Este Artículo También Está Disponible and Español.

Bitcoin has expanded his consolidation below $ 100,000 since the beginning of February. This price delay has been exacerbated by a delay in bullish sentiment among investors and a delaying euphoria with regard to the Crypto-positive influences of the new government of Trump in the US.

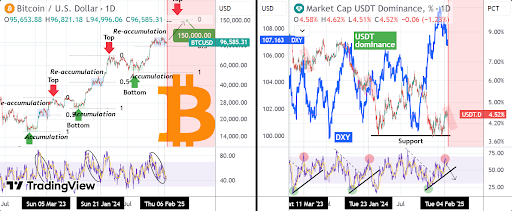

Despite this delay in the rally, technical analysis remains one Bullish long -term front views For Bitcoin. The current stagnation seems to be a re-accumulation phase for bullish investors; A pattern that is observed several times before a large upward relocation moves this cycle. Furthermore, analysis shows that the USDT -Dominance will play a crucial role in activating the next Bitcoin rally to $ 150,000.

Bitcoin’s RE accumulation phase and the role of USDT dominance

According to A technical analyst (Tradeshot) On the TradingView platform, Bitcoin currently has an interesting accumulation trend in addition to the USDT -Dominance. The USDT -Dominance reflects the percentage of the total crypto market capitalization in USDT, which indicates whether traders prefer Stablecoins over risky crypto activa. A high USDT -Dominance usually indicates a low purchasing pressure with cryptocurrencies. Conversely, a falling USDT -Dominance often suggests that traders reverse funds in Bitcoin and other cryptocurrencies.

Related lecture

Interesting is that the USDT -Dominance had a crucial simultaneous event with the preparations for Bitcoin for Rallies this cycle. Two remarkable re-accumulation periods occurred after Bitcoin in November 2022, each of which led to significant price rallies. The first accumulation period covered from January 2023 to March 2023, while the second place took place between November 2023 and February 2024. Both raccumulative phases took place at the 0.5 Fibonacci extension level of an earlier accumulation phase. In addition, these phases shared common characteristics, including a peaking 1-day RSI structure in the USDT Dominance Chart and a withdrawal into the Dollar Index (DXY).

Now Bitcoin seems to be reflect the same conditions Again, with USDT dominance and the DXY that withdrawn with the current re-accumulation phase, which has been taking place since December 2024. When the pattern continues unfold as expectedThis could indicate that Bitcoin is about to his next big rally.

USDT to send BTC to $ 150,000

If Bitcoin follows the pattern that is observed in earlier meetings, this cycle with the USDT dominance to the core could end the re-accumulation phase Within the following One or two weeks and ultimately cause a new rally to new all-time highlights.

Related lecture

In terms of a target, the analyst noted a potential goal of $ 150,000 for the Bitcoin price, at least before another important correction and a subsequent accumulation phase. Bitcoin, however CREATED MARE LEXT TIMESIn particular the psychological $ 100,000 Mark, which has served as a major obstacle in recent weeks.

At the time of writing, Bitcoin acts at $ 97,175, an increase of 1.6% in the last 24 hours. A move to $ 150,000 will represent an increase of 54% compared to the current price.

Featured image of Pexels, Chart van TradingView.com

Credit : www.newsbtc.com

Leave a Reply