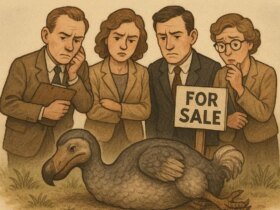

Mortgage lender executives expect at least a 20% increase in credit reporting costs by 2025 compared to 2024. And skyrocketing costs will hit as lenders try to dig out from several years of financial losses and mass layoffs.

Early November, Honest Isaac Corp. (FICO), the company behind the widely used methodology for assessing consumer credit risk, has announced an increase in wholesale mortgage lending rates from $3.50 to $4.95 per score. However, this is just one of many credit reporting costs for lenders, who also have to bear additional costs from credit bureaus and tri-merge resellers applied downstream.

Lenders told HousingWire that they have not yet seen any price increases from credit providers, as confirmations from the credit bureaus are expected in the coming weeks. However, when planning for 2025, many lenders have already started charging higher credit report fees based on initial conversations with suppliers.

For starters, the increase in FICO wholesale prices translates to an additional $1.45 per score, which amounts to $4.35 per borrower and $8.70 per joint application for a three-bureau credit report, the industry standard.

Michael Metz, operations manager at the Arizona-based lender VIP mortgagewhich has 330 sponsored loan officers in 39 active industries, expects most credit bureaus to increase their prices as well.

“By the time everything is added, we will see an increase of about $18-20 per borrower,” Metz said. This is in addition to the current level of $80-$100 for the tri-merge credit report and score bundle, based on FICO’s estimates.

“FICO has paved the way for the price increase with a 40% increase this year. I think we will see most credit bureaus seize this opportunity to make similar changes.” Metz said. “With legislation in the works banning trigger leads, they will have to be conservative and make up revenue – with the expectation that they will succeed – and now raise prices to make up for that revenue loss.”

Based in Tennessee First community mortgagewhich operates with approximately 200 registered loan officers in 38 active branches, credit reporting costs are expected to increase by 22% by 2025.

“Our new pricing goes into effect January 1 and based on our discussions with our vendor, we expect costs to increase by $12 to $20 per report,” said Keith Canter, CEO of First Community Mortgage. “We currently pay $82, so for 2025 we are budgeting $100 per report. We should have the exact amount within two weeks.”

Although the annual price increase for 2025 appears moderate compared to recent years, it represents a significant increase of 72% compared to 2023 for the First Community Mortgage.

FICO does not set the final price for customers. In 2023, the company implemented a tiered wholesale pricing structure ranging from $0.60 to $2.75 per score, increasing some lenders’ final costs by as much as 400%. In 2024, FICO returned to a flat royalty of $3.50 per score, with the same rate applied to both soft and hard credit draws.

Now that the 2025 wholesale price of $4.95 per score is official, HousingWire has contacted the three major credit bureaus:Experian, EquifaxAnd TransUnion–to inquire about their pricing policy for mortgage lenders in 2025. However, no one provided specific details or responded to the request.

In a statement to HousingWire, a spokesperson for TransUnion said: “Credit reports represent a fraction of a percent of the cost of purchasing a home, and ultimately it is an individual mortgage lender’s decision whether to pass these minimal costs on to their customers.

We are proud of the role we play in helping homebuyers qualify for a mortgage that meets their needs, and are equally proud to offer consumers free weekly credit reports to help them plan their home purchase .”

Putting it in perspective

Jim Wehmann, executive vice president of scores at FICO, wrote in a recent publication blog post that the $4.95 per score royalty is a small portion (about 15%) of the cost of a tri-merge credit report and score bundle. “With total average closing costs of $6,000, FICO’s share of total average closing costs before this new royalty per score was only about two-tenths of one percent.”

However, executives at mortgage providers view these costs differently. A white paper from the Association of Community Home Lenders (CHLA) noted that credit reports are often requested multiple times during the mortgage application process because they are only valid for 120 days. Since searches can extend over many months, this can cost hundreds of dollars.

According to CHLA, credit costs for closing a single loan have increased from $50 in 2022 to between $150 and $200 in 2024. When taking into account credit reports for applications that do not result in closed loans, costs increase dramatically to $510-$725 per loan . loan closed in 2024. CHLA plans to release a new 2025 estimate in the coming weeks.

“The credit report fee may remain a smaller portion of the total closing cost for a loan, but a mortgage company still has a loss from the other credit reports pulled that do not convert into a closed loan,” Metz said. “That ultimately has more impact on a mortgage company’s financial performance, which impacts consumer prices in a world of thinner margins.”

Phil Crescenzo Jr., a branch manager in New Jersey Nation One Mortgage Companywhich has 52 sponsored loan officers across six active branches, said total costs associated with credit reporting at its branch are now $20,000 per month, more than double what they were two years ago.

“Part of that is credit rescoring and updates, and some verifications – VOE, VOA, VOR items – through the credit reporting process, not just standard reporting,” Crescenzo said. “At some point it falls back on the borrower, or maybe the lender covers some of it, or they extend credit, but it’s all going to come from somewhere.”

The latest data from the Association of Mortgage Bankers (MBA) shows that independent building societies (IMBs) as a group saw improved profitability in the third quarter of 2024, with an average pre-tax net profit of $701 per loan (18 basis points).

However, 71% of IMBs reported profitability for both their manufacturing and service operations – down from 78% in the previous quarter, and a 20% increase in credit reporting costs would bring that figure down 18 basis points, industry analysts said.

The costs of taking out a loan

Canter, of First Community Mortgage, said the rising supplier costs come at a time when IMBs are aiming to reduce the average cost of underwriting a loan to below $10,000. At his company, credit reporting fees represent 2% to 3% of the total cost per loan. But it adds to compliance and regulatory burdens and irrational margins due to competition, he said. “Fortunately, we have been profitable in the past two quarters.”

Leading U.S. mortgage lenders have taken steps to support originators as they navigate the challenging market environment. Based in Detroit Rocket mortgagefor example, introduced the Fee Freedom initiative in 2023, which covers the cost of credit reports for brokers who originate loans through the wholesale branch, Rocket Pro TPO. The program was extended until 2024.

“Next year, with all the increases, we’re going to have to sit down and look at it,” said Mike Fawaz, executive vice president of Rocket Pro TPO. “Our decision is to continue covering credit report fees for our broker partners, similar to what we have done for the past two years. Now we’ve also told our broker partners that at some point we will cover everything if the loan doesn’t close, but if a loan closes we will charge for that. I don’t know if we will implement it next year or not.”

For now, Rocket is maintaining the program as brokers become increasingly reluctant to request credit reports because of the costs, Fawaz said. He said this approach is an investment in strengthening Rocket’s broker network.

Leave a Reply