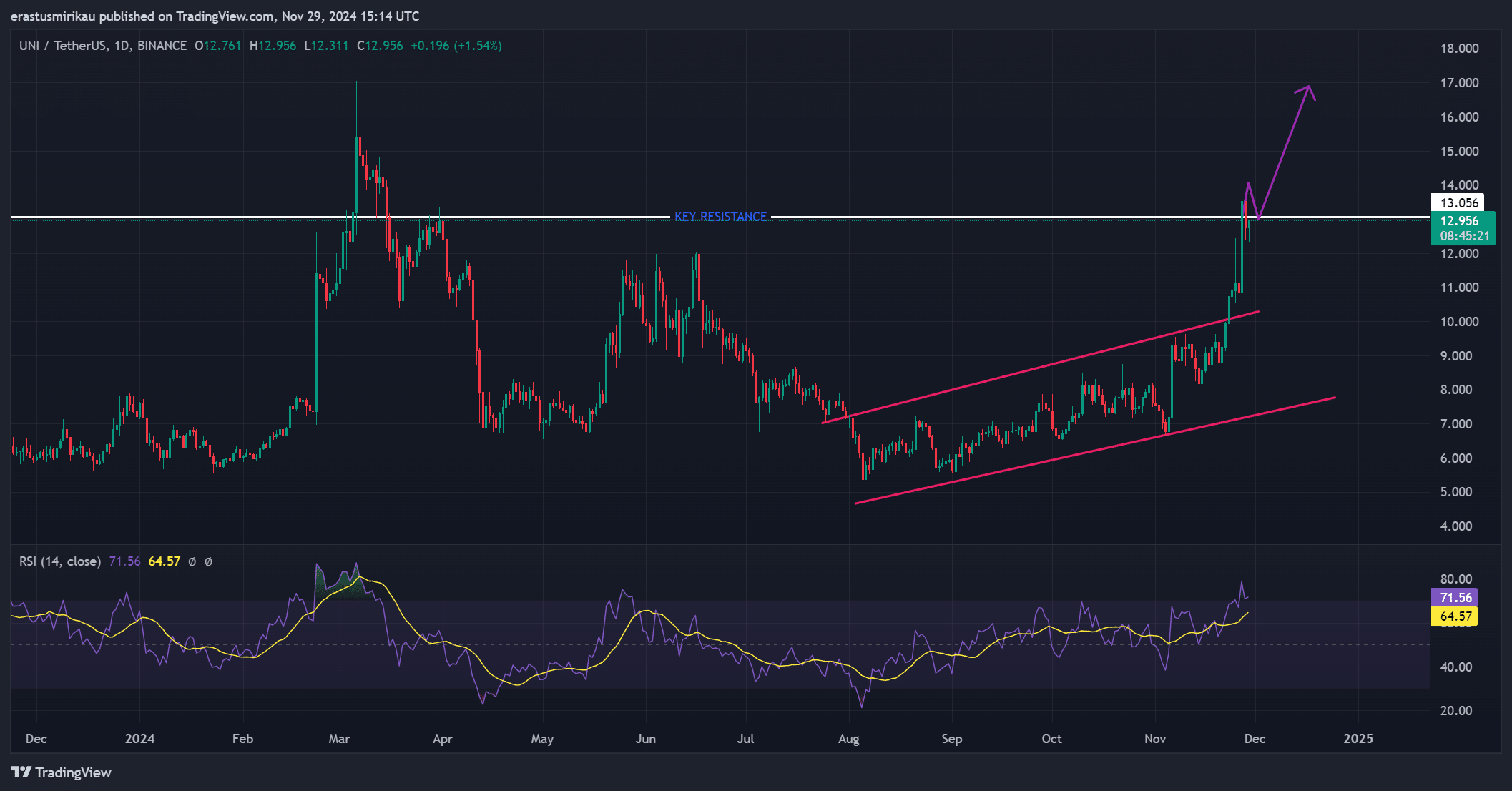

- UNI was testing its key resistance at $13 at the time of writing, with potential for further gains if a breakout were to occur

Uniswap [UNI] has gained significant momentum lately, fueled by a massive $38 billion monthly volume in Ethereum Layer-2 networks such as Base, Arbitrum, Polygon, and Optimism. This increase in activity has translated into strong bullish sentiment, with UNI trading at $12.95 at the time of writing – up 2.16% in the last 24 hours.

As liquidity and usage continue to rise, UNI is at a critical juncture. Can it maintain this momentum and move past key resistance levels, or will it face a pullback in the near future?

Are the signals in the chain signaling more bullish action?

Uniswap’s on-chain data showed a series of bullish indicators. Net network growth saw a modest increase of 0.34%, indicating more users are adopting the platform. Similarly, in-the-money trades increased by 1.56%, implying that more investors are now in profitable positions.

Moreover, concentration grew by 0.04%, indicating a shift towards greater investor confidence.

The most notable measure, however, seemed to be the spike in large transactions, which rose 6.92%. The jump highlighted the growing involvement of institutional investors and large traders – a sign that major players are positioning themselves for a potential upside in UNI’s share price.

Source: IntoTheBlock

What does UNI’s price action say about the future?

Testing the $13 resistance level at the time of writing, Uniswap’s price action was at a crucial point. A breakout above this level could push UNI towards $17, where the next resistance appeared to be.

However, the RSI read 71.56, suggesting that UNI was approaching overbought conditions.

So, while the bullish trend remains intact, investors should be cautious of possible pullbacks or consolidations before a breakout occurs.

Source: TradingView

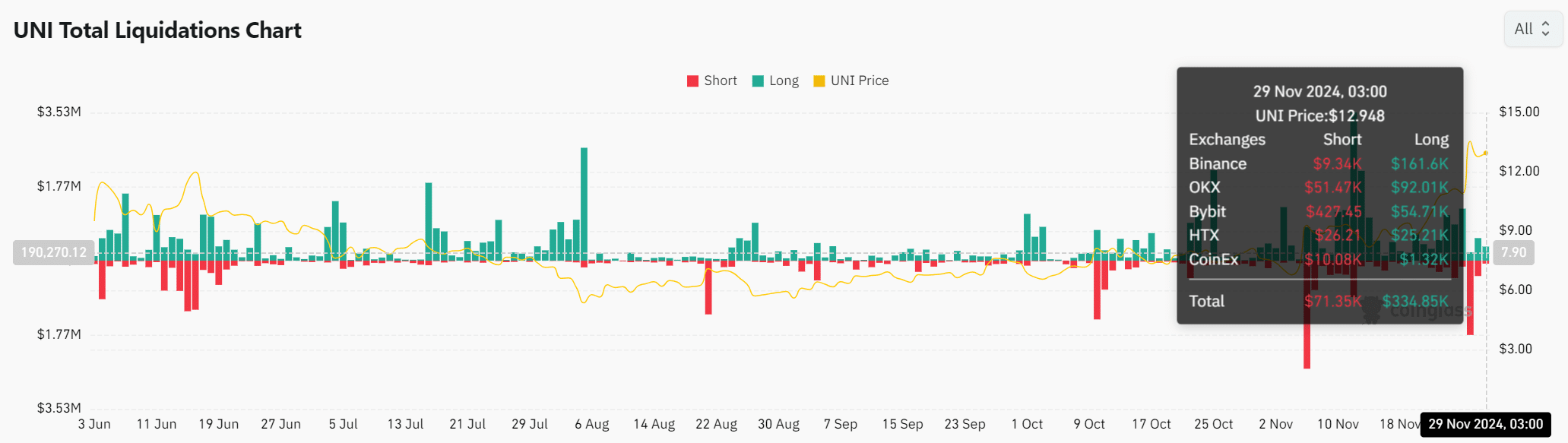

Foreign Exchange Reserves and Liquidations – Mixed Signals Ahead?

Exchange Reserves saw a modest increase of 0.12% over the past 24 hours, bringing the total to 68 million UNI tokens. This uptick suggested that investors may hold on to their tokens or prepare to sell, depending on their outlook for the market.

Meanwhile, the total liquidations revealed a higher concentration of long positions: $71.35k in short positions and $334.85k in long positions. This disparity indicated that the majority of traders are betting on continued bullish momentum.

However, it also makes UNI vulnerable to short squeezes if the market moves against the long crowd.

Source: Coinglass

Realistic or not, here is UNI’s market cap in BTC terms

Will UNI continue its upward trend?

Uniswap’s recent price surge, combined with strong on-chain signals and a rise in the number of large transactions, pointed to a bullish outlook for the token. However, with the RSI approaching overbought territory and currency reserves showing mixed signals, traders should proceed with caution.

A breakout above $13 could take UNI higher, but the risk of a pullback remains. Therefore, further gains may be likely if UNI can maintain the press momentum and break through the resistance.

Credit : ambcrypto.com

Leave a Reply