In total, the number of use fell to 502 million in 2024, compared to 860 million in 2023, the data showed. The mortgage industry last year accounted for 1.2% of all VANTAGENCORE use, compared to 3.2% in 2023.

But when considering only mortgage originations, the use of the credit score increased by 166% in 2024.

“The decrease in the wider mortgage market can reflect the less portfolio rescue by the GSEs, as well as fewer refinancing activities for the mortgage market, given the constant higher interest rates,” the report said.

According to the data, there was a “big peak in use with regard to mortgage portfolio analyzes” by the GSE US Department of Veterans Affairs and the Federal Home Loan Banks from New York, Chicago, Dallas, Cincinnati and San Francisco.

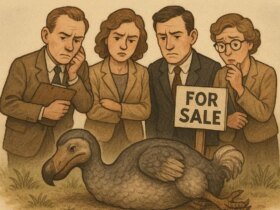

The use of VANTASCORE comes when the mortgage industry is preparing for major changes.

Last year, the Federal Housing Financing Office (FHFA) announced that it would transfer exclusive use of the current Tri-Merge Credit reporting system and lenders to use a BI-Merge model by the fourth quarter of 2025.

At that time, Fannie Mae And Freddie Mac Buys loans based on the Fico 10T and VANTAGENCORE 4.0 credit models, to replace the classic Fico scoring system that has been in use for decades.

Last summer, in one step to alleviate the transition to the new credit reporting requirements, the FHFA Vantagescore 4.0 released historical credit data.

In general, the use of VANTASCORE CREDIT Score has risen by 55% years after year to a record of 41.7 billion credit scores for the full year of 2024. Silvio Tavares, President and CEO of the company, said in a statement that the “record -breaking growth had” in 2024.

Leave a Reply