- While Bitcoin slips 22%, the strategy follows.

- Will investors in Deep-Pocket intervene to buy the dip, or do the uncertainty force them to delay?

Strategy [MSTR] has crashed 57% to $ 230 and a low-month-old-hinges after bitcoin’s [BTC] 22% dive. Given the huge Bitcoin companies from MSTR, the correlation is no surprise.

Now that Trump excludes BTC in the American strategic reserve, concerns about its impact on institutional acceptance are growing. Could this trust in Bitcoin and Altcoins shake?

Institutional Fallout: trillion erased

Risk-on assets reacted negatively to the recent crypto-top bitcoin throw $ 100 billion in market value in one day, while the S&P 500 $ 1.4 trillion paved away.

Strategy saw an even steeper decline.

With 499,096 BTC in his treasury, the strategy had positioned itself for Bitcoin’s long -term rating, especially in the midst of speculation that the US government could add BTC to its strategic reserves.

Trump’s outright rejection of this idea, however, brought a serious blow to the strategy of MSTREN, which activates a wave of sale. But the Fallout didn’t stop there.

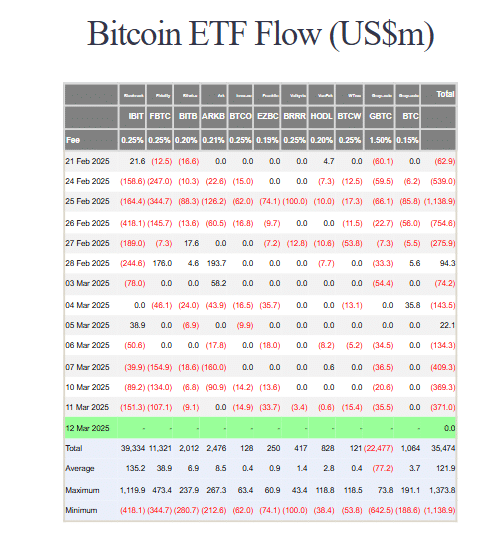

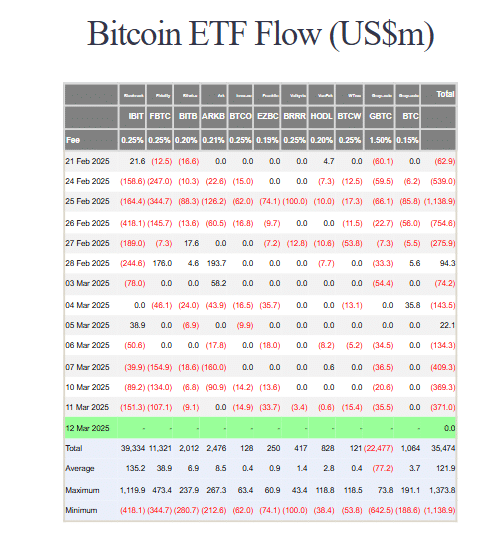

Bitcoin Exchange-Traded Funds (ETFs) witnessed more than $ 500 million on the same day, with the strengthening of the Bearish sentiment.

Since February, institutional outsourcing have been dominated, with billions of stock exchanges behind – a trend that has no signs of reversal.

Source: Fats Side Investors

Bitcoin Dominance versus Altcoin Liquidity crisis

Despite the absence of Institutional Capital Inflow in BTC, Bitcoin Dominance (BTC.D) remains above 60%, indicating that capital does not flow in Altcoins.

Historically, Bitcoin-Neergang has activated the rotation in alternatives with a high cap, but this cycle seems different.

Instead of redistribution of risks, liquidity leaves the market completely.

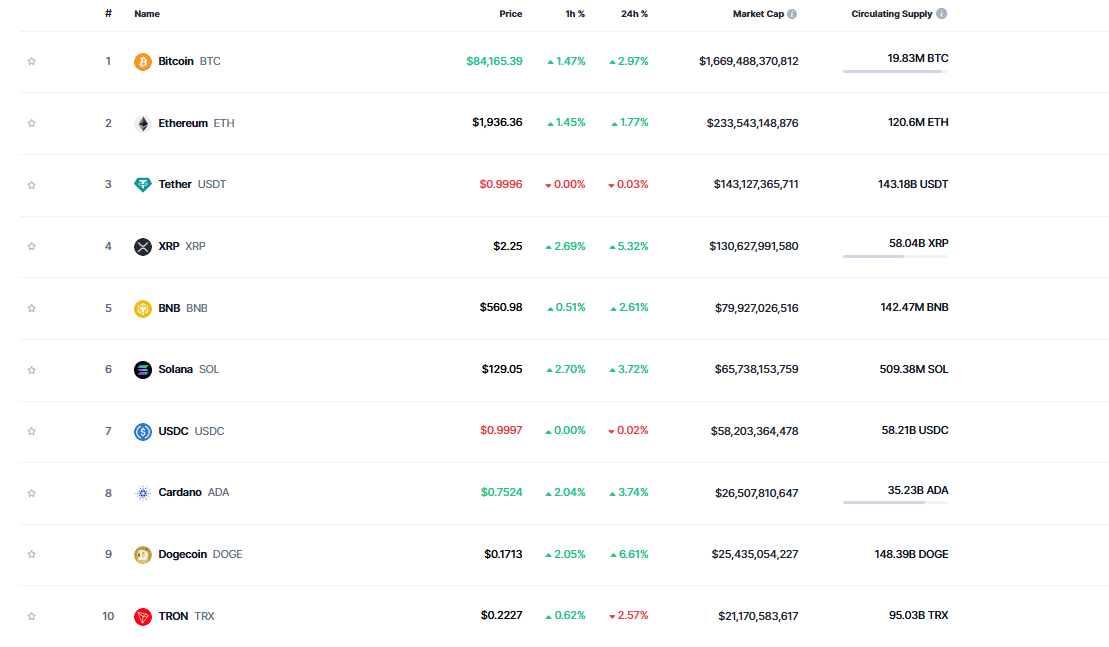

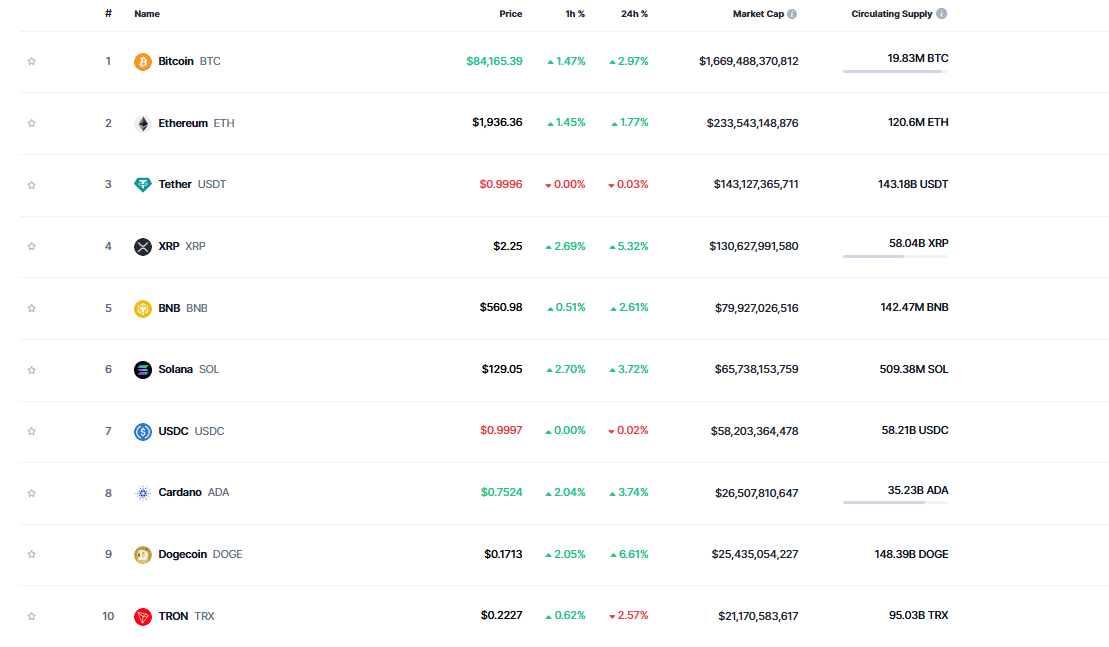

The top 10 cryptocurrencies have all fallen under the most important price zones, with Ethereum [ETH] The level of $ 2,000 losses for the first time since 2023.

Source: Coinmarketcap

This shift underlines the dependence on the Bitcoin market for capital inflow. In bearish circumstances, altcoins as BTC suffer into a risk -active.

MSTR is like a critical case study, which illustrates the broader impact of macrotrends. Drying up with institutional capital, the short -term volatility of BTC continues to exist, so that Altcoin’s general profession is filled in.

Credit : ambcrypto.com

Leave a Reply