This article is available in Spanish.

Nearly four years ago, Bitcoin experienced a dramatic 17% drop from $19,500 to $16,200 in 2020, an event that became infamously known as the ‘Thanksgiving Day Massacre’. As the holidays approach, market participants are wondering if history could repeat itself.

On Monday and Tuesday, Bitcoin’s price underwent an 8% correction, falling from $98,871 to a low of $90,791. This sudden downturn has sparked debate among analysts as to whether history could repeat itself for the BTC price.

Bitcoin ‘Thanksgiving Day Massacre’ 2024?

Alex Thorn, head of research at Galaxy Digital, went to X to sign parallels between the current market and the events of 2020. “Who remembers the Thanksgiving dump of 2020? Bitcoin fell 17% between Wednesday, November 25 and Friday, November 27, 2020. BTCUSD later went up over 3x over the next 5 months. Does history rhyme?”

A potential catalyst for the crash could be the global M2 money supply. Currently, there is a chart circulating on X that illustrates the correlation between Bitcoin and the global M2.

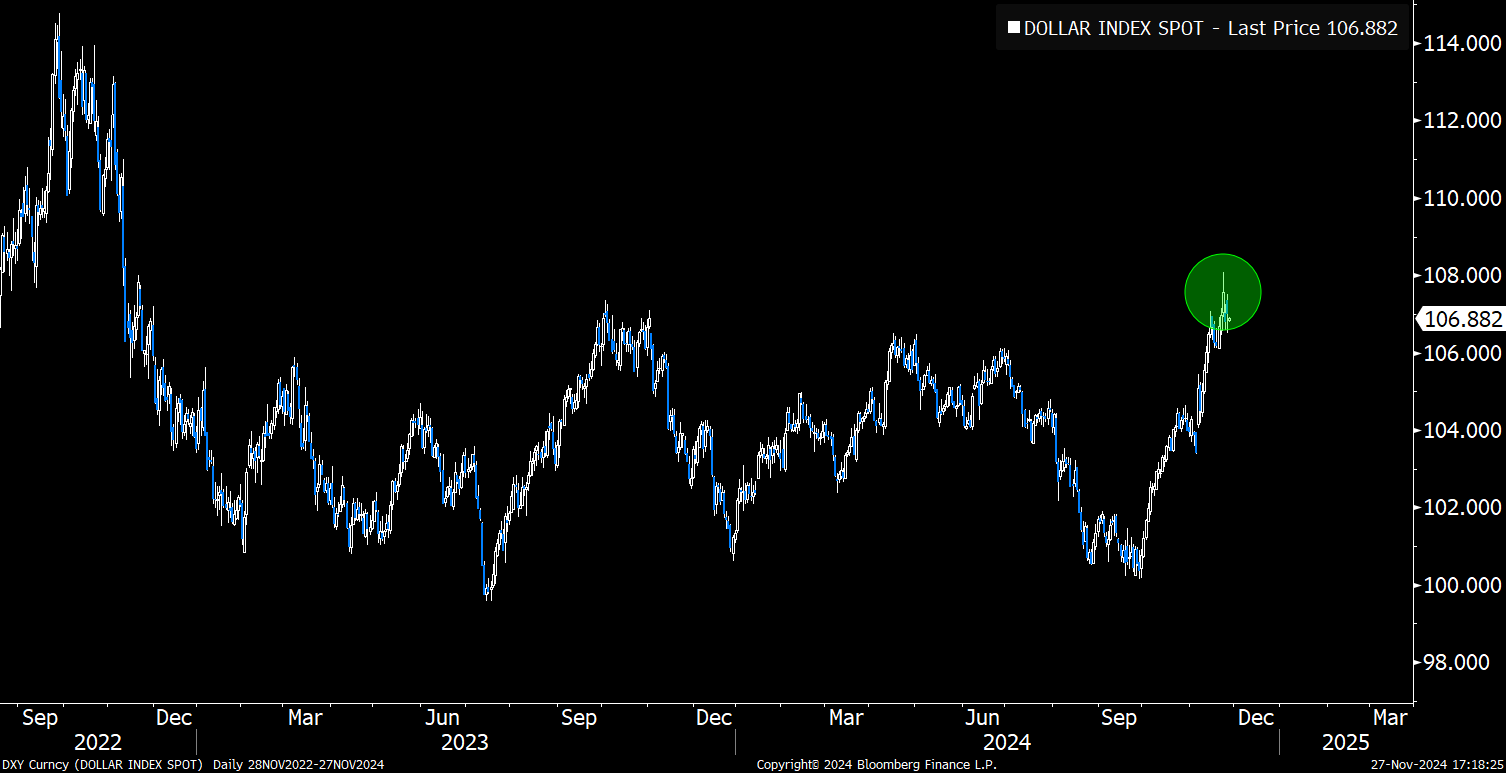

Joe Consorti, analyst at Theya, observed that Bitcoin has closely followed the global M2 since September 2023, with a lag of about 70 days. Over the past two months, global M2 has fallen from $108.3 trillion to $104.7 trillion, driven by factors such as a strengthening US dollar – which devalues foreign currency-denominated M2 when converted into dollars – and economic slowdowns dampening lending and deposit creation.

Related reading

Consorti warns: “If it continues to follow the current M2 contraction, a 20-25% correction could occur, potentially sending Bitcoin down to around $73,000 – not a price prediction, but a stark reminder of Bitcoin’s interconnectedness with the global money supply. However, he also acknowledged that Bitcoin could defy this trend just as it has in the past, especially “from 2022-2023 due to the collapse of the FTX and interest in the space evaporating as a result.”

He suggests that structural ETF inflows and corporate buying pressure could help Bitcoin resist the current M2 deflation. Consorti concludes: “In any case, a correction on this point seems about right. As previously mentioned, these rapid increases in the price of Bitcoin always have pit stops along the way. […] it’s critical to understand the assets you own, the macro environment they are in, and the forces that are driving them higher in the long term. If you really understand bitcoin, you won’t panic about selling.”

Related reading

Despite the cautious outlook, some analysts think the dip could be short-lived. Jamie Coutts, chief crypto analyst at Real Vision, points out via While acknowledging that Bitcoin “appears overextended relative to global M2” and that its liquidity model suggests caution, especially with leverage, Coutts highlights potential policy shifts that could favor risky assets.

He points to insights from economist Andreas Steno, who notes that the Federal Reserve is “in fact discussing an attempt at liquidity in the USD as early as December – changes to support liquidity developments.” Coutts concludes: “DXY could have been at the top here. The lag effect of Fintwit targeting ATMs is still real, but ultimately the Fed is waving the bull flag for risky assets again. Bullish 2025. Bullish BTC.”

At the time of writing, BTC was trading at $93,250.

Featured image created with DALL.E, chart from TradingView.com

Credit : www.newsbtc.com

Leave a Reply