- XRP -eyes break from the symmetrical triangle; Support of $ 2.00 $ 2.11 remains critical.

- Whale-portfolios continue to accumulate and indicate a bullish long-term front view.

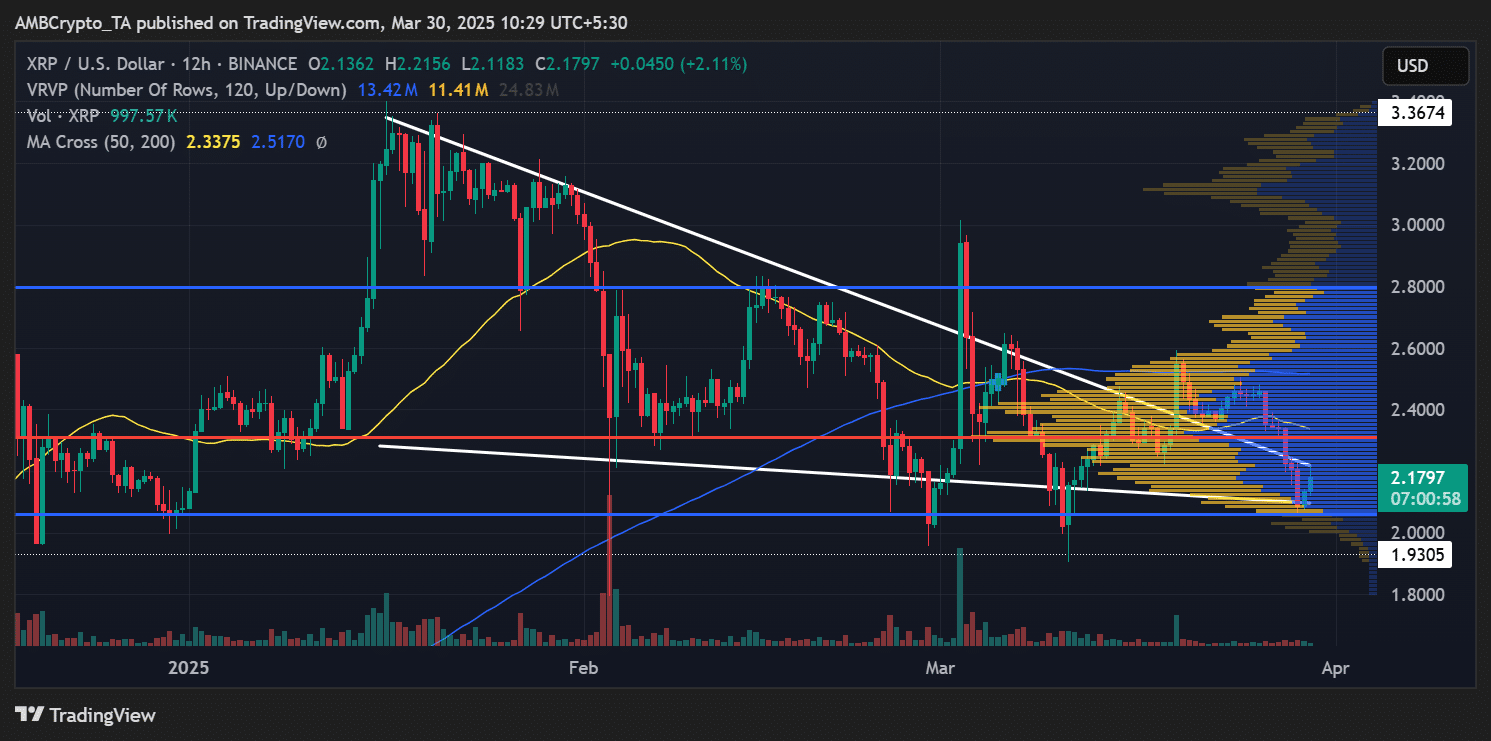

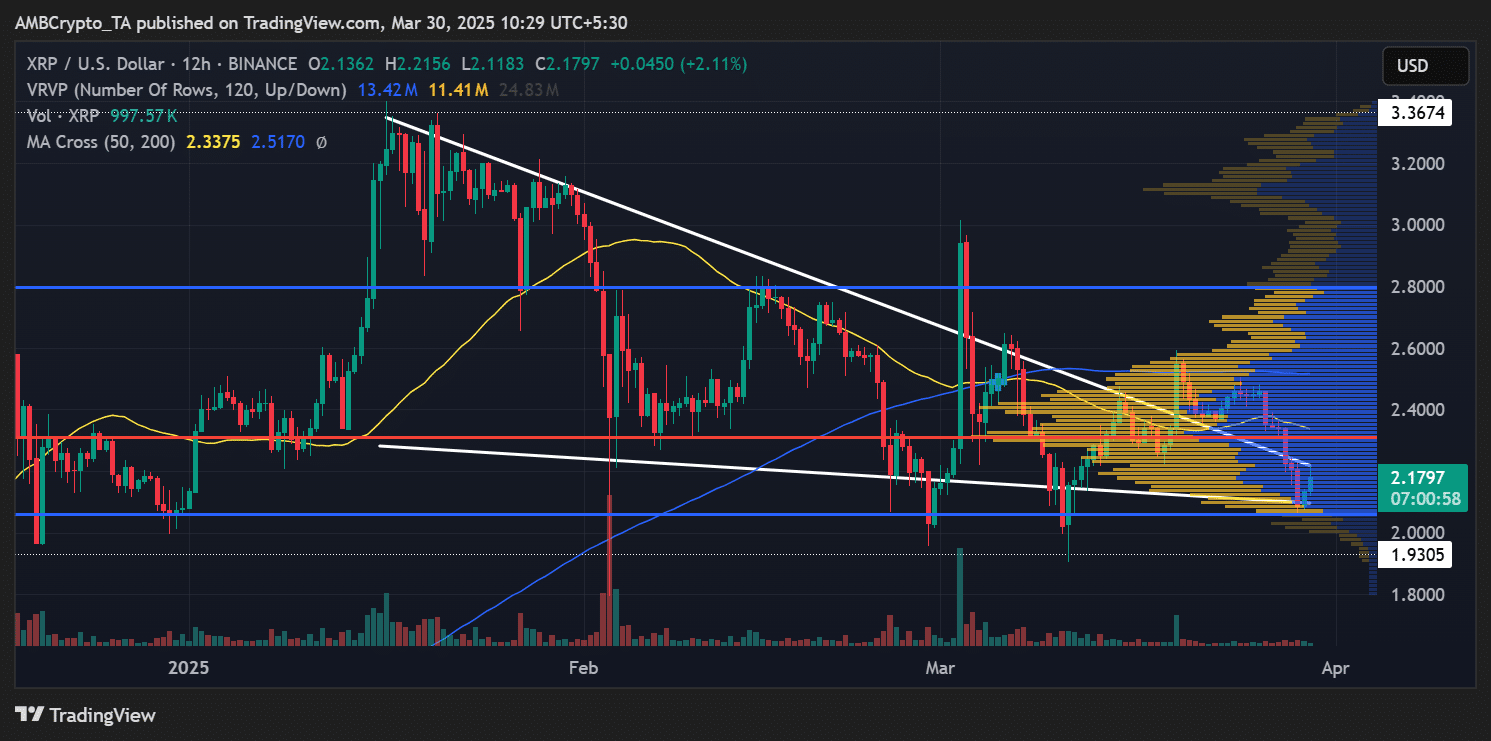

XRP is at a crucial point and consolidates on the daily graph within a symmetrical triangle.

With price action compressing and strengthening whales, all eyes are aimed at whether XRP can break out above the falling resistance.

A successful outbreak could ignite a rally in the direction of important price goals, which puts $ 3.40 back on the radar.

XRP consolidates

On the daily period of time, XRP traded at $ 2.18, resting on the lower limit of a well -defined symmetrical triangle pattern.

This technical education often indicates a continuation or a reversal, depending on the breakout direction.

The pattern has seen several price reactions in both support and resistance lines, tighter in a top, a common precursor to an important movement.

Source: TradingView

The lower support zone of approximately $ 2.00 $ 2.11 has held historically firmly retained, reinforced by high volume nodes that are visible on the volume profile visible range [VRVP].

As XRP approaches this important support with falling volatility, Bulls can prepare for a rebound.

Price objectives at Breakout -confirmation

If the XRP break decisively above the falling resistance trend line, the following direct target is at $ 2.60, followed by $ 2.84, $ 3.00, $ 3.21 and ultimately $ 3.40.

These levels correspond to Fibonacci retracement zones and earlier prize -action clusters. The relative strength -Index [RSI] Also suggests that it is not active in Overbought territory, leaving room for upward movement.

If XRP does not hold the support to $ 2.00, downward risks can arise, with the following support zones that rest near $ 1.77 and $ 1.60.

Signals on chains point to whale confidence

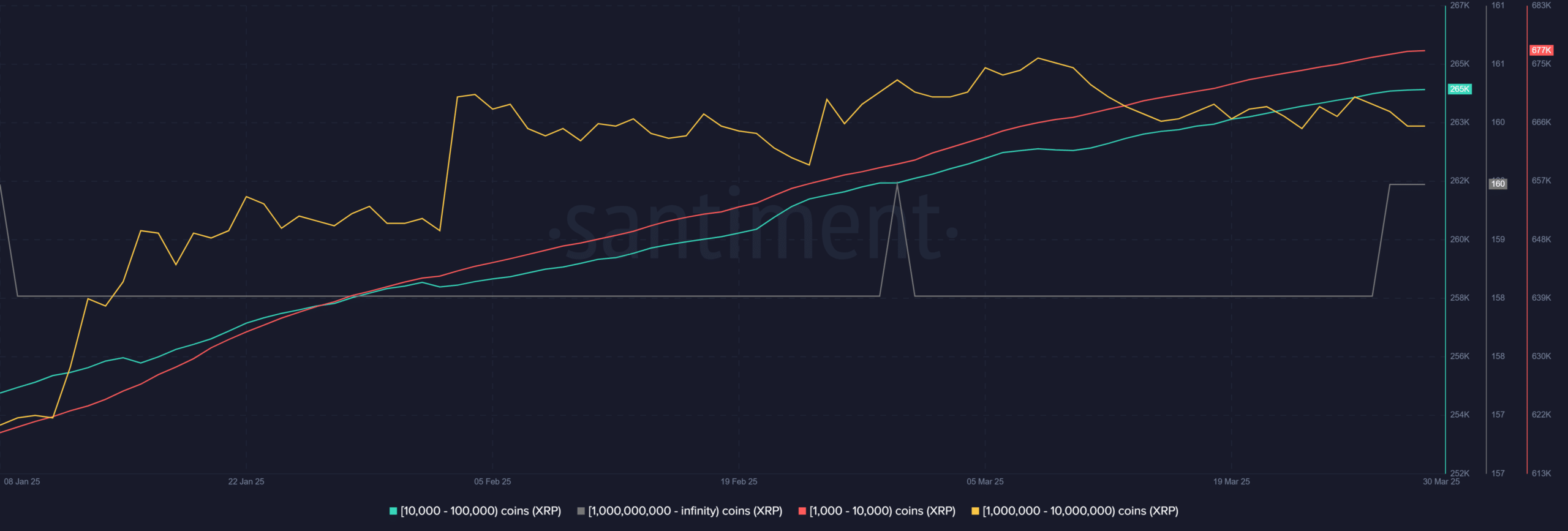

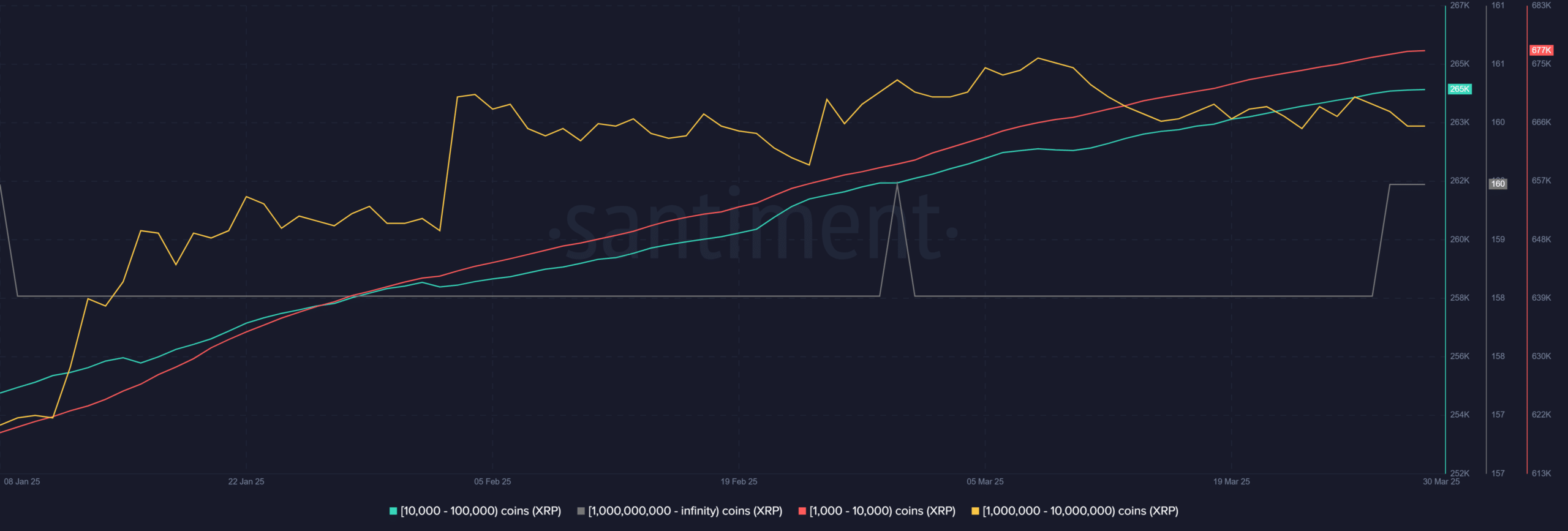

Data about chains from Santiment It appears that large holders, in particular portfolios with 1,000-10,000,000 XRP, were steadily collected via Q1 2025.

The red and cyan lines on the accumulation graph show a persistent upward route, in particular among the cohorts of 10,000-100,000 XRP and 1,000,000-10,000,000 XRP.

In the meantime, addresses with 1 billion+ XRP have also shown renewed interest, with a sharp increase around March 29.

Source: Santiment

This strategic accumulation during pullbacks reflects the growing trust in holders of high conviction.

Historically, such behavior often precedes the most important price movements, especially when they are tailored to technical consolidation zones.

Last thoughts

XRP’s price structure and whale behavior suggest that it is actively ready for an outbreak; The only question is when. A clean movement above the symmetrical triangular weather position can open the locks to $ 3+ territory.

Until then, XRP traders and investors must keep a close eye on the support zone and volume extension of $ 2.00 to confirm the directional bias.

Credit : ambcrypto.com

Leave a Reply