- Smart Dex traders and whales sold Worldcoin at an average price of $3.85.

- If this order holds, WLD could pivot to reverse recent losses.

Smart DEX traders and whales sold Worldcoin [WLD] at an average price of $3.85. Selling by Smart DEX traders was $3.8, while whales sold for $3.9, indicating a phase of potential profit-taking.

Following these sales, there was a noticeable lack of substantial buying activity, suggesting traders are being cautious. After the sale, only a few have started to pile up again, indicating mixed sentiment about the medium-term investment potential.

Currently, with a price of $2.4, investors seem to be taking a wait-and-see attitude.

Source: iCryptoAI/X

The lack of immediate buying after significant selling indicated a potential for further price declines or consolidation at these levels. If WLD can stabilize or show signs of bullish sentiment, it could attract buyers.

However, given the recent sell-off by key players, it would be wise to keep a close eye on the near-term market reaction for traders and investors in Worldcoin.

This close could determine the direction that WLD’s price will take after the withdrawal of Smart DEX traders and whales.

WLD’s price action and forecast

Analysis of the WLD/USDT pair showed a prolonged downtrend through the second half of 2024. The decline was interrupted by a resistance level that turned to a support level at $1.50.

WLD fell to the $2.41 order block after rallying from $1.50 to $4, where Smart DEX and whales took profits around the highs. If the order block holds, WLD could pivot to reverse recent losses.

The MACD showed potential for a momentum shift as the histogram shortened in the bearish area, indicating a decrease in downward momentum.

Source: TradingView

Additionally, WLD has tested this support multiple times, indicating continued buyer interest at this level. If the order block support at $2.41 remains intact, WLD could challenge levels above $4 in the near term.

A successful break of the $6.01 level could lead to a retest of higher resistance at $9.519, marking a potential bullish phase for WLD in the early months of 2025.

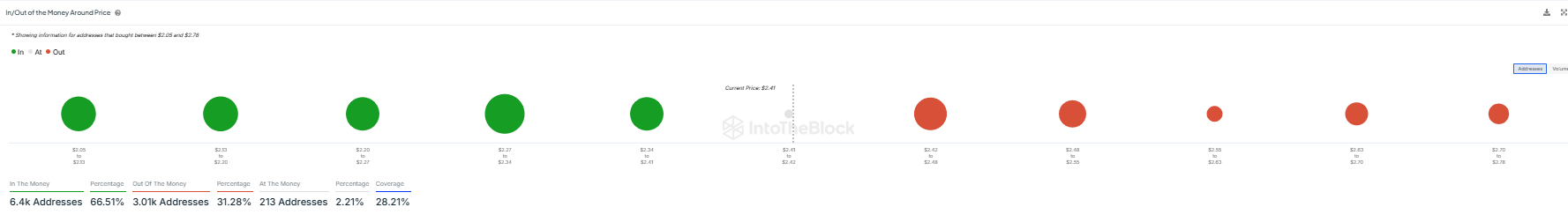

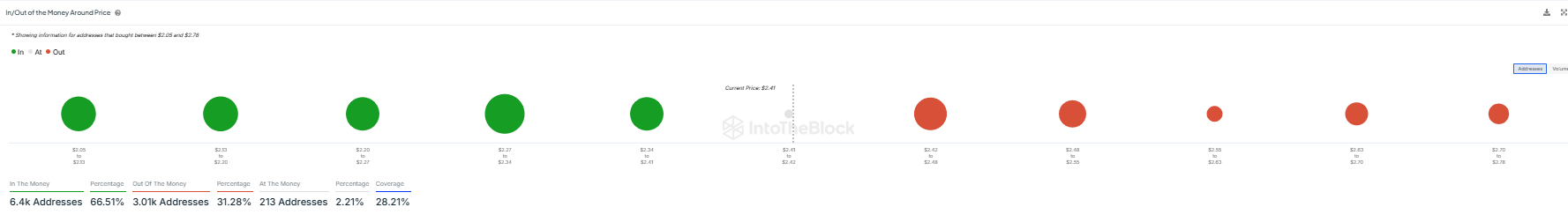

In/out of the money around the current price

WLD’s profitability around its current price reveals several investor positions.

At $2.41, 66.51% of addresses are in the money, indicating a potential support level as these holders are profitable. In contrast, 31.28% of addresses are out of the money, reflecting unprofitable positions.

If the price of WLD rises, the substantial majority ‘in the money’ could have a stabilizing effect.

Source: IntoTheBlock

Conversely, resistance could emerge near the higher prices where holders are still incurring losses, potentially limiting gains.

Realistic or not, here it is WLD market cap in terms of BTC

Realistic or not, here it is WLD market cap in terms of BTC

This distribution of profitable and unprofitable positions could influence WLD’s price movements in the short term, as holders’ reactions to breakeven points determine market dynamics.

Credit : ambcrypto.com

Leave a Reply