The US Federal Reserve announced yesterday, as expected, a 0.25% interest rate cut. During the press conference called to announce the rate cut, Fed Chairman Jerome Powell defended the decision, portraying it as an attempt to achieve a more balanced economic position. However, he revealed that the organization would take a cautious approach and consider further rate cuts. Yesterday, both the US stock market and the cryptocurrency market saw serious declines.

US Fed Rate Cut and Inflation Targeting: What You Need to Know

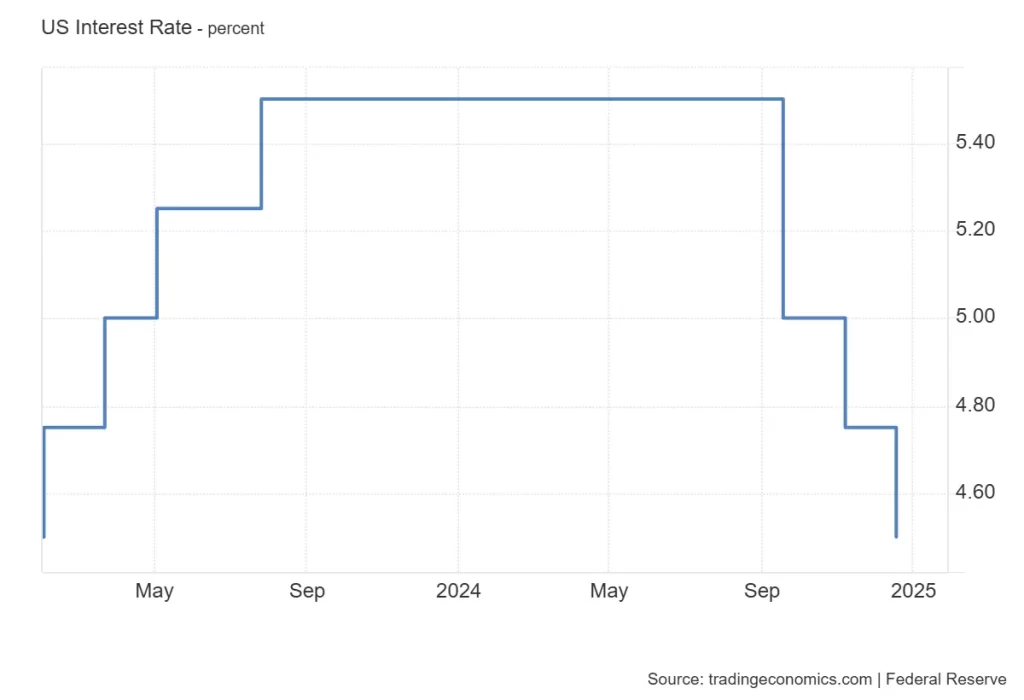

Yesterday, the US Fed Fund rate was cut to 4.5%. It was the third major correction this year. Initially this was reduced to 5% on September 18. On November 7, it was reduced for the second time to 4.75%.

During the press conference, Powell emphasized the organization’s commitment to supporting the country’s economy and labor market.

However, he stressed that the organization has not yet decided on a strict rate change plan, claiming that the possibility of a further rate cut depends on three key factors: new economic data, the outlook for the economy and the risks to the economy and inflation.

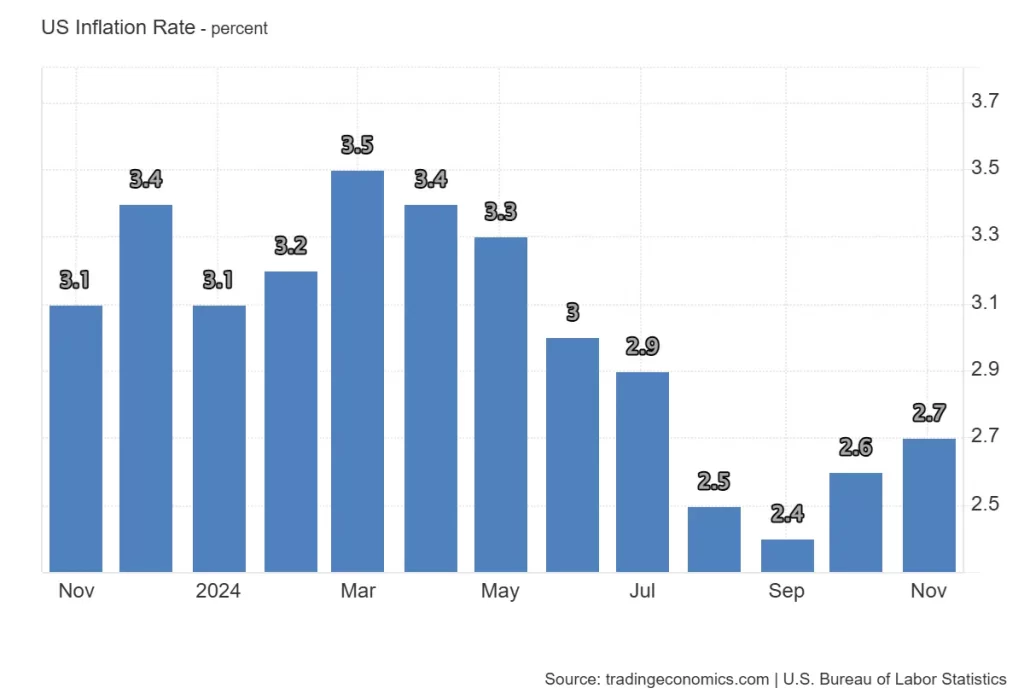

At the beginning of this year, US inflation was 3.1%. An annual peak of 3.5% was reached in March. This had fallen steadily, especially between March and September. In September it fell to an annual low of 2.4%. However, since then the rate has risen continuously. In November this was 2.7%.

- Also read:

- Metaplanet Stock Debuts on OTCQX: A New Era for Bitcoin Strategy in the US

- ,

Market Reactions: Stocks and Crypto Dive

On December 18, the day the interest rate cut was officially announced by the US Fed, the crypto market fell by approximately 0.58%. Early yesterday, the price of Bitcoin was $106,080.05. Towards the end, the price dropped to a low of $100,207.97, marking a significant drop of 5.85%. Similarly, the S&P 500 index also plummeted by more than 2.90% yesterday.

Following the Fed’s rate cut, Bitcoin and crypto took a hit, with Bitcoin falling 5.85%. Read the Bitcoin Price Prediction to find out what’s next for the market!

Altcoins face bigger challenges

As of December 18, the total market capitalization of the crypto market excluding BTC was $1.53 trillion. At the time the market closed, it was only $1.42 trillion, recording a notable decline of 7.74%. In the past 24 hours, Ethereum is down over 4.7%, XRP is down 6.8%, BNB is down 1.6%, Solana is down 3.3%, Dogecoin is down 6.2%, and Cardano is down 4.9%.

In conclusion, the Fed’s hawkish outlook signals long-term challenges for markets.

Never miss a beat in the Crypto world!

Stay informed with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Frequently asked questions

The US Federal Reserve cut interest rates by 0.25% and lowered the interest rate to 4.5% on December 18, 2024.

The crypto market fell 3.29% to $3.51 trillion after the Fed’s 0.25% rate cut. However, trading volume rose 34.78% to $265.97 billion, indicating increased activity.

Credit : coinpedia.org

Leave a Reply