Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

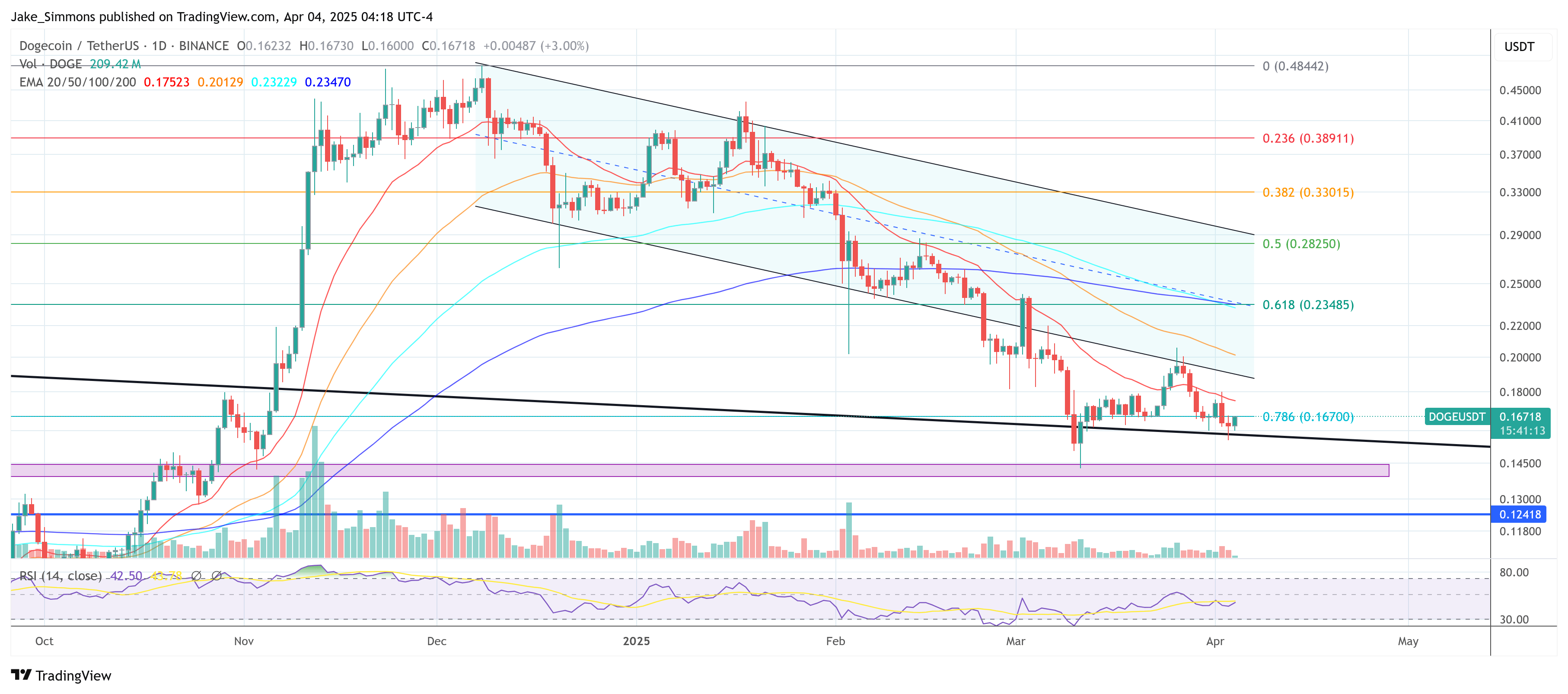

Dogecoin is again in the hot chair while the meme coin tests a multi-year trend line that dates from the intoxicating days of 2021. Both the daily and the weekly charts underline the meaning of this zone, in which the market dangerously floating in the neighborhood of a spell that could determine the current price by another quarter or a dramatic return.

Dogecoin could dive further

On the weekly graph, the trend line slides down from the historically raised levels near the top of the last cycle and convergates with the 0.786 Fibonacci racement at around $ 0.167. Dogecoin is therefore on shaky soil while it slid under the 0.786 Fibonacci level at $ 0.167, but is still clinging to the multi-year trend line, which is currently floating around $ 0.157.

The ability to stay above the line can decide whether the market can prevent a renewed sale that can erase a quarter of the current value. In particular, DOGE has already fallen by around 66% compared to the peak of December above $ 0.48 last year, which reveals how tight the bulls are needed to keep the line to prevent a wave of sales pressure.

Related lecture

Zooming in on the daily period, the story becomes clearer. After Dogecoin had stopped from a Downtrend channel on 24 February, it made an attempt to fight his way back in on 2 and 3 March, to be pushed under the canal floor quickly. Subsequent rejections on 6 March and 26 March along the lower limit confirm that the bears have little intention to give Doge an easy path above. This persistent refusal is accompanied by decreasing volume, indicating that buyers have had difficulty collecting the momentum needed to reclaim a foot on the ground in the channel.

The weekly EMAs are spread above the price, especially with important lines that are well above $ 0.16, while the daily EMAs have changed in ceilings in the short term that Dogecoin has repeatedly overcome in recent sessions.

Related lecture

If DOGE falls under the multi-year trend line, it could again test the support zone, just about $ 0.14 as on 10 and 11 March-rejected in red on the map. If Doge does not defend the trend line and slips under $ 0.14, the next large Pivot $ 0.12, symbolized by the prominent blue line, will be symbolized. A retreat would fall 25% compared to the current price levels, which means that the bearish sentiment may be deepened well into the second quarter.

All eyes are now locked on the interplay between the price and the decades long slope that served as a magnet as a buffer over several market cycles. If buyers step firmly at the intersection of the multi-year line and the 0.786 Fibonacci level, the next challenge would be to recapture the lower limit of the falling channel that Dogecoin did not do despite repeated tests. On the other hand, a decisive break under $ 0.14 would increase the chance of a capitulation to $ 0.12 or possibly lower.

For now, the fate of Dogecoin seems to depend on whether this long -term structural support can endure the storm. If this is the case, the battered meme -Munt can still scrip a comeback. If not, the market can be confronted with a free fall that re -encourages memories of the most volatile chapters in its history.

Featured image made with dall.e, graph of tradingview.com

Credit : www.newsbtc.com

Leave a Reply