In the midst of the recent fall in price, XRP, the native token of Ripple Labs, has formed a bullish price action pattern and is ready for a price rally with double digits. Today, January 31, 2025, the general cryptocurrency market seems to be recovering, including Bitcoin (BTC) and Ethereum (ETH), but it seems to have a hard time.

XRP current market sentiment

Despite the positive market sentiment, XRP is currently near $ 3.13 and has experienced a modest price destination of more than 0.80% in the last 24 hours. In the same period, investors and traders have demonstrated a lower interest rate, resulting in a fall in trade volume of 35%.

This modest price destination ensured that XLM XRP surpassed in terms of profit, because it increased more than 13% in the last 24 hours. It seems that XRP traders and investors are now shifting their attention to XLM, in the midst of potential spot ETF interviews.

XRP Technical analysis and upcoming levels

According to the technical analysis of experts, XRP has formed a bullish flag and pool price pattern on the daily age and it seems to be struggling to break out.

Based on the recent price action, if XRP successfully breaks this pattern and a daily candle closes above the $ 3.21 level, there is a strong possibility that it could rise by 40% to the $ 4.50 level in to reach the future.

With XRP’s Relative Strength Index (RSI) near 59, this indicates that it is actively having enough room to rise and to experience impressive price wins.

XRP’s mixed shipment

Looking at the bullish price promotion, investors seem to collect token, as revealed by the on-chain analysis company Coinglass. Data from Spot -entry/outflow shows that exchanges have witnessed in the last 24 hours of an outflow of more than $ 12 million in XRP, indicating potential accumulation and the purchasing pressure and a further upward rally can cause.

Traders bet on XRP

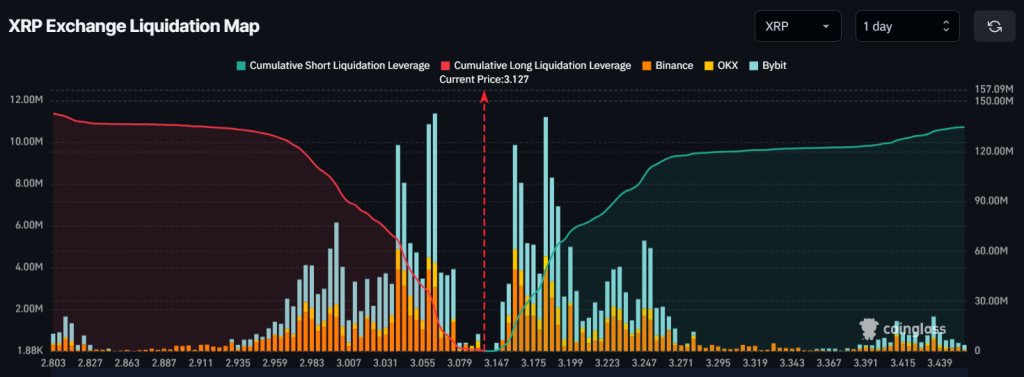

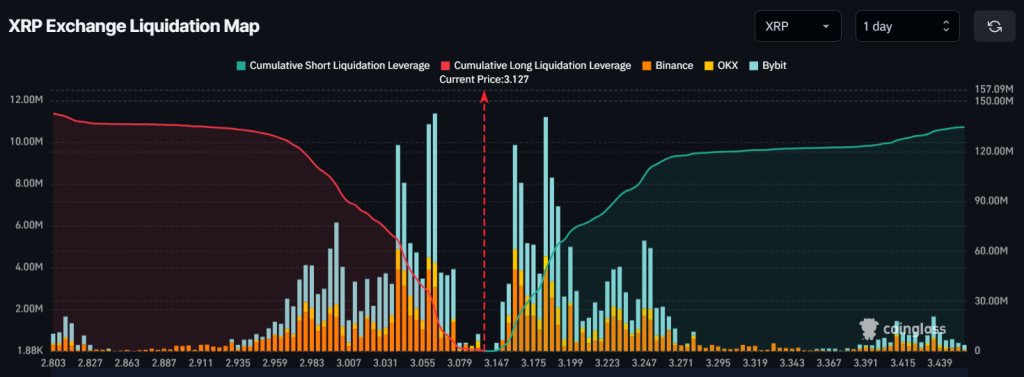

Despite the bullish prospects of investors and whales, intraday traders betting on the Bearish side found. The Exchange Liquidation card from XRP revealed that $ 3,063 is a level where bulls are used too much, with $ 24.50 million in long positions. In the meantime, $ 3,183 is the level at which Short Sellers have $ 50.09 million in short positions.

This data shows that Short-sellers currently dominate in the short term, because they take almost double the positions of long-term holders.

Credit : coinpedia.org

Leave a Reply