- Ada traders were delivered too much at $ 0.634 at the bottom and at $ 0.708 at the top.

- On-chain statistics revealed that stock exchanges have witnessed an outflow of more than $ 8 million in ADA tokens.

Cardano [ADA] gets the attention of crypto enthusiasts because of the considerable fall in price in the last 24 hours.

With a fall of 13%, ADA has reached a crucial level where the participation of the trader and investors has risen, which leads to a remarkable increase in trade volume.

Ada’s current price momentum

At the time of the press, Ada acted near $ 0.665. It has seen an increase of 90% in trade volume in the last 24 hours. However, this peak in trade volume does not necessarily indicate a price rally.

Such increases usually occur when an asset falls apart or falls apart from a price pattern. Significant volatility asks traders and investors to liquidate their open positions or ownership for profit booking.

Cardano price promotion and upcoming level

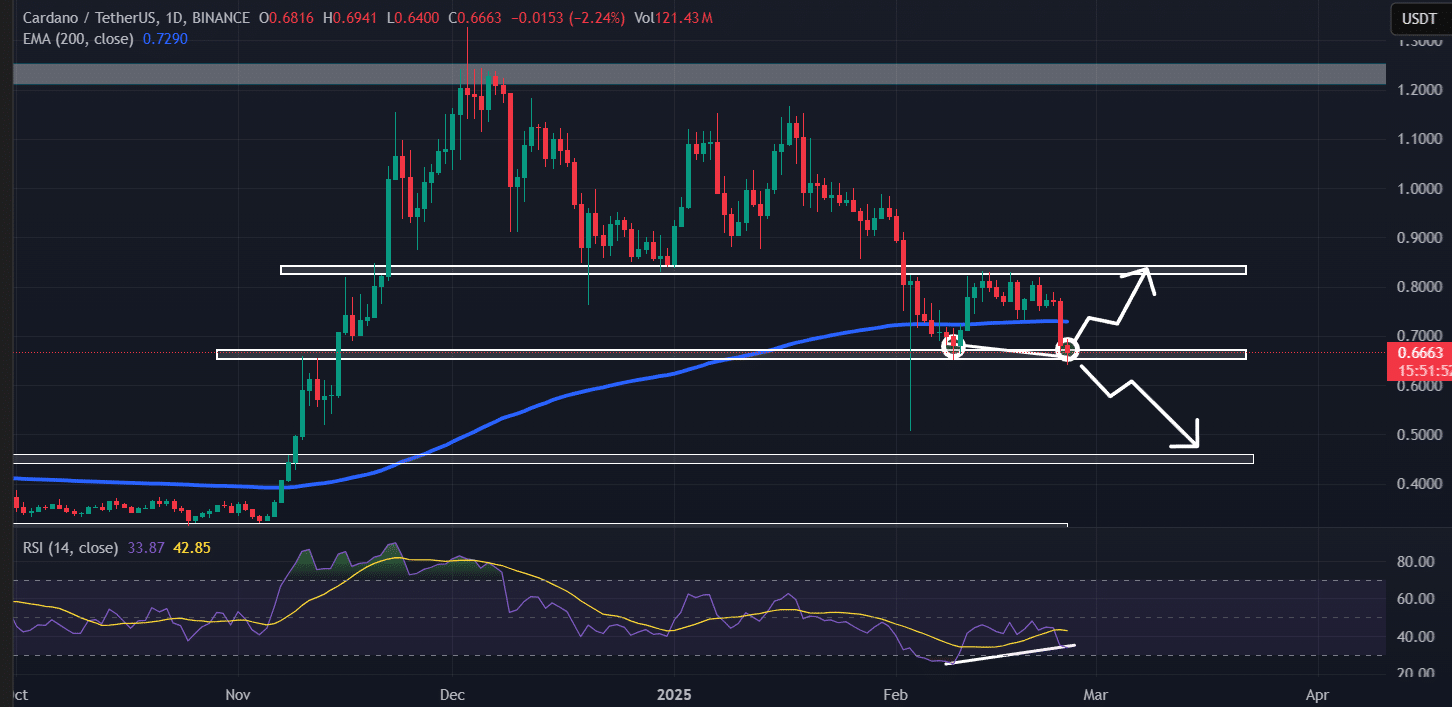

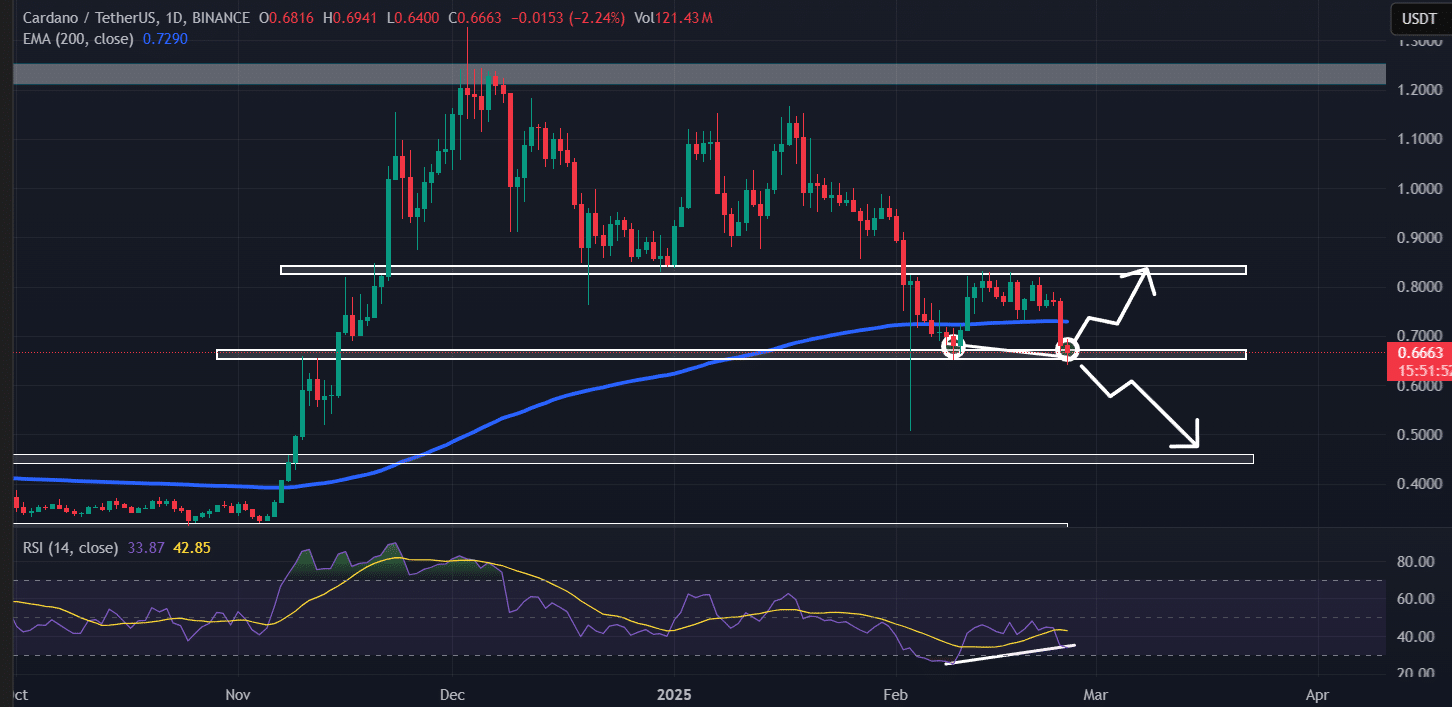

According to the technical analysis of Ambcrypto, ADA seems to form a bullish pattern with double soil on the daily period. However, the recent price drop has pushed it to a crucial support level of $ 0.65.

This level has a strong history of price outlets, which further strengthens these bullish prospects.

Source: TradingView

In addition, the technical indicators of ADA have flashed a bullish divergence, indicating a considerably upward potential.

Based on the historical price momentum, if ADA is above the level of $ 0.65, there is a strong possibility that it could rise by 25% to reach $ 0.85 in the future.

On the other hand, if Ada infringes $ 0.65, it can fall by 30% to reach $ 0.45.

$ 8 million in ADA outflow

Despite the continuous fall in the price, holders seem to be accumulated in the long term ADA tokens and follow after price action, as the on-chain analysis company Coinglass reported.

Data from Spot -Inflow/outflow shows that exchanges have witnessed in the last 24 hours of an outflow of more than $ 8 million in ADA -Tokens.

Source: Coinglass

In a market condition where prices continue to fall, however, the outflows of the exchange of potential accumulation, which can cause the purchasing pressure and generate further upward momentum.

Ada Traders’ $ 17 million bet on the short side

In the meantime, intraday traders seem to follow the current market sentiment, bet on the short side, as reported by the on-chain analysis company Coinglass.

At the time of writing, short positions dominate, while long traders seem to be exhausted.

Data shows that the most important liquidation levels are $ 0.634 at the bottom and $ 0.708 at the top, whereby traders at these levels are used too much.

Source: Coinglass

If the market sentiment remains unchanged and the price drops to $ 0.634, almost $ 3.08 million will be liquidated in long positions.

Conversely, if the sentiment shifts and the price sets to $ 0.708, approximately $ 17.30 million is liquidated in short positions.

This on-chain statistics indicates that short traders still believe that the price of ADA will not recover quickly. This conviction can be the reason for the formation of $ 17.30 million in short positions.

Credit : ambcrypto.com

Leave a Reply