The Cryptocurrency market saw a large increase and a lot of buying activity after Donald Trump returned to the White House. Because Trump signs various executive orders that support the cryptocurrency market, more people are interested in trade. The following week is important for the market because the Federal Open Market Committee (FOMC) meeting and decisions about interest rates, together with other major economic news, will probably influence future trends in the market.

Markets remain stable and bullish under Trump’s new policy

This week everyone focused on the policy of US President Trump after he took office, and it seems that the markets have been handling it reasonably well so far. Instead of worrying, his announcements people actually make bullisher. He has discussed large investments in artificial intelligence (AI), which makes significant changes to the crypto policy, keep the interest rates low and checking inflation by reducing oil prices. This has encouraged investors to take more risks, so that the S&P 500 has reached a new record high.

Read also: Bitcoin Price Prediction 2025: Will BTC break $ 109k and hit a new all time?

As we start a new week, various important events can form the future trends of the cryptocurrency market.

US 4Q WIND Season

Next week large technology companies such as Microsoft, Meta Platforms, Tesla and Apple will report their income. Analysts predict that these large players, together with three other large companies, will see their income grow by more than 17% compared to the following year, which is almost double the 9% growth expected from the other 493 companies.

Because these companies are so highly appreciated, investors will probably look more than just the usual profit and turnover figures.

American FOMC meeting

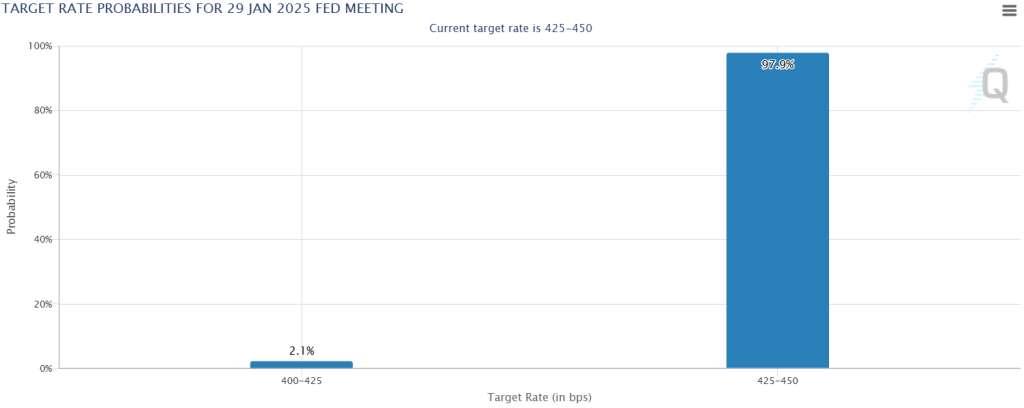

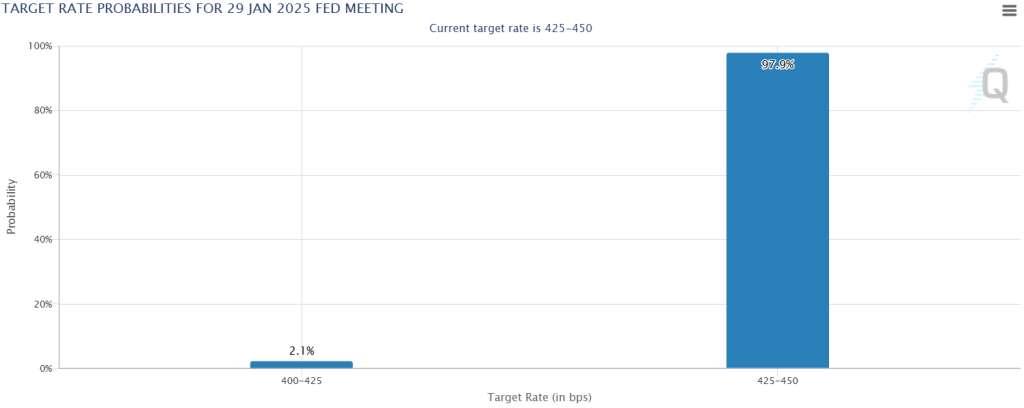

It is generally expected that the Federal Reserve will keep its most important interest rate unchanged this Wednesday while waiting for more information that shows that inflation is decreasing.

At the World Economic Forum in Davos, Switzerland, Trump said he would insist on immediate cuts on interest rates worldwide, and would again visit his frequent but ineffective pressure on the FED during his first term. Early in his second term, Trump has already tightened immigration and announced plans to levy import tax from 1 February.

This creates uncertainty for the FED, making it difficult to plan monetary policy. The FED meets quickly and is expected to maintain the current interest rate between 4.25% and 4.50%, because recent data support a gradual approach to achieve their 2% inflation objective.

FED chairman Jerome Powell and his team are faced with the challenge of balancing current monetary policy with uncertainties about the future and to decide how much to reveal about the prospects of the FED.

US Core Personal Consumption Expenditures (PCE) Price index

In November the total PCE prices in the US increased by 2.4% compared to last year, which is an increase compared to the three-year low of 2.1% that was seen in September. The core -pce price index, which uses the FED to gauge underlying inflation, rose only by 0.1% -the smallest increase in six months. This kept the annual Core PCE rate stable at 2.8% in December, which was lower than the expected 2.9%.

Looking ahead, the total PCE is expected to rise to 2.6% on an annual basis, which will be announced on Friday. The core -PCE inflation percentage is also expected to remain stable at 2.8%.

European Central Bank (ECB) interest decision

The ECB is expected to reduce interest rates by 0.25% during the next meeting on January 30, which results in the rate to 2.75%. This would be the fifth rates since June 2024, aimed at supporting economic growth.

Conclusion

With the Fed probably on a break, the ECB is ready to lower the rates, and Trump’s pro-crypto signals still fresh, the cryptomarkt seems to be positioned for a generally bullish week ahead. However, traders must be prepared for volatility around the FOMC announcement and important releases for business profits.

Credit : coinpedia.org

Leave a Reply