Starter homes are more affordable for the average American than they were a year ago, but over the past decade they have become significantly less affordable. That is the conclusion Redfin reached in a data report released Monday.

The national real estate brokerage analyzed household income levels and monthly housing payments to calculate the affordability measure. Buyers needed to earn $77,000 per year by August 2024 to afford a starter home that averages $250,000. Entry-level homes are defined as homes priced in the fifth through 35th percentiles of their respective markets, and homes are considered affordable if the mortgage payment does not consume more than 30% of the household income.

The income needed to buy a typical starter home is down 0.4% from August 2023, when the median price was $240,000. Wages have increased as the median household income is now $83,853, up from $79,689 a year ago. And affordability has been helped by lower mortgage rates, which fell more than half a percentage point over the year and averaged 6.5% in August, according to Redfin.

“It’s great news that starter homes are becoming slightly more affordable, but there’s a catch,” Redfin senior economist Elijah de la Campa said in the report. “Starter homes are no longer what they used to be. Ten years ago, a four-bedroom turnkey home in a nice neighborhood was often considered a starter home, but today a small fixer-upper apartment is often all a first-time home buyer can afford.”

Importantly, while the starter home segment has become slightly more affordable over the past year, it is much less affordable than it was during the housing recovery following the 2012 recession and in the pre-pandemic period of 2019.

When comparing income to the cost of monthly mortgage payments, the average buyer now earns 8.9% more than they need. In August 2023, this was only 3%. But in August 2019, households earned 57% more than they needed, and in August 2012 they earned 113% more.

Redfin calculated the average monthly mortgage payment by assuming a 3.5% down payment and using the average sales price and average mortgage interest rate for each month.

| August 2024 | August 2023 | August 2019 | August 2012 | |

| Income needed to afford an average-priced starter home | $76,995 | $77,343 | $39,997 | $24,905 |

| Average family income | $83,853 | $79,689 | $62,843 | $53,046 |

| Median sales price for a starter home | $250,000 | $240,000 | $165,500 | $95,000 |

| Share of starter homes that are affordable for an average household | 75.8% | 72.6% | 98.2% | 98.4% |

| Share of income an average household would have to spend to purchase an average-priced starter home | 27.5% | 29.1% | 19.1% | 14.1% |

Redfin noted the post-pandemic spike in home prices due to a sudden increase in demand coupled with historically low mortgage rates. As a result, the average price of a starter home is now 51% higher compared to August 2019 and 163% higher compared to August 2012. Wage growth has increased by 33% over the past five years and 58% over the past twelve years.

“Put another way, the income needed to afford a starter home has tripled since 2012, while the median household income hasn’t even doubled,” according to Redfin.

In both 2012 and 2019, almost all starter homes for sale were affordable for households with an area median income (AMI). That share has fallen to about 76% today. For lower-income households earning 80% of the AMI, only 43% of starter homes are affordable.

“While many people make enough on paper to afford a starter home, they often have other expenses, like student loan debt, that keep them from buying,” says Blakely Minton, a Philadelphia-based Redfin agent, in the report.

“Buyers of starter homes are getting older than before. When I first started working in the real estate industry twenty years ago, they were just kids out of college. Now graduates are saddled with huge student loans and are moving back in with mom and dad or renting.”

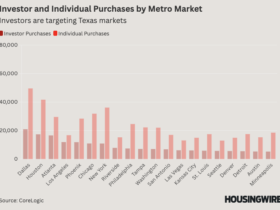

In analyzing the nation’s 50 most populous metropolitan areas, Redfin found that several have become more affordable in the past year. In Anaheim, California, the income needed to buy a starter home has shrunk 8.1% since August 2023 — though the income needed to enter the market stands at an eye-watering $217,300.

Austin (-5.8%); West Palm Beach, Florida (-5%); Phoenix (-4.8%); and Dallas (-4.7%) also saw improved affordability for the typical first-time buyer over the past year.

Conversely, some relatively affordable metro areas in the Midwest recorded the sharpest increases in the revenues needed to enter the market. In Chicago, a buyer must earn $77,238 per year to afford the average-priced starter home, an increase of 15.4% year over year. It was followed by Los Angeles (+14.7%), Detroit (+14.5%), Cincinnati (+9.7%) and Pittsburgh (+9.6%).

Leave a Reply