- Price action suggests that SOL could easily reach the $195 level in the coming days.

- SOL’s liquidation data indicates that bulls are currently dominating the assets, meaning that the bets on the long side are significantly higher.

It looks like whales are back in action, just like Solana [SOL]The world’s fifth-largest cryptocurrency by market cap is approaching the $195 breakout level.

Whales acquires Solana for $35 million

On October 28, blockchain-based transaction tracker Lookonchain posted on

Additionally, these whales have staked their acquired SOL tokens, indicating optimism among traders around SOL as a long-term investment. According to data, these remarkable SOL gains were made by just three whales.

Look at chain noted that the whale wallet address “AA21BS” raised over 153,511 SOL worth $26.4 million. Another wallet address “EHax” raised 35,498 SOL worth $6.12 million, and the last whale’s wallet address “EGzi” raised 13,000.8 SOL worth $2.3 million.

However, these notable withdrawals were made through the cryptocurrency exchanges Binance and Kraken.

Solana technical analysis and key levels

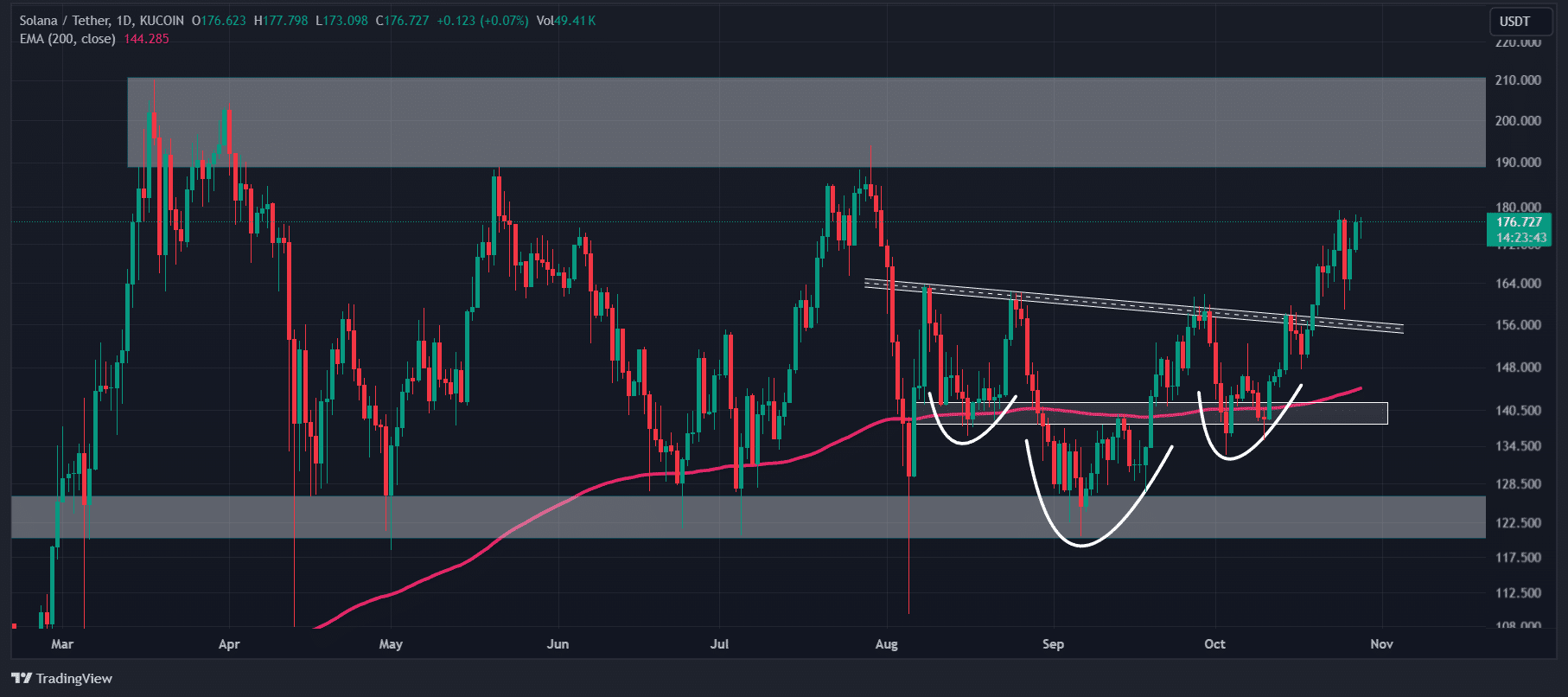

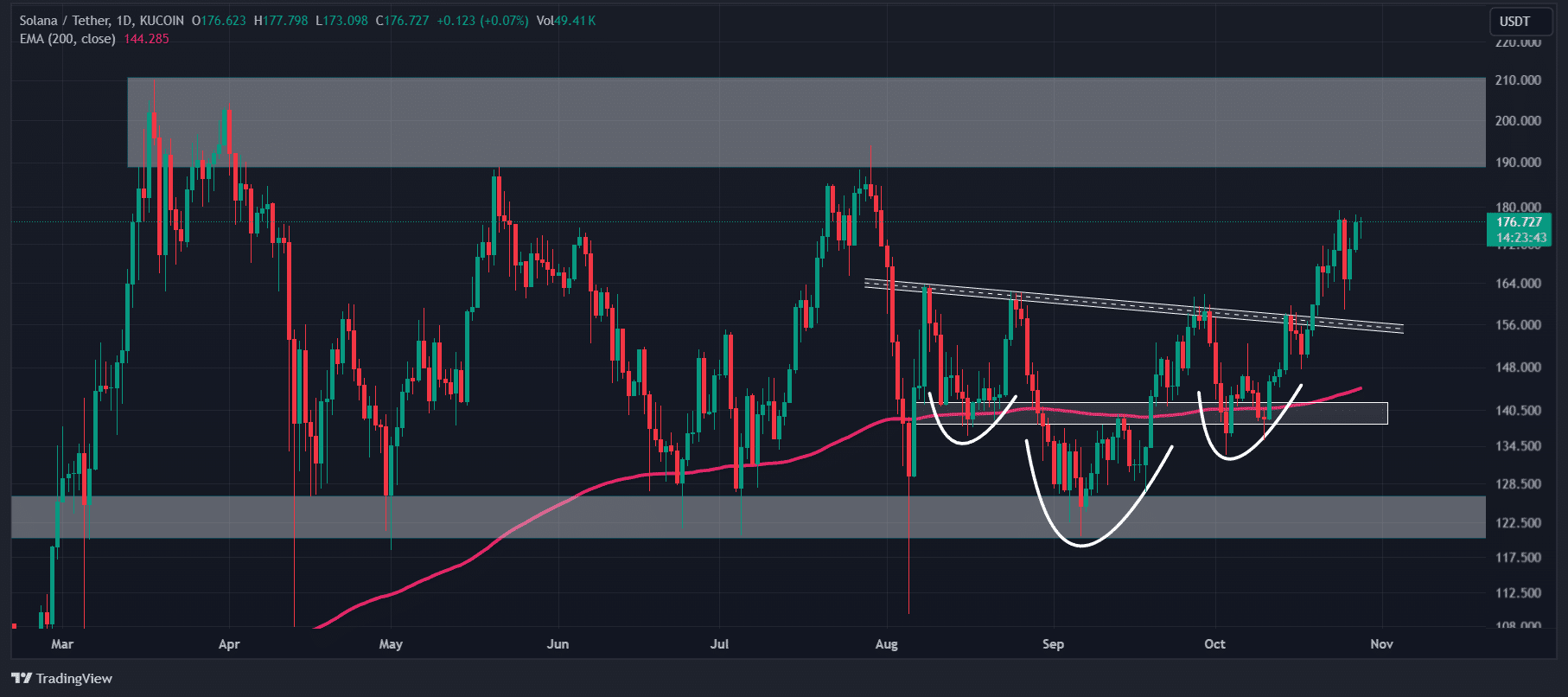

According to the data, these significant accumulations followed the retest of a bullish inverse head-and-shoulders pattern, indicating a positive outlook for SOL holders.

Source: TradingView

According to AMBCrypto’s technical analysis, SOL appears bullish and is approaching a crucial resistance level at $195. Based on the recent price action, there is a high possibility that SOL could reach the $195 level in the coming days.

However, these notable SOL acquisitions and current sentiment suggest that SOL has the potential to reach its all-time high of $260 in the coming days. As of now, the 200 Exponential Moving Average (EMA) indicates an upward trend.

Mixed statistics in the chain

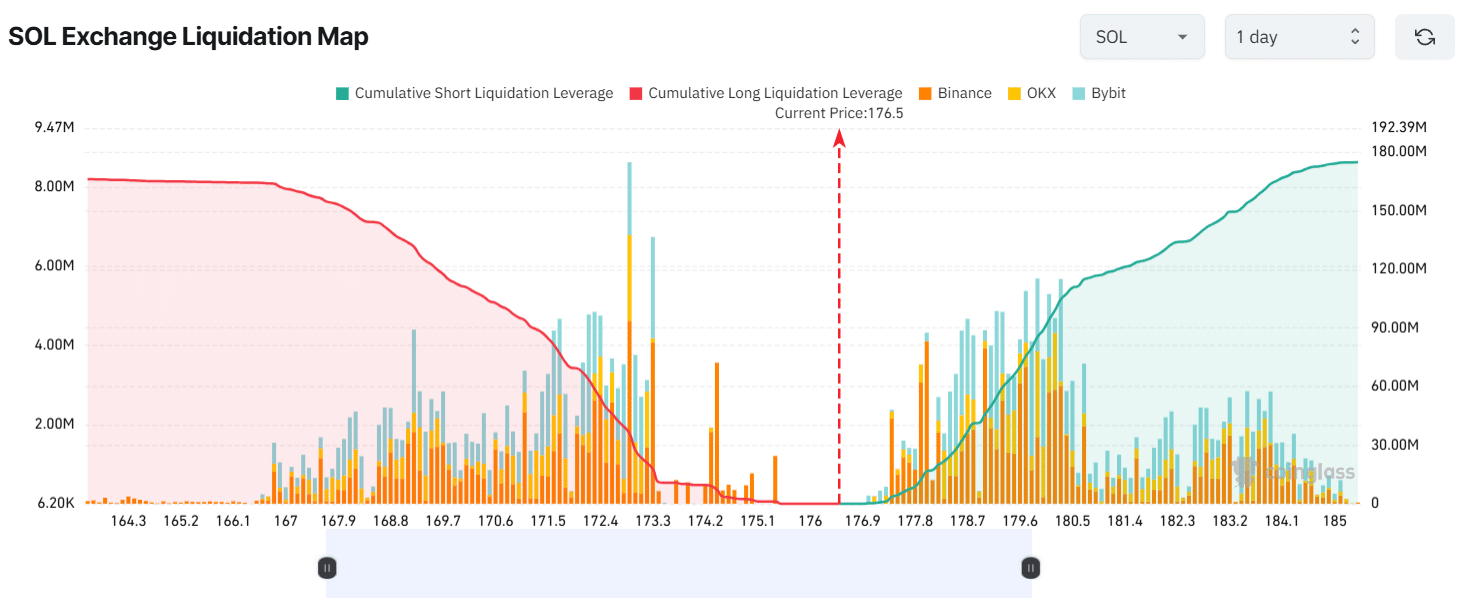

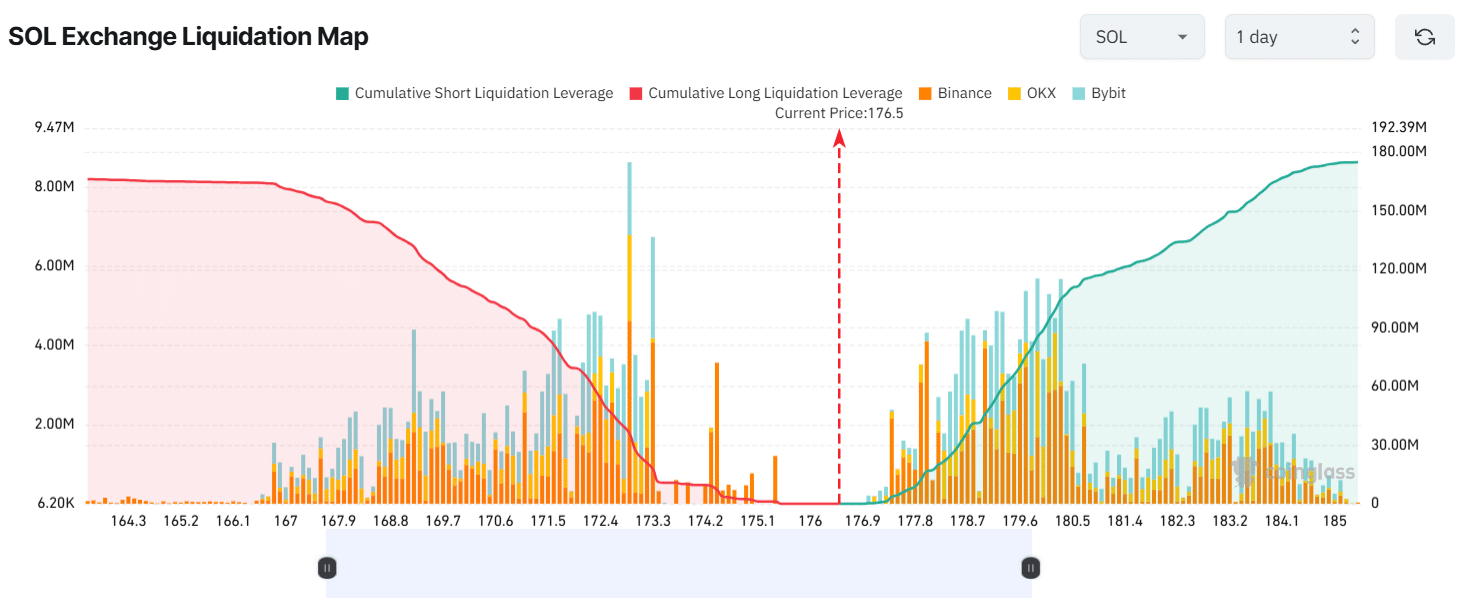

Despite this positive outlook, SOL-on-chain metrics indicate mixed sentiment. According to on-chain analytics firm Coinglass, SOL’s Long/Short ratio currently stands at 1.03, indicating bullish sentiment among traders.

However, open interest has fallen 7%, indicating a possible liquidation of short positions during the recent rally.

Currently, the key resistance levels are at $172.9 on the downside and $178 on the upside, with traders at these levels being over-leveraged, according to the Coinglass data.

Source: Coinglass

If SOL sentiment remains unchanged and the price rises to $178, short positions worth nearly $16.70 million will be liquidated. Conversely, if sentiment changes and the price falls to $172.9, long positions worth approximately $36.06 million will be liquidated.

Is your portfolio green? View the SOL Profit Calculator

This liquidation data indicates that bulls are currently dominating the assets, as long positions are double the short positions.

At the time of writing, SOL was trading around $176.33 and has experienced a modest 1.2% increase in the past 24 hours. During the same period, trading volume increased by 30%, indicating greater participation from traders and investors amid the whale participation.

Credit : ambcrypto.com

Leave a Reply