- Bitcoin ETFs saw record inflows amid the broader market’s recovery, signaling optimism among investors

- Political shifts are driving the influx of digital assets, with Republicans seen as pro-crypto

Amid a broader market recovery, Bitcoin [BTC] ETFs have been gaining popularity lately, with significant inflows – a sign of a positive market trend.

Bitcoin ETF update

According to Farside InvestorsBitcoin ETFs recorded collective inflows of $371 million on October 15.

Leading the pack was BlackRock’s IBIT with $288.8 million, followed by Fidelity’s FBTC with $35 million. Additionally, Ark 21Shares’ ARK ETF reported figures of $14.7 million, while Grayscale’s GBTC finally saw inflows of $13.4 million.

While some ETFs had no inflows, none reported outflows. This can be interpreted as reinforcing the growing interest in Bitcoin-based investment vehicles.

Just a day ago, Bitcoin ETFs recorded their highest single-day net inflows since June – a combined value of $555.9 million.

Leading this momentum was FBTC, which reported inflows of $239.3 million – the largest since June 4. In addition, GBTC also saw renewed interest with figures of $37.8 million – the highest level since May and the first positive inflow in October.

This coincided with Bitcoin trading at $67,823.08 on the charts, after rising 3.56% in 24 hours and gaining 9.44% over seven days. As expected, this has fueled speculation that the crypto may be gearing up for a new all-time high.

CoinShares Links This to Elections – But Why?

The latest version of CoinShares is interesting report also highlighted a notable increase in digital asset inflows, totaling $407 million. A shift attributed to growing investor interest, coupled with a potential Republican victory.

This recent surge in capital is a sign of increased interest in crypto, one driven by expectations that a Republican Party-led administration could bring about favorable regulatory shifts for the sector.

The report noted:

“Digital asset investment products saw inflows of $407 million, as investor decisions are likely more influenced by the upcoming US elections than by the outlook for monetary policy.”

The company supported its analysis by pointing out that the recent inflows are closely aligned with political developments, rather than economic indicators.

Notably, stronger-than-expected economic data had minimal effect on halting the earlier outflows.

According to CoinShares, this increase in inflows was followed by the recent US vice presidential debate. Following this, polling momentum shifted to Republicans, who were seen as more supportive of digital asset initiatives.

Managers weigh in…

ETF Store president Nate Geraci supported this perspective, emphasizing that the results of the US election could have a major impact on the future of the digital asset industry.

He said,

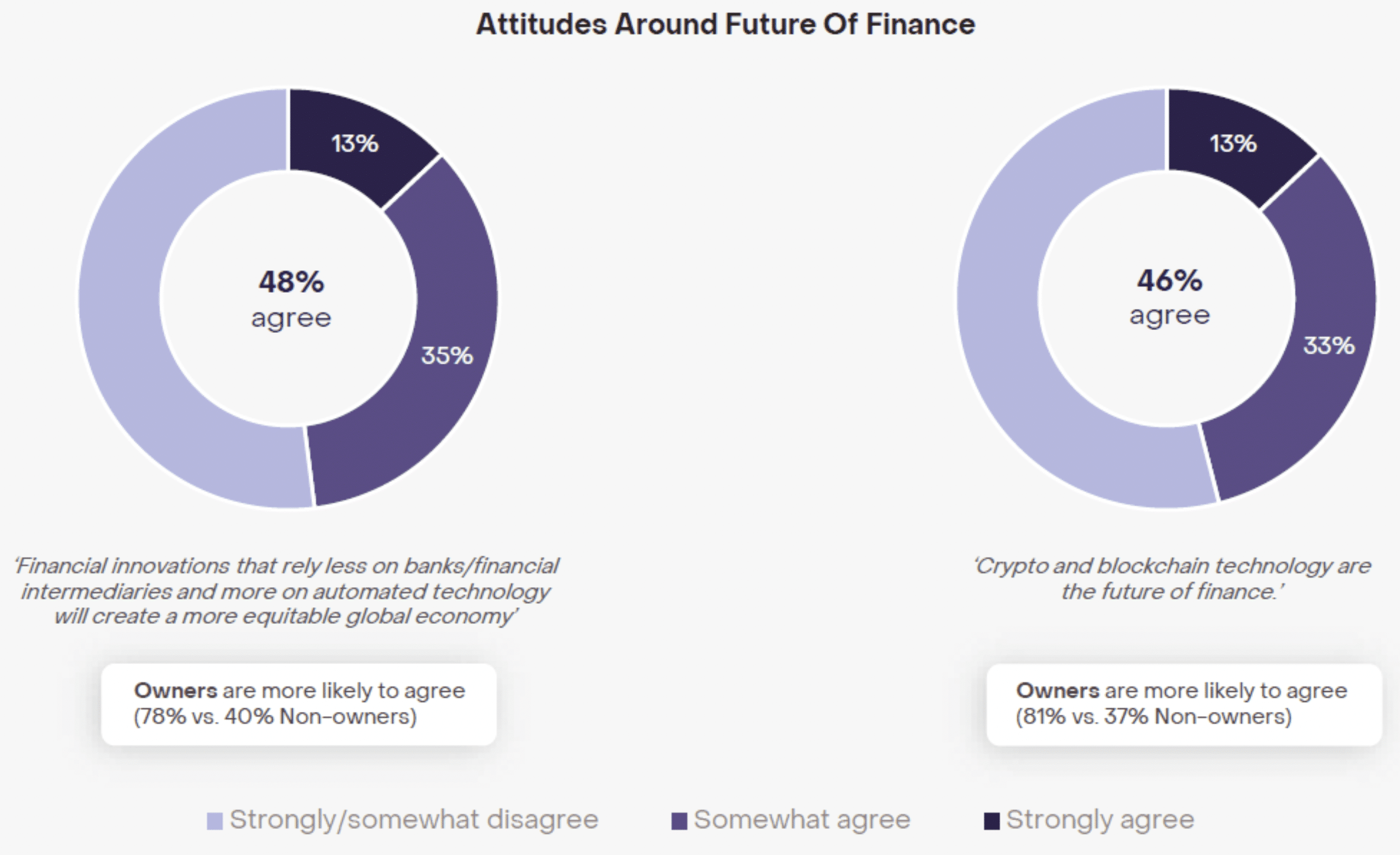

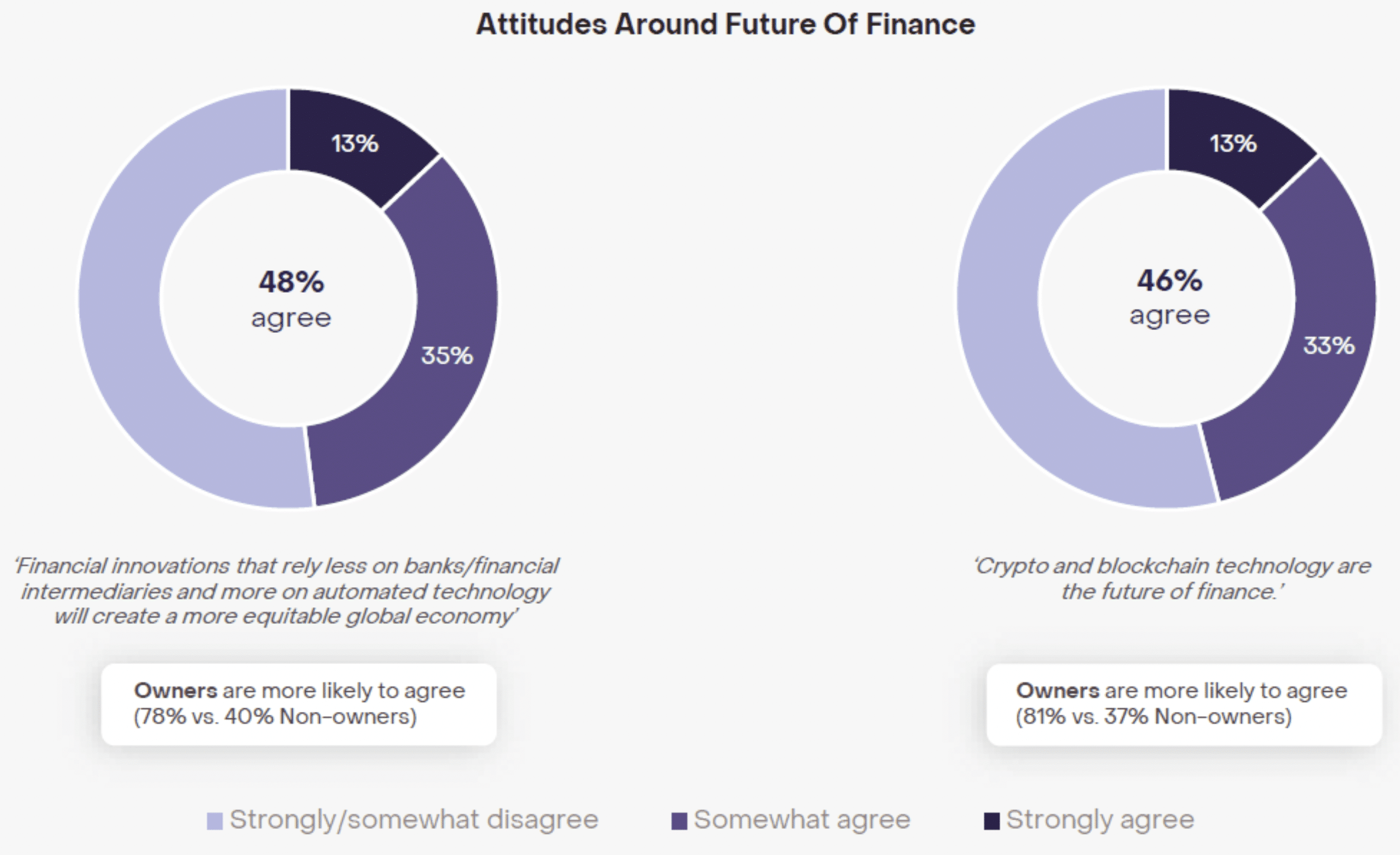

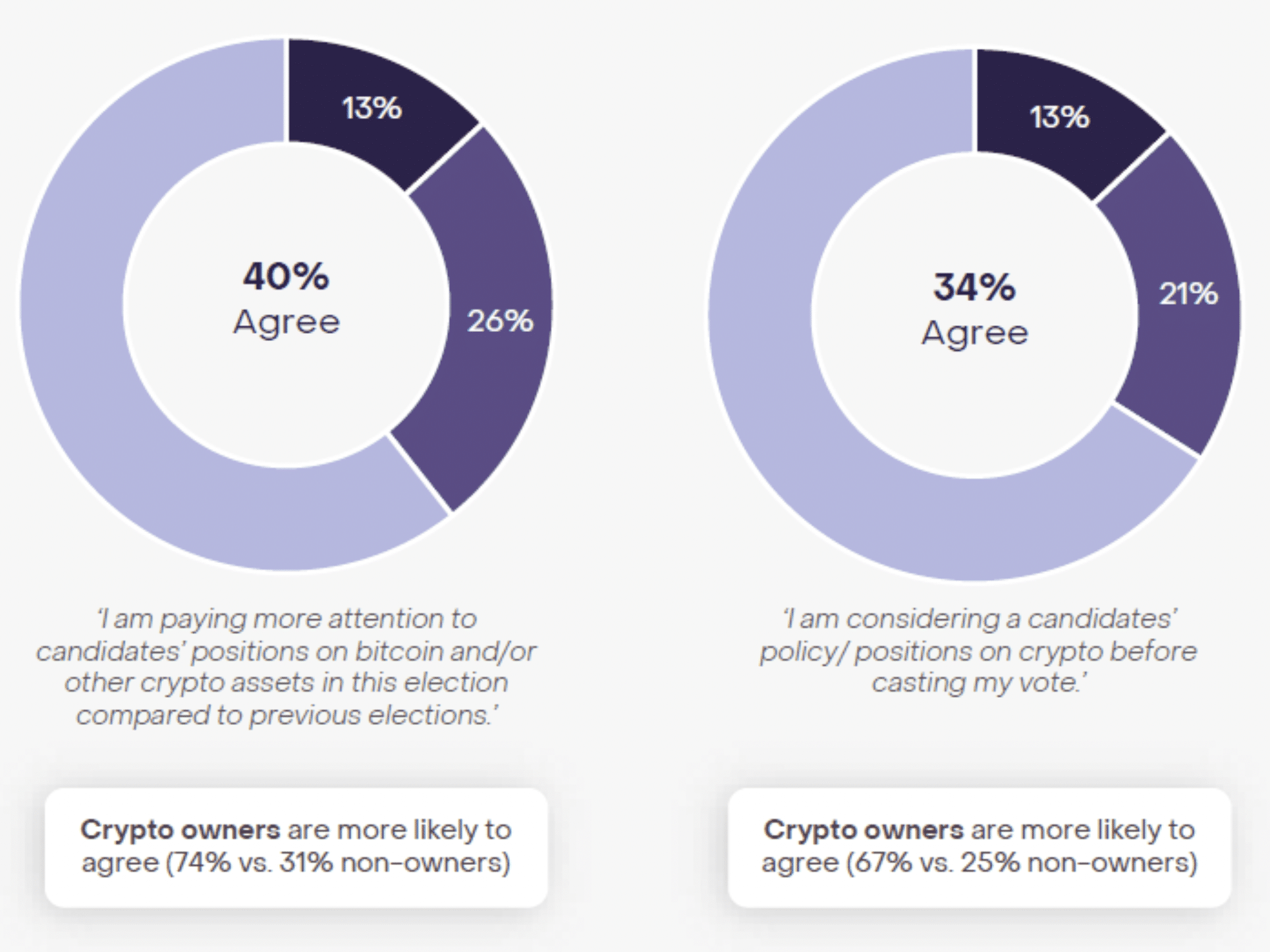

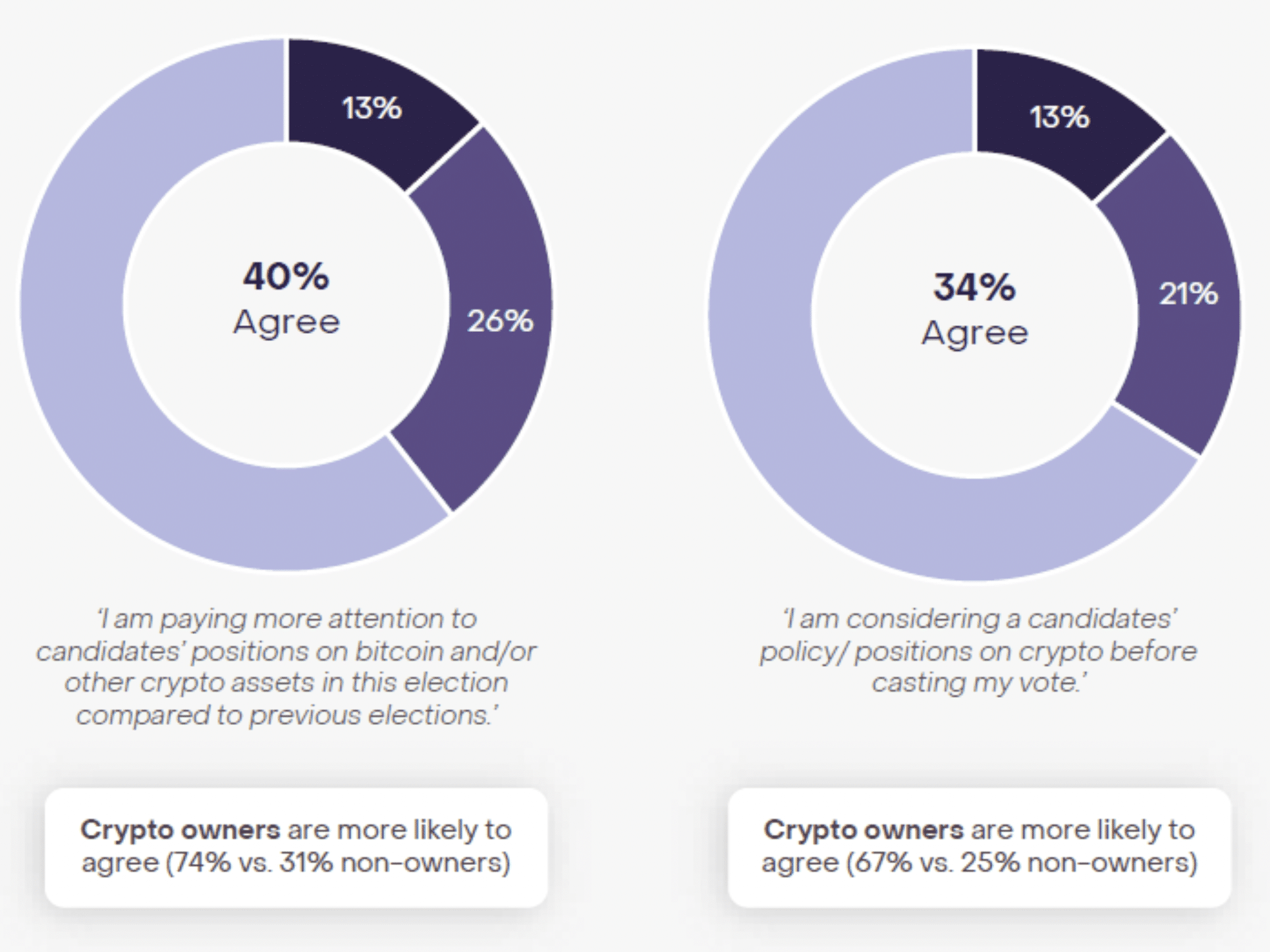

“46% agree that crypto and blockchain are the future of the financial world. 34% said they considered candidates’ crypto holdings before voting.”

Source: Nate Geraci/X

Geraci added,

“It’s becoming a mainstream problem.”

Source: Nate Geraci/X

Geraci highlighted insights from a recent poll for this Grayscalea study into the interaction between cryptocurrency and the upcoming elections.

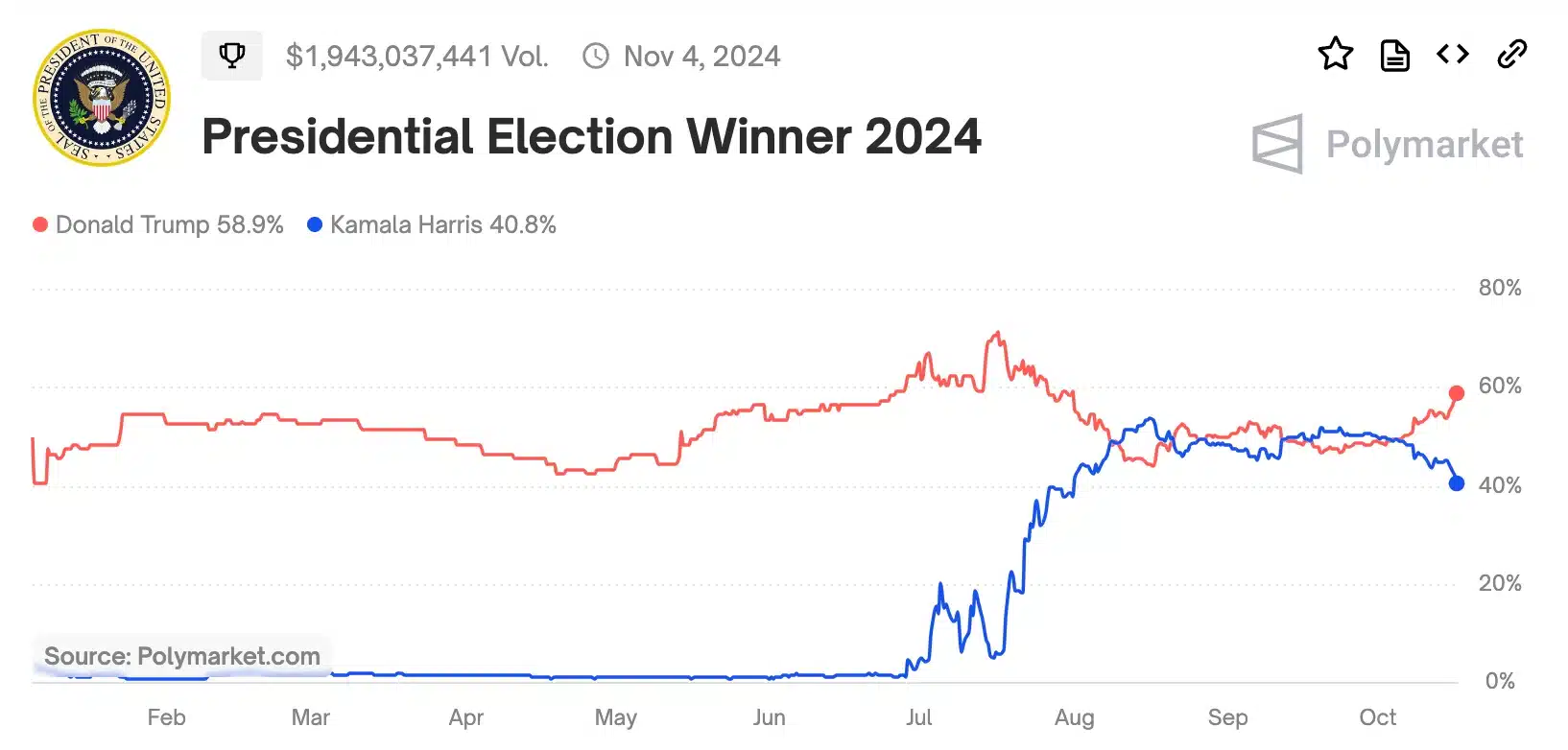

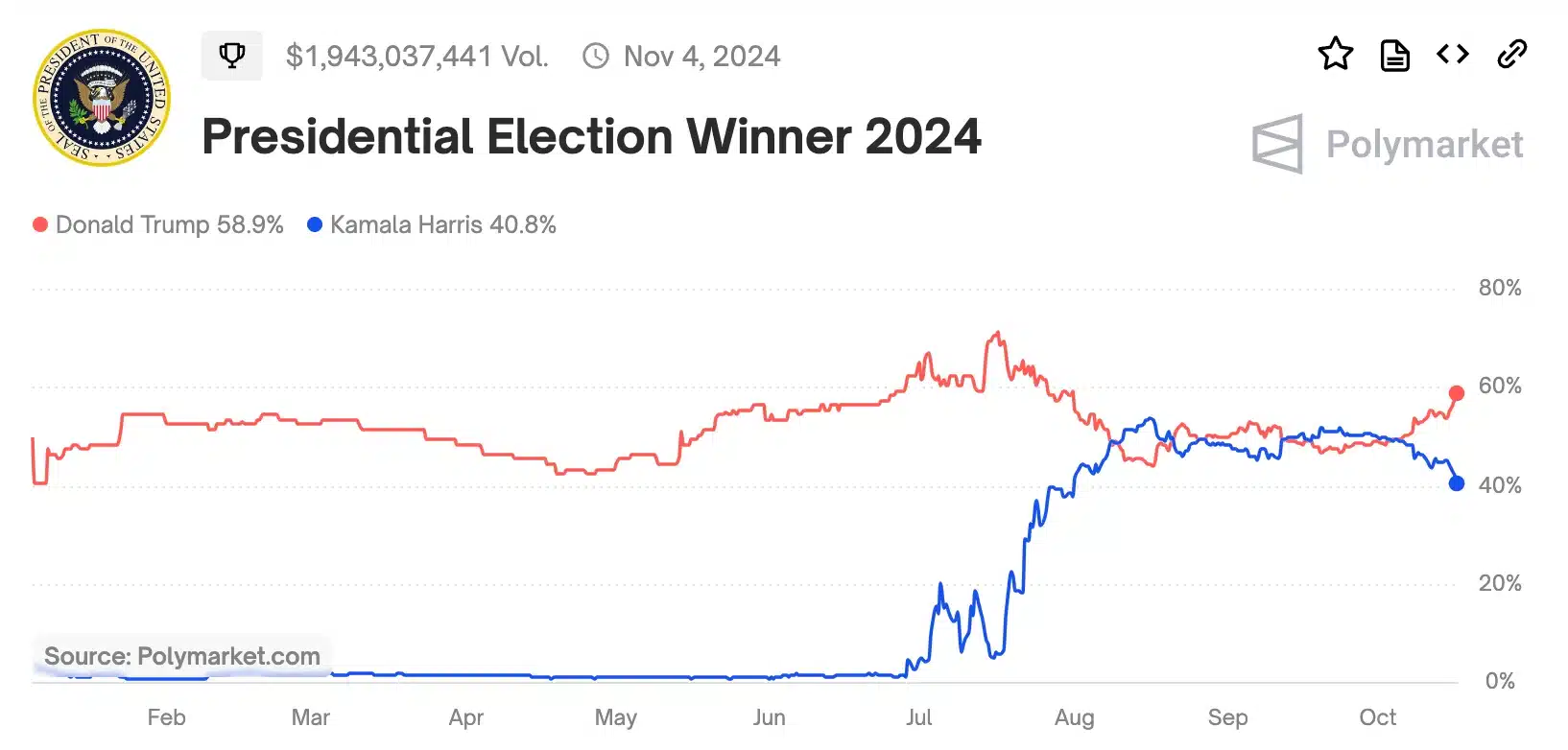

With Trump gaining popularity as the Republican candidate on Polymarket, the latest stretch promises to bring crucial developments for the sector.

Source: Polymarkt

Credit : ambcrypto.com

Leave a Reply