- Bitcoin Futures’ order book remains loose.

- Bybit moves $3.3 billion worth of BTC to a new wallet.

Bitcoin’s price action [BTC] creates a dynamic environment as the futures order book remains loose.

Recent data from the Bitcoin liquidation heatmap showed increased activity, indicating possible liquidations that could cause price movements.

This creates a playground for big players to influence price movements in the zone between $67.5K and $69.5K, indicating volatility.

With Futures positions in these zones competing with each other, the price of Bitcoin can move up or down quickly with relatively small amounts of capital.

Source: Coinglass

A key support level at $63K could be tested if Bitcoin fails to hold above its key Fibonacci retracement level. However, long-term holders can find reassurance in the strong support of the 180- and 120-day moving averages.

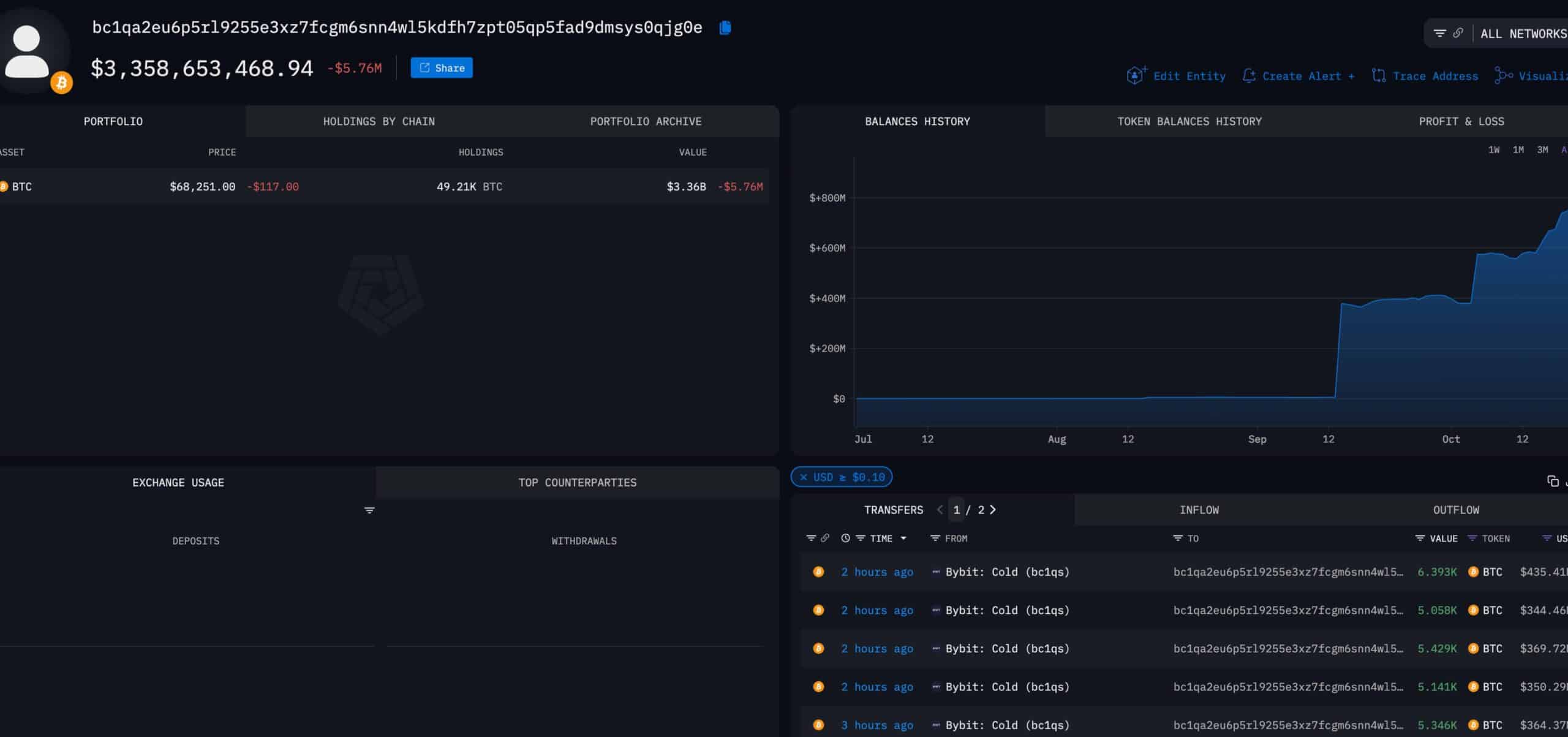

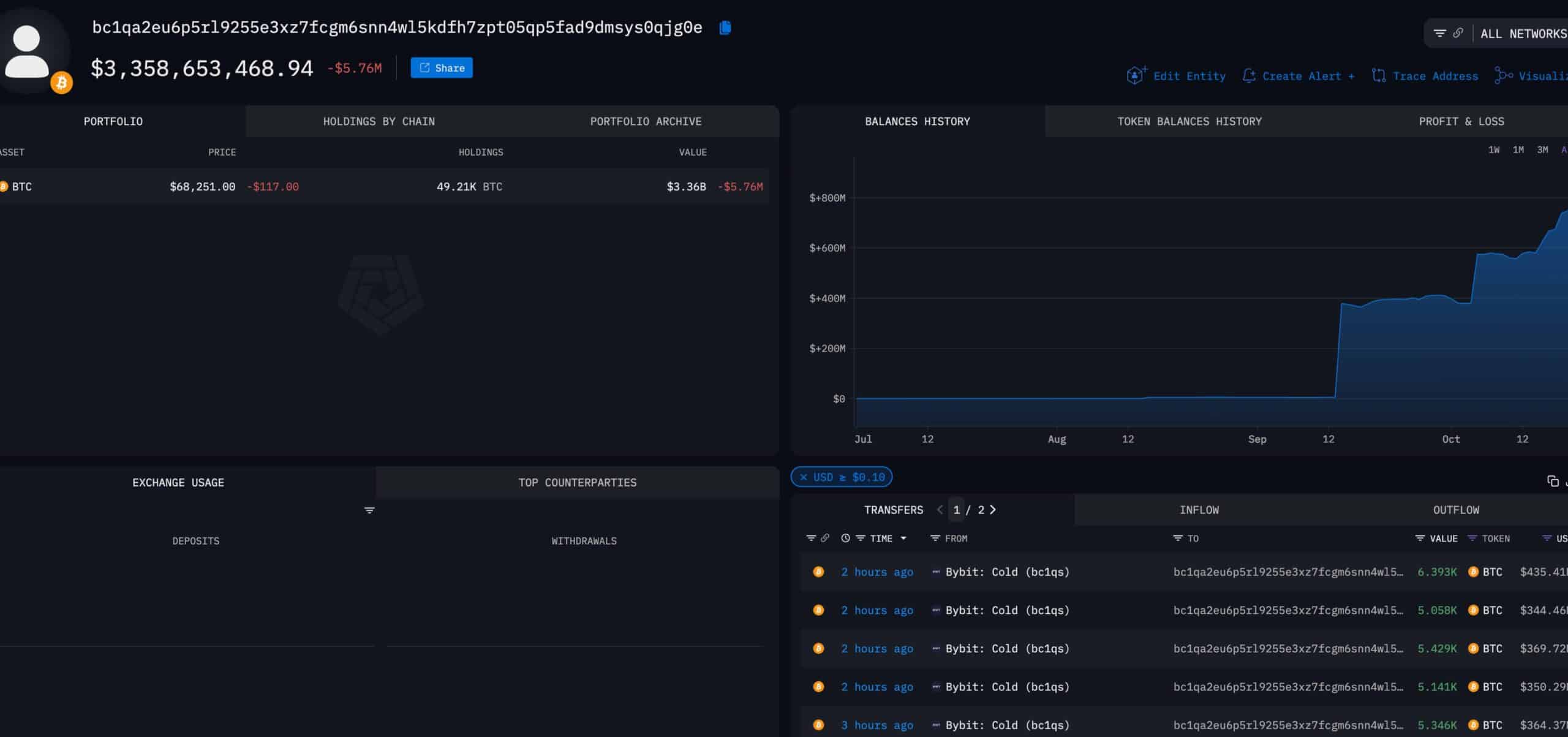

Now that nearly 49,000 BTC has been moved from Bybit’s cold storage to a new wallet, some investors are paying close attention to these important transfers.

Such large-scale transactions could signal market shifts, and the Bybit team’s internal asset movements should be carefully monitored, especially if liquidations are on the cards.

Source: Arkham

BTC local top and sentiment

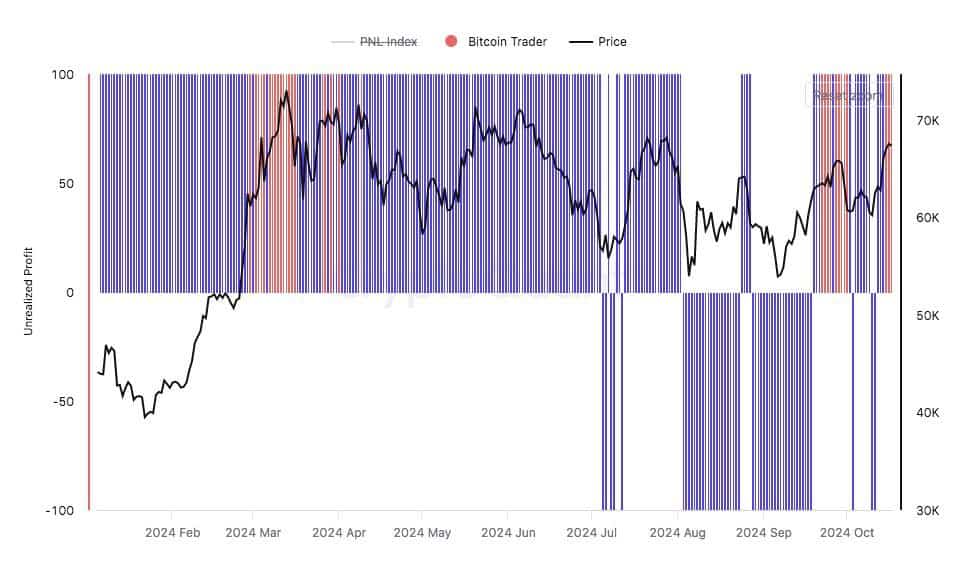

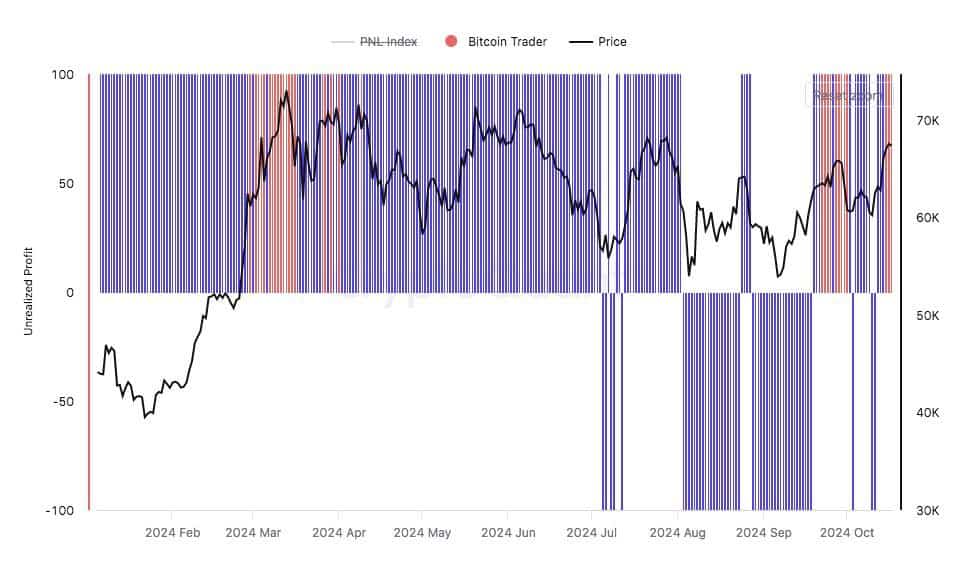

In terms of price predictions, Bitcoin is approaching the $70,000 resistance, with CME Futures slightly above current prices.

Market participants are watching closely to see whether BTC can break through this resistance or face rejection.

Bulls will have to defend the USD 68,000 support level as maintaining this price is crucial to avoid a bigger decline.

Historically, traders have tended to make money when unrealized profits rise sharply, as they are now (over $7 billion), which could increase selling pressure and cause a local top before another decline.

Source: CryptoQuant

Moreover, sentiment around Bitcoin has become more positive after a period of pessimism. There has been a noticeable shift towards bullish sentiment on social media.

Buying during fear and selling during euphoria has historically been profitable for traders. This trend increases the confidence of those looking to take advantage of the current market dynamics.

Read Bitcoin’s [BTC] Price forecast 2024–2025

As Bitcoin moves through its swing price range and key resistance levels, traders should remain alert to shifts. The coming weeks are likely to see volatility, with major players influencing the market through strategic trades.

The key question is whether Bitcoin will break higher or undergo a short-term correction before its next rally. Price swings are expected within the two main liquidation zones, creating opportunities for both futures and spot traders.

Credit : ambcrypto.com

Leave a Reply