- ARB recently recorded a significant net outflow chain, a trend that often leads to price declines.

- However, both whales and retail investors have absorbed the selling pressure and are betting on ARB’s potential for further gains.

After a month-long decline of 19.37%, Arbitration [ARB] has reversed course. Over the past week, the stock rose 24.03% and has extended its upward momentum with a gain of 4.85% in the past 24 hours.

Recent data indicates that ARB’s recovery is being driven by strong participation from whales and retailers. While current market sentiment supports further growth, potential risks to this trend remain.

The enormous outflow from the chain poses a risk to the ARB’s profits

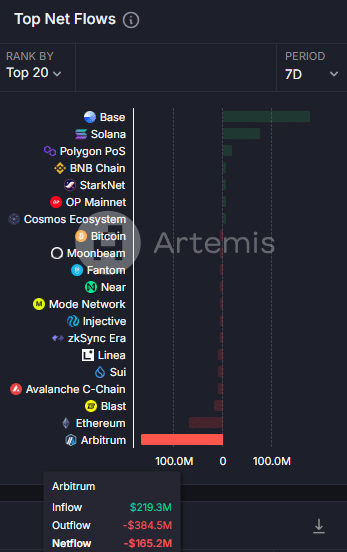

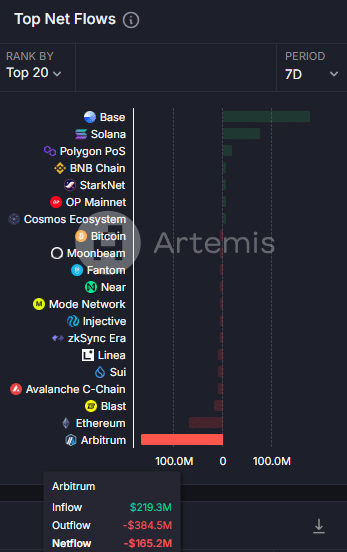

ARB faces a significant challenge as it has recorded the largest negative chain netflow over the past seven days, surpassing Ethereum, Avalanche, SUI, and Injective.

Artemis data showed that ARB’s chain net flow was -$165.2 million, which was the most substantial outflow recorded during this period.

Source: Artemis

Chain net flow reflects the total movement of assets across a blockchain. It is calculated as the difference between the total inflow (assets received) and outflow (assets sent) across all addresses.

A negative on-chain net flow, as seen at ARB, typically indicates reduced user activity and declining confidence in the asset, which can lead to price declines.

Despite this, AMBCrypto reports that whales have mitigated the potential downside by absorbing selling pressure and stabilizing the market for the time being.

Whales prevent a further decline in the ARB

Despite ARB’s significantly negative on-chain net flow, a single whale transaction helped stabilize the assets, preventing a sharp price drop. A whale is an address that controls 1% or more of the total supply of an asset.

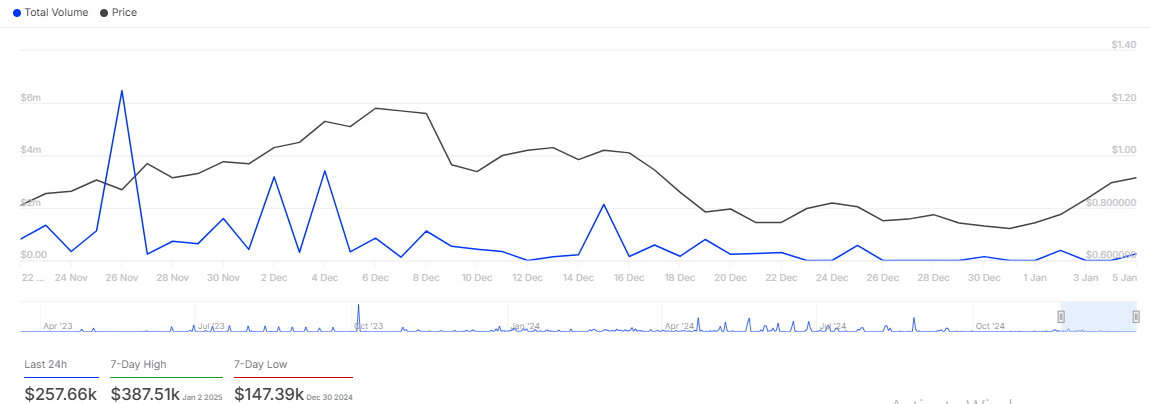

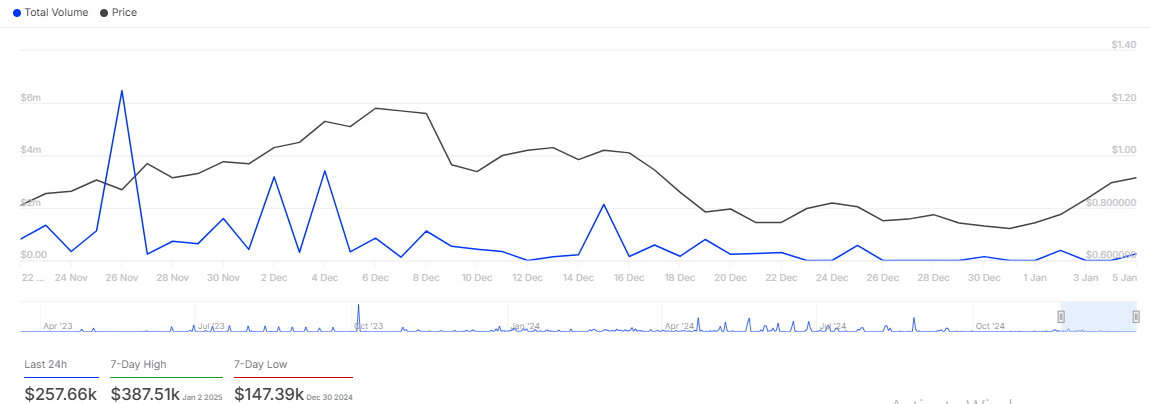

Data from IntoTheBlock shows an increase in high transaction volume over the past 24 hours. One transaction involved 281,420 ARB, worth $257,660. This likely buy order coincided with a 4% price increase over the same period.

InHetBlok

Such significant purchases by whales often have a ripple effect on the broader market. In this case, this move led to increased demand among retailers, further supporting ARB’s recovery.

Demand in retail is increasing

As whales dampen Arbitrum’s price, retail traders are driving bullish momentum. Key market statistics point to growing confidence and activity among smaller investors.

One notable metric is the funding rate, which has steadily increased and now stands at 0.0082%. This indicates bullish market sentiment, with long traders paying a premium to keep their contracts active.

At the same time, open interest rose 8.81% to $256.01 million, due to an increase in the number of unsettled derivative contracts. This indicates increased speculative activity in the market that favors ARB.

In addition, spot traders are increasingly transferring ARB from exchanges to private portfolios for long-term investments. More than $2.39 million worth of ARB was delisted from the exchanges in the past 24 hours, potentially leading to a supply shortage.

Source: Coinglass

Read Arbitrums [ARB] Price forecast 2024–2025

This simply implies that there is reduced availability of Arbitrum on the exchange, and this could drive up prices as demand exceeds supply.

If these trends continue, Arbitrum is well positioned to maintain its upward momentum and post further gains in the near term.

Credit : ambcrypto.com

Leave a Reply