The total crypto market sentiment became Beerarish as large assets such as Ethereum (ETH) and Bitcoin (BTC) registered mass fall in the last 24 hours. In the midst of this, Ethereum, with a significant price fall of 7%, has reached an important level that currently acts as a make-or-break situation for the active.

Ethereum (ETH) Technical analysis and upcoming levels

According to the technical analysis of experts, Ethereum has reached an important level of $ 1,820 for the second time this month with a remarkable price decrease and this level seems to weaken, which indicates a potential further decrease.

Based on recent price promotion and historical patterns, if it does not have this level and closes a daily candle below $ 1,800 marking, there is a strong possibility that it could fall by 18% to achieve the $ 1,490 level in the coming days.

In the meantime, Ethereum is already weak and in a falling trend on the weekly period while it is traded on the daily period of time under the 200 exponential advancing average (EMA). Moreover, despite ETH, that at the beginning of March 2025 at his agreed momentum, it has successfully re -tested its fault level and is now at the point of a huge price decrease.

If ETH continues to hold this pattern, it will open a path for Ethereum to reach $ 1,200 or even lower.

Current price momentum

At the time of the press, Ethereum acts nearly $ 1,870, after he has registered a price fall of 7% for the past 24 hours. During the same period, however, the trade volume jumped by 50%, which points to increased participation of traders and investors compared to the previous day.

$ 391 million in short gamble

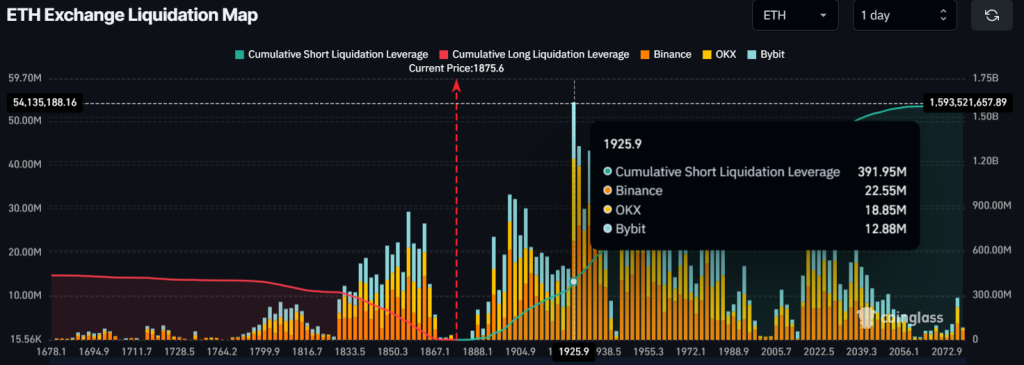

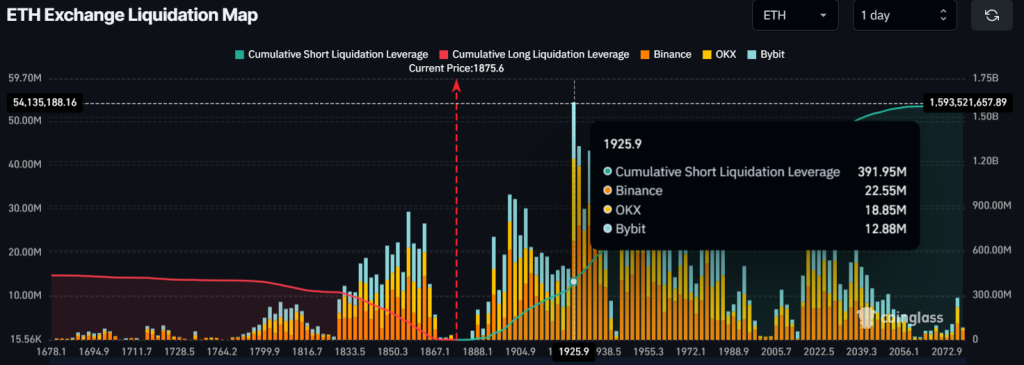

Despite a significant jump in the trade volume, Ethereum traders Beararish remain, after the broader market sentiment, as reported by the uncleaning analysis company Coinglass.

Data shows that traders on the short side are currently used too much for $ 1,925, with $ 391 million in short positions at this level. In the meantime, traders bet on the long side, too many huts at $ 1,855, with $ 120 million in long positions.

This clearly indicates that bears dominate and can easily liquidate long positions while the price of ETH is pushed lower.

Credit : coinpedia.org

Leave a Reply